Globally, the different focus of conflict wakes caution in the market. Also, at the local level the focus is on the dollar.

Financial conditions for Argentina improved in June, mainly due to external factors. Even so, in the market they see as a latent possibility that there is a bassist correction, taking into account the amount of conflict spotlights in the world, and the overheating of the dollar at the local level.

The content you want to access is exclusive to subscribers.

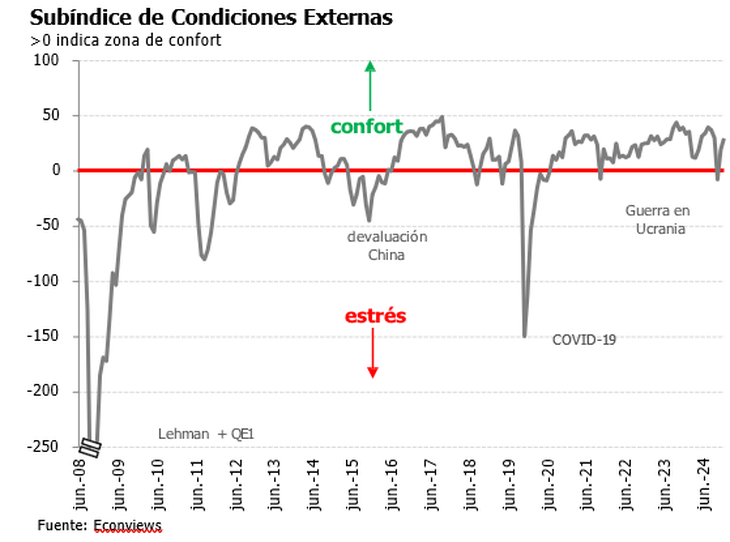

This was reflected by the Financial Conditions Index (ICF)prepared every month by the consultant Econviews and the Argentine Institute of Finance Executives (IAEF) to explain the dynamics of the business climate in the country. In the sixth month of the year, the referential reached 58.8 units, 12.1 above the level of May and 30.9 above over June 2024.

The rebound was mostly explained by the “external conditions” segment. There, eight of the ten evaluated variables exhibited increases, standing promptly those of the Stability in currencies and emerging actions.

image.png

“The instability of the commodities (by the war in the Middle East) did not infect the actions or the bonds, which contributed to the improvement of external conditions for the second consecutive month, after the record fall of April. Another controversial event that neither did a dent in the mood of the market was that the US Congress approved a budget that increases the deficit,” said the report issued on Monday.

Even so, Econviews and the IAEF predicted that “Given the various open fronts (tariffs, fiscal deficit and debt, wars in Europe and the Middle East), we see chances of another correction down in the coming months”.

At the local level, the focus is on the evolution of the dollar

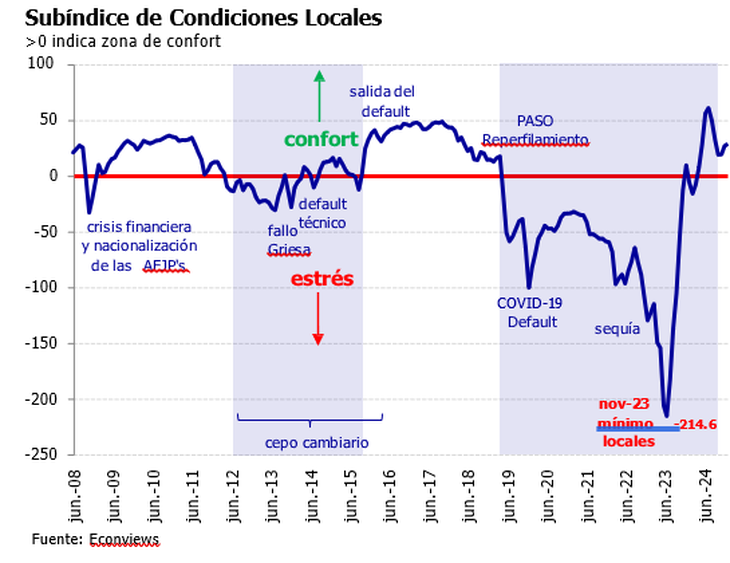

At the local level there was a greater disparity between the variables. Among the improvements, those of short -term liquidity, and confidence in banks (determined by the evolution of dollar deposits), while lA expected devaluation was the variable that deteriorated the most in the analyzed period.

image.png

Precisely, the report double click on the evolution of the exchange rate, explaining that the increase in the first days of July responds to seasonal elements such as the “final of the thick harvest, the temporary decrease of retentions, the collection of the bonus and the winter holidays”, although they also impact the typical dollarization of pre -electoral portfolios and the current account deficit.

“With balance in fiscal accounts, the risk of traumatic correction is less, but it is likely that in the coming months the dollar will move between the middle and the top of the band“Econviews and IAEF estimated.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.