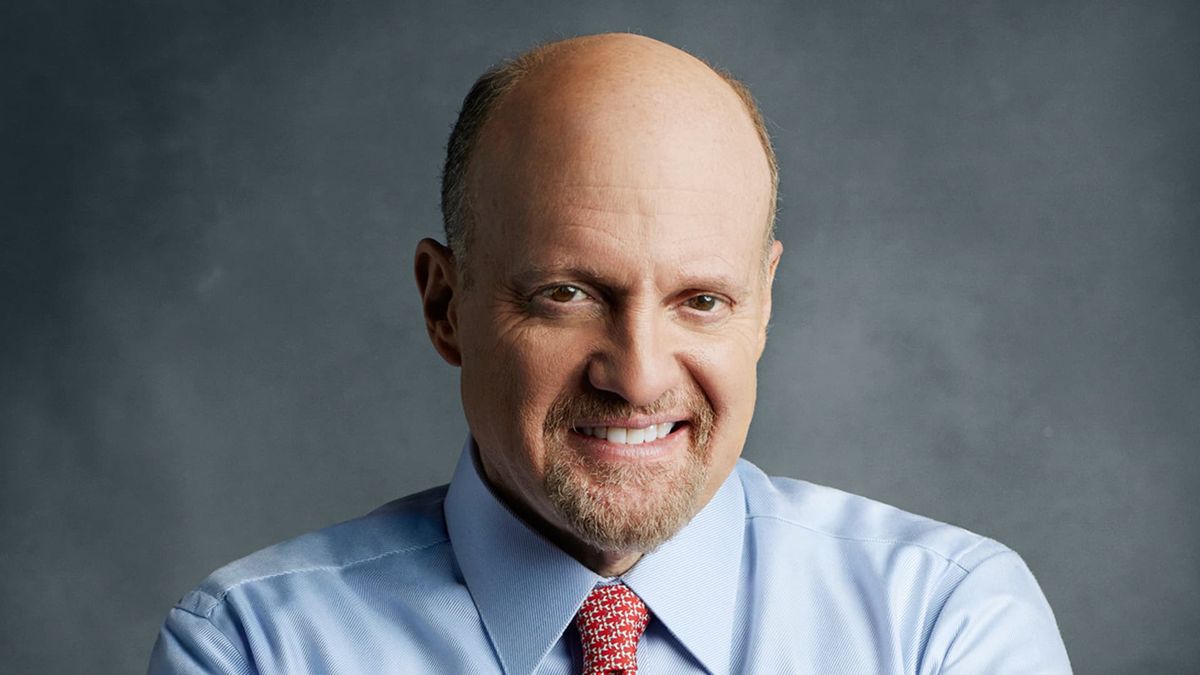

The expert Jim Cramer explained how to properly operate roles of companies such as Nvidia and Microsoft, among others.

The Nasdaq 100 index, focused on Actions of Technology companiesit retreated slightly from its historical maximum registered in mid -August. However, the Wall Street Guru Jim Cramer explained why investors should not part with these major corporations.

The content you want to access is exclusive to subscribers.

Specifically, the famous CNBC driver and former coverage fund manager indicated that it is not a good idea to liquidate this type of companies when they suffer a blow that, as demonstrated, New records always recover and mark.

“I will never try to prevent them from selling. It’s not my job. I just want to remember how these individual actions generated enormous wealth for those who kept them,” he said. “They earn that money by staying firm in good times and bad, not buying and selling shares,” he added.

Wall Street, waiting for Nvidia

At the moment, Markets await the quarterly results of NVIDIAthe company with the greatest capitalization of the market, which will be published on Wednesday.

In this framework, Cramer recognized the doubts that surround Nvidia in this quarter, especially around the demand of their chips by China and the large cloud service providers.

Nvidia

Wall Street eagerly wait for Nvidia’s results.

Depositphotos

In fact, he explained that some investors fear that companies are showing less willing to pay for high -cost products.

However, he reiterated that those who do not adopt these chips run the risk of being left behind in the intense competence of hyperscators. In his opinion, hardware for generative artificial intelligence will mark the future, and Nvidia is a fundamental piece in that advance.

How to operate technological actions

In turn, the specialist stressed that selling actions of technological giants and then trying to repurchase them is usually a failed strategy, since these companies tend to recover quickly after correction episodes.

In addition, he advised investors Avoid operating only following the behavior of other market participants.

“When it comes to these megacorporations, it is almost impossible to choose the time to sell them and then repurchase them later at a lower price,” he said.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.