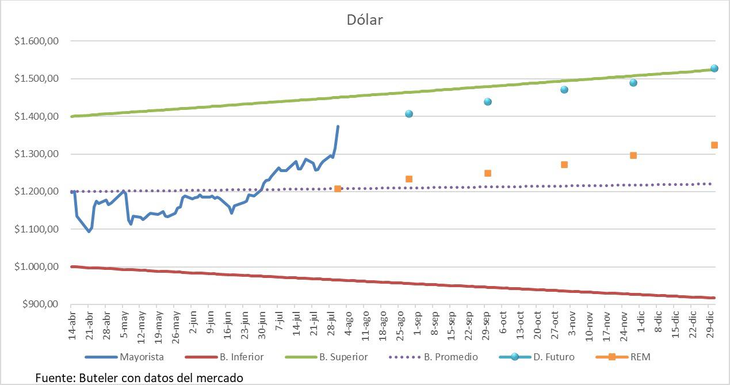

The dollar futures operated with huge increases, up to 4.3% and the market already “price” a value at $ 1,528 by the end of the year.

Dollar futures operate with huge rises of up to 4.3% and the market already “price” a value at $ 1,525.

Gentileness: The Comodorense

Future dollar contracts operated with strong generalized increases throughout the curve this Thursday, July 31. So, For December, the price of the foreign currency was $ 1,528, which implies that it would be above the ceiling of the flotation band that, uploading 1% monthly, for the end of the year around $ 1,526 would be located.

The content you want to access is exclusive to subscribers.

Image

Specifically, the contract of August It was the one who climbed the most, to $ 1,406, which implies an increase of 4.3%. He was followed by September, with 3.5% progress, at $ 1,438. Subsequently October rose 3.2% to $ 1,465, while November amounted 2.3% to $ 1,489and finally December, grew 1.7% to $ 1,525.

Walter MoralesPresident & strategist of Wise Capitalhe said: “The exchange gap no longer exists. The government validates what happens with the MEP and the CCL with the official dollar, therefore we go towards a scenario of disappearance of the Blue. So far this year, the dollar increases 25% against accumulated inflation of 17%, which shows an improvement in real terms of 5.5%“

For its part, Lorena Giorgiochief economist Balancesfrom his networks, he contributed: “We are beginning to test how much confidence has the market to the scheme of exchange bands. If you believe that the roof is maintained at least to the elections, the rational is to sell dollar and stay in pesos doing carry trade“

Future dollar: Was there intervention?

Pedro Siaba SerrateHead of Research & Strategy at PPIhe said: “We, based on the position sold official in June, plus a significant fraction of the increase in Rofex’s open interest in July, We estimate that the current position would be close to US $ 4,630 million (around US $ 2,700 million in July)“

In turn, from ADCAP They took note of the intense day in the futures curve and highlighted whatand the demand intensified after the strong rise of the officer at about 11 am. “The operated volume exceeded the usual market level and was barely below the peak registered on 07/15 (2,970,736 contracts), with strong concentration in the August contract,” they detailed.

Besides. They assured that the open interest jumped 5.7% and marked a new maximum so far in management: 7,590,091 contracts. “To find a similar level you have to go back to 10/30/2023,” they explained.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.