The term deposits registered an increase of 2.5% in real terms in July and already explain two thirds of the total stock of deposits in pesos. The performance was overcome the monthly inflation, despite exchange volatility.

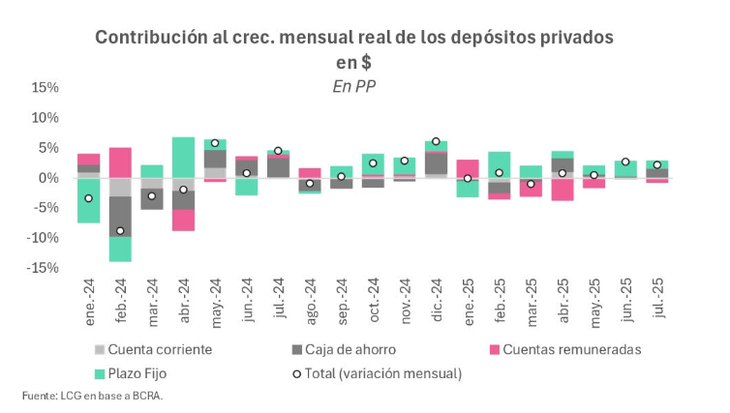

In July, the fixed deadlines They registered their sixth consecutive month of real growth, with a rise of 2.5% monthly (adjusted by inflation) and a real interannual variation of 55.4%, according to the latest LCG report. The report indicates that the fixed deadlines already represent two thirds of the total stock of deposits in pesoscontributing 1.2 percentage points to the general expansion of private deposits, which grew 2.2% in the month.

The content you want to access is exclusive to subscribers.

This behavior is given parallel to a real monthly drop in the common investment funds. According to LCG, “although it is true that the months prior to June the paid accounts already showed casualties, we understand that the July fall was due to true disarmament of savers within the framework of the rise of the official dollar Already the volatility of rates of the instruments that make up the FCI, after the elimination of the Lefis. Against a year ago, 43.3% are located below, “they explained.

As for expectations, From LCG they argue that in the new level of rates well above inflation will encourage its growth, at least in the short term. However, they did not rule out that the proximity to the elections encourages dollars in dollars.

Screen capture 2025-08-06 095939

Rate volatility impacted FCI

Fixed term: What banks offer the best yields after the last rise in rates

After the recent adjustment of rates arranged by the Central Bank, some entities They began to improve their yields to attract savers. According to official data, the highest annual nominal rate (TNA) on the market is 38%, offered by Banco CMF and Banco Meridian, two entities that are not part of the best known group of banks. With that rate, a fixed term of $ 100,000 to 30 days yields $ 3,123, provided it is maintained until the expiration.

Above the average system, other entities such as Reba Financial Company are also highlighted, which pays a 37.5% TNA, and Banco VOII, with a 37% annual yield.

On a barely lower step, but even with attractive rates, some traditional and provincial banks are located. For example, Banco de Corrientes and Banco de Córdoba offer a rate of 36%, while Banco Galicia, Banco Mariva and Regional Credit Financial Company are positioned with 36.25% per year. They also appear in the Top Ten Banco Comafi and Banco Bica, both with an annual rate of 35%.

For its part, Banco Provincia added this week a new functionality to its digital wallet account, which now allows you to constitute fixed deadlines with a preferential rate of 36%. On the other hand, if the deposit is made via traditional homebanking, the performance is lower, with a 32%TNA.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.