The Financial digitalization It advances firm in the world companies, but a fact stands out above the rest: the use of dollars in business transfers shot 121% year -on -yearaccording to the 7th edition of the Interbanking Index. In total, more than 7,500 operations in dollars In the first six months of the year, consolidating a trend that had begun to take strength in the late 2024.

The possibility of studying dollars through digital channels such as interbanking begins to Transform the financial behavior of companiesboth for payments to third parties and for transfers between their own accounts and even the payment of salaries in foreign currency.

In the first semester of 2025:

This growth is parallel to the general advance of the digital financial ecosystem: between January and June, companies transferred more than $ 932 billion in totala rise in 69.2% interannual, with more than 71.8 million processed operations.

One of the categories that won the most traction was that of Salary transfers in dollarsthat went from being marginal to having a growing presence in the system. This type of operations reflects not only the availability of multimoned digital instruments, but also a growing preference of companies and individuals for the partial dollarization of incomein an still uncertain economic context.

Interbanking

The report emphasizes that more than 552,000 legal cups are active in the network

Increase the amount of legal cuits

The report emphasizes that more than 552,000 legal cups They are active in the network, with an average 9 bank accounts per company. In turn, the adoption of digital solutions advances not only in quantity but also in complexity: companies use multiple channels, instruments and currencies to administer their liquidity and optimize their treasury.

According to interbanking, this evolution is driven by the demand for more flexible, safe and efficient toolsas Multibanco apps, open apis and platforms like Frisvywhich incorporate artificial intelligence for financial management.

The number of companies connected to the interbanking network went from 477,660 in 2021 to 552,684 in 2025which is equivalent to 12 companies every 1,000 inhabitants. However, the country continues well below its neighbors in terms of business density: Uruguay records 61.5 companies every thousand inhabitants, Peru more than 102 and Colombia34.8.

The total of Business bank accounts exceeds 4.9 millionwhich represents a 48% growth in four years. This data reflects a more intensive and diversified use of digital financial instruments by the corporate world.

Dynamic sectors and digital transformation

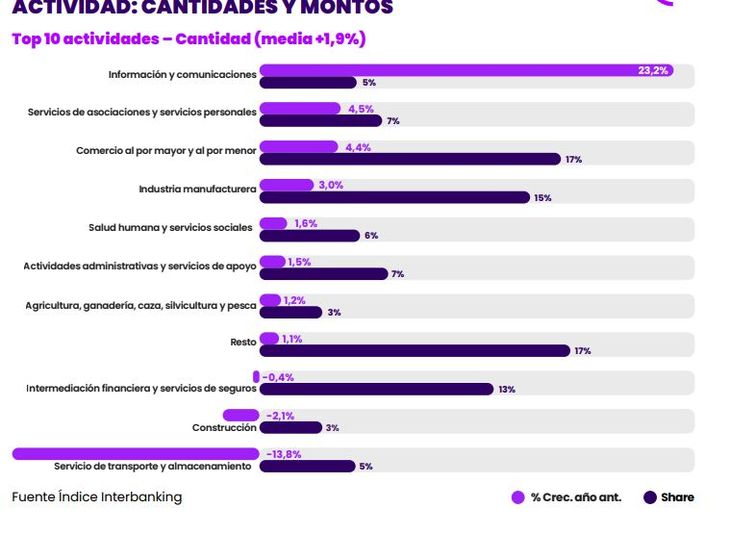

The activity that showed the greatest growth in amounts was Information and communicationswith a rise in 135% in transferred money and 23.2% more operations. In volume of operations, he led the Wholesale and Retail Trade With more than 12 million transfers; while the greatest amount was mobilized by Financial intermediation and insurancewith $ 185 billionalmost 20% of the national total.

In net terms, the number of companies in activity also grew: the Balance between High and Low I improved a 26.2% compared to 2024explained in part by a 10.6% reduction in casualties. In particular, the sector of Construction showed a net improvement with 299 new companiesdriven by a lower number of closures.

Itnerbanking 2

The activity that showed the greatest growth in amounts was information and communications

Financial digitalization grows in the interior of the country

Although Buenos Aires, Córdoba, Santa Fe and CABA continue to concentrate 76% of the total companies and 92% of the operated amounts, some interior provinces showed a growth well above the national average. Formosa (+102.7%), Neuquén (+100.6%) and Santa Fe (+89.3%) They led the interannual growth in operated volume. They also stood out Chaco, Chubut and Río Negrowith increases above 80%.

In regional terms, the Central Region – which includes Córdoba, Santa Fe and La Pampa – was the most dynamic, with an increase of 85.5% in transferred amounts, followed by the Patagoniawhich grew 79.2%.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.