The market will give its projection of the exchange and inflation rate for the coming months, after the strong rise of rates and the dollar shooting.

The City Gurús will release Wednesday The forecasts of the official dollar, inflation and rate, in the survey of market expectations (REM) of July, which will publish on Wednesday the Central Bank (BCRA). This report will be key since expectations were stressed after the dollar jump in July and the volatility of the fees after the end of the Lefis.

The content you want to access is exclusive to subscribers.

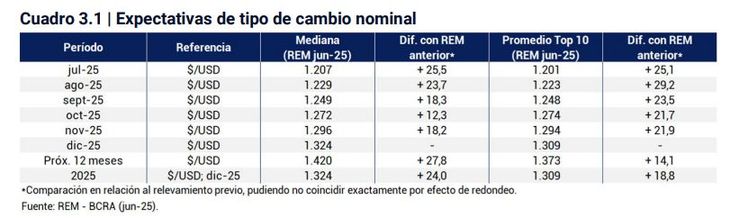

It should be noted that in the last measurement the projections of the dollar were located in $ 1,207 per dollar for the average of July, $ 25.50 more than in the previous REM. For the top 10 of analysts, the expected average nominal exchange rate for July was $ 1.201.

By December 2025, the set of participants predicted a nominal value of $ 1,324, which yields an expected year -on -year variation of 29.7% (+2.3 pp with respect to the previous REM). The figure is far from the first projections estimated by the Government for the preparation of the 2026 budget: It estimates that the nominal exchange rate will increase 20.4% per year, to $ 1,229 at the end of December.

The REM, meanwhile, projects a slight exchange depreciation for this year, since the annual rise of the American ticket is slightly above the inflation prognosis for the same period, which is projected in 27% (for the estimate included in the 2026 budget, will be 22.7%).

According to the June REM, analysts project a path of moderate increases for the official dollar in the coming months, between 1.6% (September) and 2.2% (July). Thus, the median expectations places the exchange rate on average at $ 1,207 for July, $ 1,229 for August, $ 1,249 for September, $ 1,272 for October, $ 1,296 for November, and $ 1,324 for December.

Recall that, in mid -April, the Government announced a flexibility of the stocks and a new flotation exchange scheme, with an initial floor of $ 1,000 and a roof of $ 1,400, together with a monthly update of 1% of those values (below in the case of the lower level and up in the case of the band’s cap).

REM June 2025.jpg

Dollar for 2025 (monthly average):

- Next 12 months: $ 1,420 (June 2026)

Dollar in July: how did he go to the currency

He Retail dollar accumulated over July a jump of 14%. In a retail market, measuring the Central Bank (BCRA), crossed the $ 1,367.3.

In the segment of future dollaron the last day of last month he marked $ 1,406 for August, while By the end of the year, the “Price” market that the dollar reaches $ 1,525,.

If the July 31 values are taken into account, The officer was 5.6% below the upper band of $ 1,451.5 (Remember that it is adjusted to a rhythm of 1% monthly) and 50.6% above the floor of the flotation band of $ 964.1 (It decreases at 1% monthly). And if the center of the band is taken to $ 1,208.7, the value was up at 13.6%.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.