Last month the monetary authority, in coordination with the Government, participated strongly in the A3 market to try to contain the value of the official dollar, which still jumped 14% from end to end.

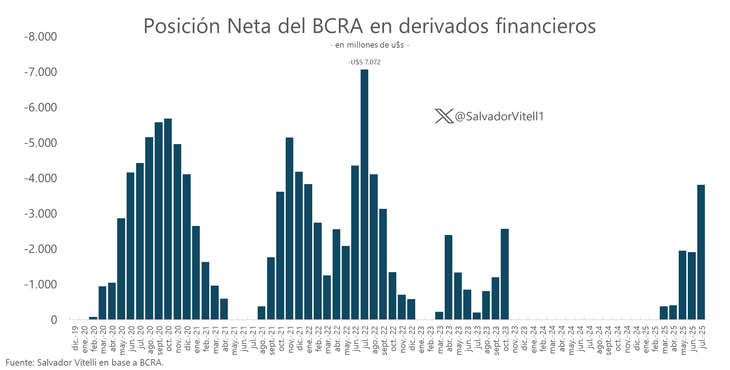

The Central Bank (BCRA) sold US $ 1,902 million in future dollar contracts during Julyaccording to data from the monetary authority itself. Thus, Its position sold increased Au $ S3.811 million, its highest level since August 2022.

The content you want to access is exclusive to subscribers.

The figure has already exceeded at October 2023, which had been the last with a position sold until March this year, when the central one, in coordination with the Government, resumed its participation in the A3 market (former Rofex) To press the official exchange rate price.

Future intervention

The official strategy until now consisted of selling short contracts so that their price is located below the wholesale dollar, thus encouraging a foreign exchange for sale in the “spot”, and then repurchase in futures.

Market sources indicated that in August a Change of dynamics in the BCRA strategy, with a greater focus on the long stretch of the curve. In particular, the activity in the May contract of next year is highlighted, which already presents an open interest (number of contracts in force) higher than the October contract this year.

The IMF had noticed a selling position of US $ 5,000 million in futures

A weeks ago, The International Monetary Fund (IMF) came to point out in its staff report that the position sold in futures became approximately US $ 5,000 million. From the agency they ruled out a potential risk to reserves since these are liquidated contracts in pesos, but suggested that these types of interventions should be “temporary and limited to situations of disorder in the market”.

“The position is the one that said the fund; that is, US $ 5,000 million. It is a dated issue, because when taking 31/7 it has closed the contract last July,” he explained in dialogue with this media Gabriel Caamaño, director of the Outlier consultant.

For its part, the financial analyst Christian Buter He argued that this policy was not entirely effective In terms of the government’s own objectives, since the exchange rate had a significant bullish dynamic. “While we supposed that the dollar was going to rise through the end of the settlement of agriculture, the magnitude of the rise was high (14% end to end),” he deepened.

This reflects how the ruling has been using the entire battery of tools at hand, under the tutelage of the IMF, to contain the value of the “green ticket” and thus avoid risks on the deceleration of inflation. The intervention in futures was recently added the strong leap in the Interest Rates of Interest in Validado after the change of monetary scheme, which generated more doubts than certainties in the market agents.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.