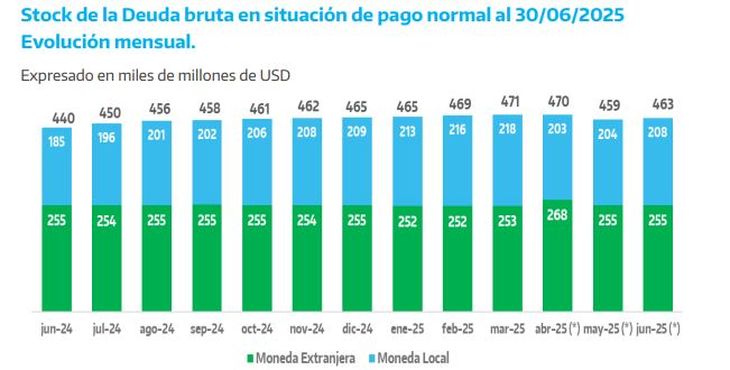

In June, the gross debt of the central administration rose and reached a new maximum of US $ 465,355 million. Between December 2023 and June 2025, the gross debt accumulated a rise of US $ 40,061 million.

The gross debt of the central administration grew again in June and reached a new record: US $ 465,355 million, according to the latest report published by the Finance Secretariat. The monthly increase was U $ 4,336 millionwhich represents a rise in 0.94% compared to the level recorded in May.

The content you want to access is exclusive to subscribers.

If the fall in treasure deposits is also considered in the Central Bank – which were reduced by US $ 1,530 million to attend maturities and were at US $ 11,691 million -, the net increase in consolidated indebtedness increases AU $ S5.866 million, with a adjusted total of US $ 453,665 million.

From the Ministry of Economy they explained that the Debt growth is explained, in large part, by the capitalization of interests of bonds and letters issued in previous exercises, The effects of exchange volatility and market movements after the establishment of the weight flotation scheme, implemented from April 14. In turn, they pointed out that the fulfillment of the tax program and the recent recapitalization of the BCRAagreed with the IMF, allowed to cushion part of the impact.

Debt1.jpg

From the Ministry of Economy they explained that debt growth is explained by the capitalization of bond interests and letters

Public Debt: Operations and Composition

During June, The treasure carried out debt operations for US $ 29,788 million. Of that total, US $ 12,625 million were new YU $ S17,163 million plans were allocated to cancellations, which resulted in a net reduction of operational debt for US $ 4,538 million.

Regarding the legal distribution, the debt under foreign legislation rose US $ 279 million and stood at US $162,489 million. In parallel, debt under national legislation increased by US $ 4,057 million, reaching US $302,866 million at the official exchange rate.

Between December 2023 and June 2025, The gross debt accumulated a rise of US $ 40,061 million. However, if it is adjusted for the transfer of BCRA liabilities to the treasure and the use of state deposits, the consolidated stock shows a drop of US $ 33,286 million.

Detailed composition

According to the Congress Budget Office (OPC), the national currency debt presents the following distribution:

-

55.9% in titles adjusted by CER (inflation), such as bonce, discount, torque, quasipar, promissory notes and guaranteed loans.

-

42% In debt to fixed rate without adjustment, composed of LECAP, Boncap, Bocas, Badlar Bonds, Fiscal Consensus Bonds, and other instruments such as transient advances of the BCRA and Fuco balances.

-

2.1% In debt in dollars payable in pesos, including the Linked dollar bonds, 2036 dual bonds and Lelink letters.

The Foreign currency debtFor its part, it includes bonds in dollars, euros, yen and other currencies, both issued in restructuring and placed to official organizations. In this segment, the main concepts are:

-

37.8% in Step-Up bonds (bonars and global restructured in 2020).

-

21.9% In non -transferable letters to BCRA.

-

21.4% in IMF loans (programs of 2022 and 2025).

-

15.7% in credits of other international organizations.

-

3.2% in other liabilities (guarantees, bank loans, guarantee letters and minor titles).

From the Ministry of Finance, they stressed that the evolution of indebtedness was marked by the capitalization of interest, the evolution of the exchange rate and accounting adjustments, more than for new net debt in operational terms.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.