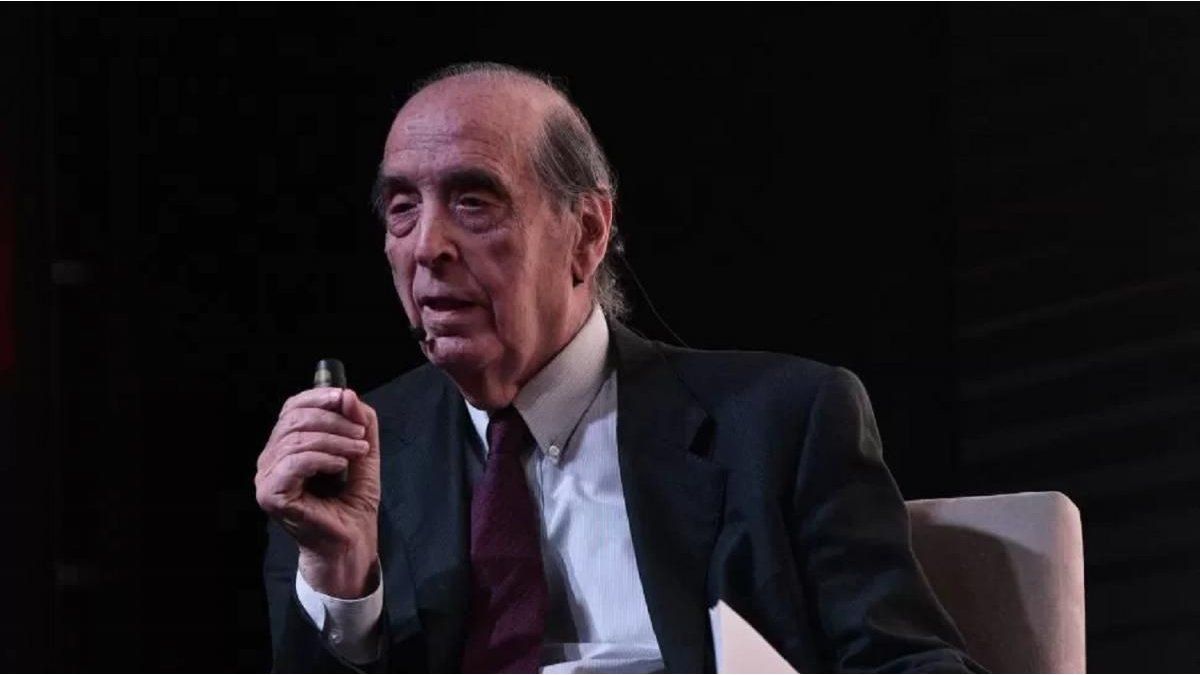

The economist Ricardo Arriazuone of the professionals most listened to by the markets and officials of the Casa Rosada, He loaded hard against the exchange scheme of flotation bands, which Luis Caputo’s economic team He launched at the end of April, after signing the agreement with the IMF.

In a talk for investors organized by the stock company Megaqm, Arriazu too criticized the decision to withdraw the market to fiscal liquidity letters (Lefis) and stop fixing a reference interest rate. Their statements are given within the framework of rumors that indicate that The Central Bank would have to reverse with the idea that the system is handled with market rates.

“I’m completely against of that measure, because while in Argentina the dollar is account, the currency It is of phenomenal importance “said the expert.

In this regard, he said that until only a few weeks ago “Monetary policy was like the US, since the BCRA bought and sold Lefis at a certain price, and set the monetary policy rate. ”

“Suddenly they decided to change, eliminate the Lefis and go to a tendency scheme. Then they said they were going to match the lace for all depositors, more than anything for common investment funds, they were uploaded 5%, ”he added. Arriazu said that“ they are taking out fund That has a cost for banks. ”

“The result of putting the band was that my inflation calculation, with the 1% devaluation was 18% for this year, now I am at 27%,” he added.

In this regard, the economist warned that the change the retreat from the Lefis “What he did was raise the interest rate and volatility. ”

“The only benefit is that they could not tell him that they are delaying the exchange rate, But they tell him anyway. The truth is that I can’t understand the benefit ”, Arriazu remarked.

In this regard, he recalled that when he was young and was based in the US, he was part of a group of economists who recommended the exchange of the exchange rate. “I was from the float group,” he said. However, he indicated that when he arrived in Argentina and see that it is a kind of second currency with which the public is handled, he abandoned that theory. In fact, He was one of the great defenders of the convertibility of Domingo Cavallo in the 90s.

As at that time, insisted on the need for structural reforms to be carried out that allow a low exchange rate. Although it maintains a low level of optimism.

“Macro balance is what they did, structural reforms are few because they have no power to do them. This is a federal country where half of the expense and taxes are in the provinces). What I do is see the medium and long term, ”he explained.

As an example, He recalled that some time ago he gave the Filo del Sol Mining Project in San Juan and that now after the agreement with the 50%IMF.

“There are 50% likely to fail. Argentina is a country of lost opportunities. I’m not going to play Argentina. A small group of people changed. But the vast majority of Argentines still think in the same way ”, He warned.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.