The Central Bank chose an instrument that allows to better camouflage the amounts it uses to intervene and thus continue controlling interest rates.

He Central Bank (BCRA) He changed his strategy once again. This time he decided to stop participating in the rest market and chose another instrument that allows to better camouflage the amounts he uses to intervene and in this way continue to control the interest rates That, they were supposed to be “endogenous” after the end of the Lefis. This happened, in addition, In a week in which he announced a new rise of lace for banks in the pre -tender of the Treasury, which achieved a good “rollover” only for the monetary tourniquet.

The content you want to access is exclusive to subscribers.

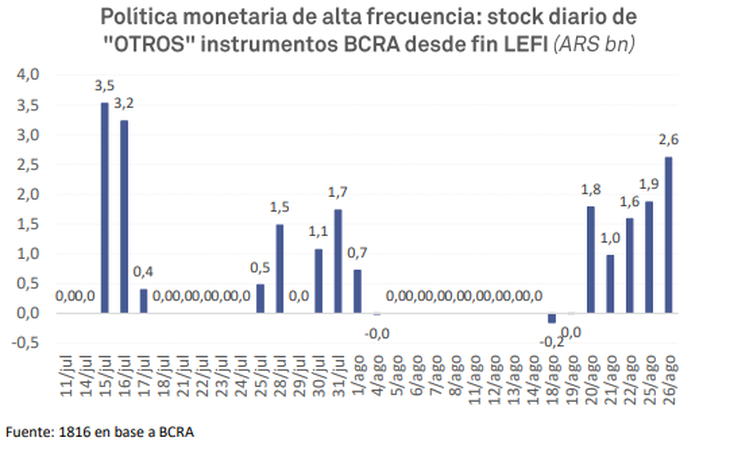

As a result, from the City they began to unravel the new official maneuvers to intervene in the markets. Operators concluded that beyond that there is an “obvious” daily participation in the “Overnight rate”, the one seen in operations such as passes or ciones at 1 day, this last week the central “It would have been very active sterilizing pesos in the” simultaneous “of Byma, which is consistent with what is seen in monetary statistics”revealed a report by consultant 1816.

Image

In this way, the Central Bank withdraws pesos from the market to prevent excess of liquidity that can press up at the exchange rate. The central difference is that before it did it on the wheel rest, which leaves more “traces” on the amounts used for this purpose and Now he does it in the “simultaneous” wheel of Byma, which is less transparent And, in this way, avoid clearly seeing how much it is intervening.

In fact, some operators say that, like banks and Alycs, that wheel against the bond can arbitrate, “It ends up generating a floor to the stock market”. It should be noted that byma’s “simultaneous wheels” are a type of operation in the financial market that combines a purchase and sale of the same asset with different dates, simultaneously, but These operations do not appear in public data as if it happens with the rests.

In turn, various sources from the City, say that this operation leaves a business to the Alycs “, since These can take money in the Caión market and place it to the BCRA in the “simultaneous” wheel at higher rates. This is the cost paid by the BCRA for absorbing pesos with a less transparent mechanism, in addition to the obvious consequences that It leaves the real economy with very high rates for financing.

To illustrate the current levels of rate: the Repo is located around 58% levels, the stock market to 47% TNA, and the “simultaneous bya” wheel, absorbs 50% TNA weights.

Rates: Lace and tender, the two events that marked their dynamism

“While the government does not explicitly raise it in that way, at this point there is no one in the market that does not think that all monetary policy is focused on keeping under the value of the dollar”they said Thursday since 1816.

This week The Central Bank rose 3.5 points the minimum cash requirement of all the deposits of the system (and increase 2 points the lace of sight deposits that can be integrated with titles) And he did, unlike other cases, in the prior to the tender. This allowed him to improve the “rollover” of all the maturities of the treasure even at rates below those of the market.

“Considering that it was the fourth increase in lace announced in just 40 days, We could already talk about a monetary regime with endogenous “. It seems that integrable lace with titles rise what is needed so that the Ministry of Economy can renew the maturities (at least to the elections), “he criticized the same report.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.