The retail exchange rate receded and the Blue continues as the cheapest in the market.

He wholesale official dollar It fell $ 21.5 to $ 1,338.5 this Tuesday and registered its greatest fall in a month and a half, while the parallels also backed up, after last Monday the new disbursement of the International Monetary Fund (IMF) for US $ 2,000 million.

The content you want to access is exclusive to subscribers.

At a retail level, on average financial entities established by the Central Bank (BCRA)the dollar is sold at $ 1,362.47, and in the Nation Bank (BNA) closed to $ 1,350. Thus, the Card or tourist dollarand the Savings dollar (either solidary), equivalent to the official retail dollar plus a surcharge of 30% deductible from the income tax, it was $ 1,755.

For its part, the Blue dollar It goes back $ 5 to $ 1,325 and is positioned again as the cheapest in the market. He MEP dollar loses 1% $ 1,343.08, and the dollar counted with liquidation (CCL) low 1.1% to $ 1,346.66.

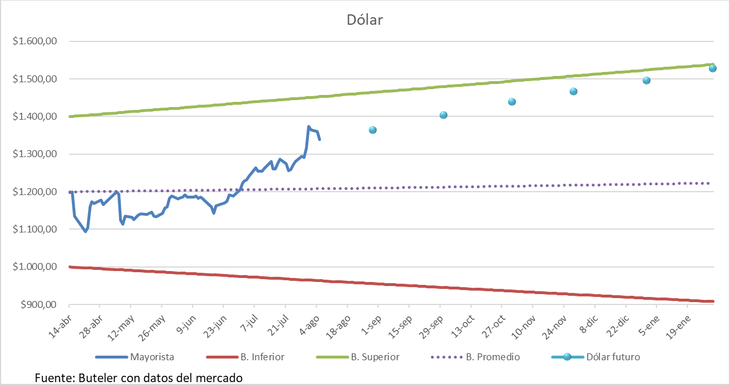

The contracts of future dollar They operated downwardly. The “price” market that the wholesale exchange rate at the end of August will reach $ 1,364.5 and that in December will do it to $ 1,495.

He IMP confirmed last week the approval of the first review of the program with the Argentina. Despite this, two relevant changes were introduced: a downward review of the accumulation goals of net reserves and the decision that inspections become semiannual instead of quarterly.

In this way, now the Government will need US $ 5,000 million to meet the objective of reserves, although long -term demand remains intact.

The wholesale dollar could stabilize around $ 1,350

The economist Gustavo BerHe pointed out that the wholesale dollar is stabilized around $ 1,350 from “a greater supply that operators would be observed for the liquidations” and the appetite for ‘Carry’.

Likewise, it emphasizes that the behavior could be deepened of not there is no transfer at prices, since the real rates remain high, beyond the usual pre -electoral dollarization.

For its part, the economist Christian Buter He stressed in X that the wholesale dollar fell 1.58% and chained its third consecutive fall, while all positions in the future dollar were adjusted down.

Dolmay

@cbuteter

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.