The municipal taxes They are a key vector of business competitiveness, price training and investment allocation in Argentina. He Argentine Institute of Fiscal Analysis (Iaraf) detailed the existence of up to 155 different taxes in the country, of which 85 have municipal origina figure that exhibits the dimension of fiscal pressure exerted by local governments.

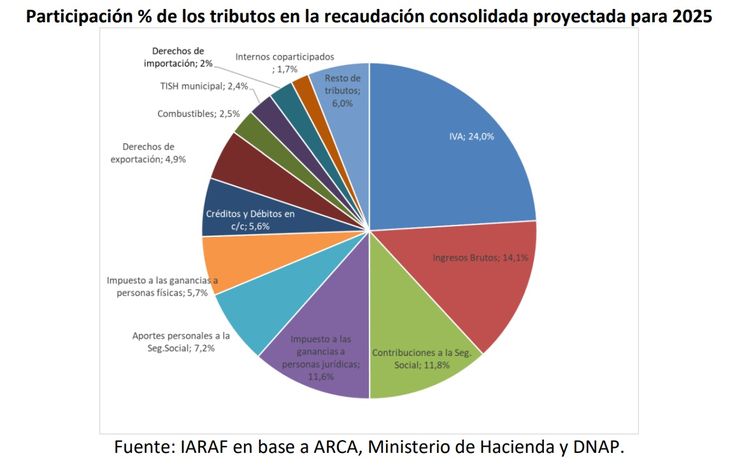

If the effects of the Federal Tax Copartition and Municipal Co -participation are considered projected, for every $ 100 that enters the tax coffers in 2025the national treasure would retain $ 25.7, the ANSES I would receive $ 28.1, the provinces and the Autonomous City of Buenos Aires They would concentrate $ 33.7 and the municipalities would obtain $ 12.5.

On the other hand, the Municipal Fees Reportprepared by the Center for Studies of the Argentine Industrial Union (UIA) He revealed that, for 2024, they were created 6 new rates nationwide. This phenomenon intensified in the province of Buenos Aireswhere 13 of the 45 relieved municipalities increased the aliquots compared to 2022, while only a municipality decided to reduce them.

WhatsApp Image 2025-07-18 at 09.22.48

Of 155 different taxes in the country, 85 have municipal origin.

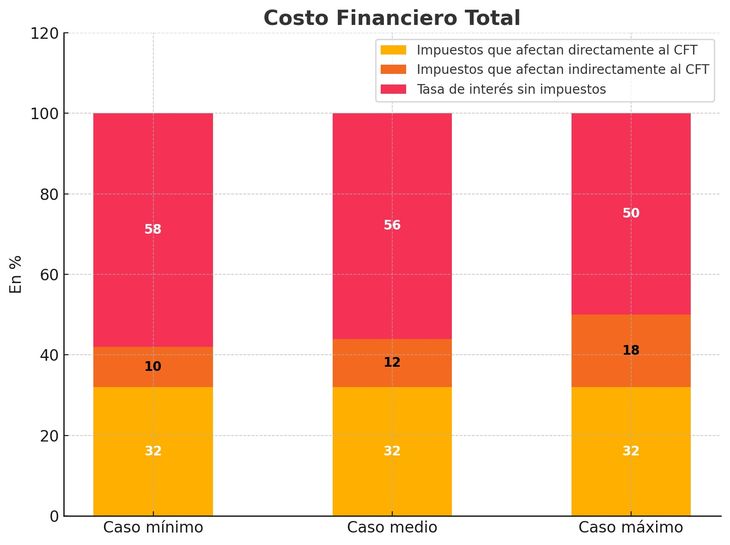

The impact of municipal rates on the cost of financing

The intensification of the tax pressure explained the increase in the cost of credit in recent years. Financial entities faced almost constant increases in the provincial and municipal aliquots since 2009, according to a report of the IERAL and the Mediterranean Foundation.

According to the analysis, the Tax load would explain approximately 44% of the total cost of the loan. In concrete terms, if a person pays a monthly fee of a personal loan that includes U $ S1,000 In interest, it actually pays U $ S440 corresponding to taxes, while the remaining U $ S560 They represent the net interest rate applied by the financial entity.

Among the most relevant taxes are the Banking and Debit Tax, known as Check taxTaxes to the gross income applied to credit operations, and the stamps tax that tax transactions with cards and other instruments. To this are added municipal rates by branches, ATMs and self -service terminals.

WhatsApp Image 2025-07-18 at 09.23.05

Among the most relevant encumbrances are the Banking and Debit Tax, known as the Tax to the Check.

Rates and areas with the highest prevalence

The study disseminated by the UIA identified that one in three municipal obligations responds to the Safety and hygiene inspection rate (Tish). This tribute, which directly impacts on productive and commercial activity, is equivalent to 0.7% of total collection If the three levels of government are considered, and represents approximately 1.8% of the final price of different food products.

The other tax with strong presence is the Economic Activities (Thae) rateused to formally authorize the functioning of shops and industries.

In addition, the supply ratea charge that is charged on food products that enter municipalities for commercial purposes, remains in force in certain districts.

The survey that elaborated the UIA explained that, within the 45 municipalities relieved In the province of Buenos Aires, 13 decided to increase the aliquots of their rates during the analyzed period. Other 31 municipalities maintained the current percentages and only resolved to apply a reduction.

According to the data collected, the average percentage paid by industrial companies was 0.79% in 2022, while in 2024 it reached 0.85%.

WhatsApp Image 2025-07-18 at 09.22.48 (1)

What is the participation of each tribute in the consolidated collection projected by 2025.

Those responsible for the “tax tragedy”

Matías Olivero Vila, President of Logic NGOa civil association dedicated to promoting tax awareness, attributes the responsibility that Argentina appears among the countries with greater tax pressure to legislative and executive powers in their three levels of government.

However, he also pointed out that there is a “Fiscal ecosystem” which was functional to that situation, composed of key institutions such as the Judiciary, the tax authorities, the business sector and citizenship as a whole.

Olivero Vila explained that “there is an aspect of the judicial action that does affect the tax policy, since the judges have been, in general, more and more tolerant of the excesses committed in the norms by the political powers.”

“These powers have been sanctioning increasingly violations of constitutional principles or regimes, especially the property right, assuming that those judges tend to force their interpretations so that political power ends up imposing their will, whether due to underlying, procedural or procedural issues or for the times involved,” he completed.

In turn, he added that “the widespread perception of taxpayers is that there is a high risk that little or nothing happens when they take their cases to justice, and that even the failures contrary to the State, in general, are written with limitations so that the damage is more digestible to the treasury“In the same line, he continued:” As there are no forceful judicial limits in the face of clear constitutional violations, those political powers were increasingly running the limits. “

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.