The agreement with the International Monetary Fund (IMF) To relax the accumulation goals of reservations, only give Argentina a break. When passing the goal of gathering some U $ S5,000 million For the first semester of next year, greater pressure on the financial needs of 2026.

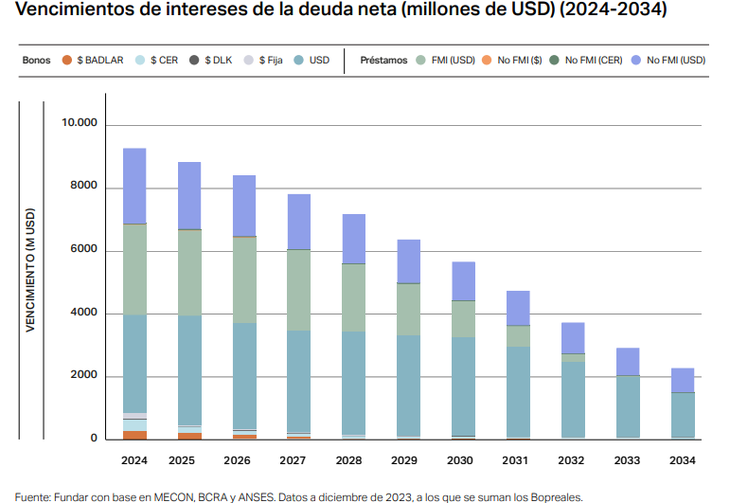

In this regard, the Center for Economic Studies of the Province Bank He points out that “in 2026, the Government has to pay $ 13,500 million of external debt.” “With a current account of US $ s10,000 millions (official projection), next year they do There is US $ 23,500 million to close the external gap. Without market financing this is complicated, ”warns the entity.

In that sense, remember that the “Staff Report” of the IMF relaxed the reservations goal for this year, eliminated the objective of September and the Central Bank must add US $ 5,000 million until December. Previously, he had to accumulate $ 4,000 million until September 30 YU $ S8,000 million before the end of the year.

The economist of that study center, Matías Rajnerman, said that “relaxing the reserves goal with the IMF can make the short term easier, but complicates the median.”

Mistrifications-capital-founding

“Between current account deficit and debt payments, in 2026 more than US $20,000 million must be covered. With half of the reservations-PBI relationship that the region “Explains Rajnerman, who wonders then “How do credit reopens?”

The study center report indicates that “The relationship between reserves and country risk is narrow.” “The countries with more reserves have less country risk and vice versa. With the new goal, reserves would close 2025 in US $ 45,000 million: 7.5% of GDP (15% regional average). That’s what it will be like difficult to reopen external credit ”, The professional points out.

Leonardo Anzalone, from the Center for Political and Economic Studies (CEPEC), He pointed out to the scope that “as of 2026, maturities with international organizations begin to have a much larger volume.” With the IMF between capital and interest, they approach US $ 5,000 million, explained.

Miss-Intereses-Foundar

The professional indicated that “The evolution will have to do with the possibilities of the current government to roll the debt, That is, to pay interest and kick capital, which is basically what international finances do. ”

“Now, to kick By nowadays capital terms, what is needed is a considerable decrease in country risk ”, added. The economist commented that at least three elements can be taken to take into account for the loss of risk.

“There is an electoral risk, if you want, which is present in the country at risk, But I don’t think it’s the most important thing, although of course it is, ”he said when referring to the next October elections.

Anzalone considered that “The second element and not for that reason, is the international context, still complex, where the world is discussing tariffs. When that occurs, in general, countries seek quality assets ‘Fly to Quality’, ”he explained. “And thirdly, it seems to me that there is an important fact and that is valued in the Staff Report, which has to do with Argentina to initiate a process of accumulation of reservations I wasn’t doing, ”he said.

The CEPEC economist explained that the government “You need to accumulate reservations and that ‘fattening’ of the Central Bank will make the fiscal anchor and adequate monetary conduct the risk of the country falls at levels that allow us to renew the debt ”.

With the help of the IMF it can be achieved

Guido Zack, Director of Economics of Fundar, states that the problem of The accumulation of reserves is of less importance to the IMF to breach a payment. “Whenever there is political will of the Monetary Fund there will be ‘waivers’ so as not to generate important obstacles.” “The goals are relative, you have to take them with a clamp,” he said.

Zack considered vital that Argentina begins to accumulate reservations, anyway. There is a correlation between the dollars contained in the Central Bank, the GDP and the risk rate. On average the region has 4 points less than Argentina with 20% reservations, he explained.

“The rest of the countries in the region have positive reservations for 20 points of the product or more also, that would imply that Argentina with 15 points of the product should have between US $ 80,000 YU $ S90,000 million of net reserve. We are very far from that, ”he said.

It should be noted that today the Net BCRA reserves are US $ 7,211 million.

The economist said that “we need genuine dollars, which do not necessarily come from foreign trade or the current account ”

“The challenge remains the same, lowering the country risk in such a way of power refinance maturity at a sustainability compatible rate ”, explained the director of Fundar. There are two variables that They look as opposite. On the one hand accumulate and win the elections. For the first, one more expensive dollar is required, which would discourage imports and boost exports, but generate inflation. For the second it is convenient to revalue the weight and lower inflation, but do not come together.

“Most likely, it is a bit of the two. What the Government is doing is to go with everything for the outcome of electoral today and tomorrow to start gathering reservations,” Zack said.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.