The stock market indices of the United States fall on their first day of the week, after the Labor Day holiday.

After a Monday without operations, Wall Street starts the week with strong corrections. Among the investors of the American stock market predominates caution this Tuesday. Meanwhile, it is expected that the economic data that will be known this week will finish defining the position of the Federal Reserve of the USA (Fed) On the reduction of interest rates, in the face of their meeting in the middle of the month.

The content you want to access is exclusive to subscribers.

For their part, global markets also operate with losses on Tuesday. In Europe, the Euro Stoxx 50 falls 0.96%, while the German Dax 1.55%collapse, and the French cac 0.50%is compressed. Out of the Eurozone, the British ftsethat corrects 0.62%.

In Asia, the Shanghai bag falls 0.45%, while the HANG Kong Hang Seng operates 0.47% down. The exception is the Japanese Nikkeii That, after the strong correction of this Monday, currently rises 0.35%.

Wall Street down, but groking its roof

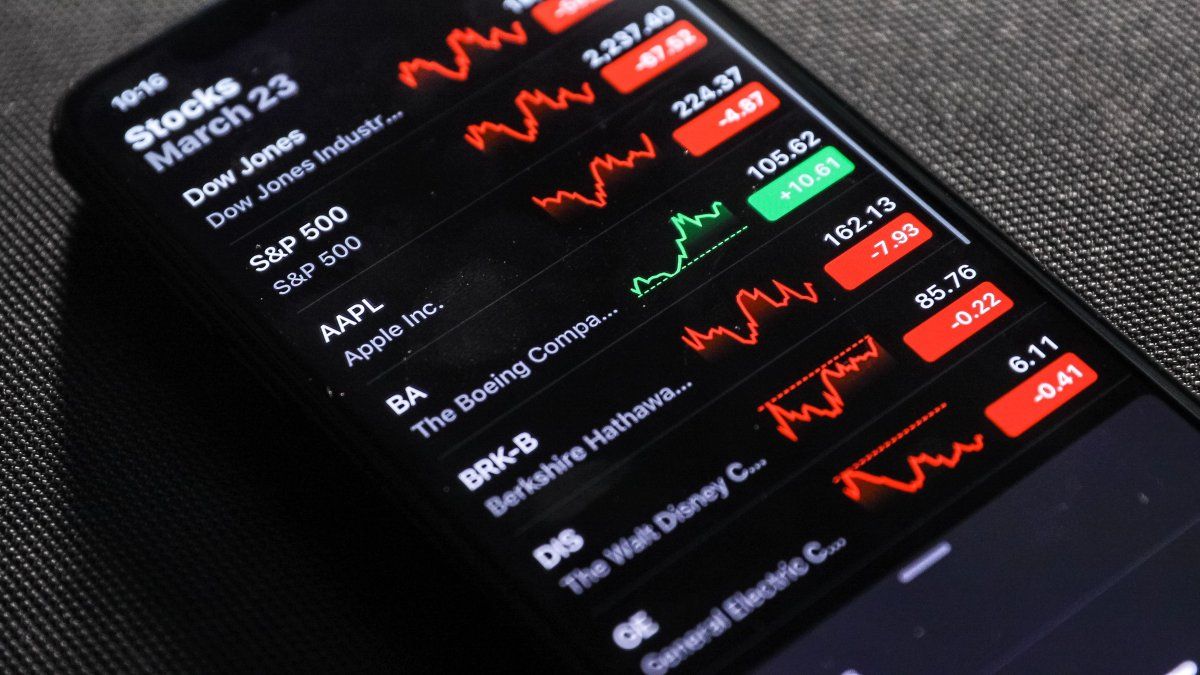

The industrial index Dow Jones drops 0.86%, while the Technological Business Plaza Nasdaq Composite falls 0.98%. For its part, the indicator of the most important companies in the market, the S&P 5000.96%contracts.

Anyway, Wall Street comes from closing a bullish month, with the S&P 500 having scored a monthly increase of 3.56% and a historical mark of 6,501.86 points last Thursday.

LIVING FINANCE MARKETS ACTIONS INVERSIONES INVERSIONS DOLAR BONDS

Today new reports of the US economy are known, in particular of the industrial sector.

Depositphotos

The key data of the US economy

The United States will be the main focus of markets this weekwith a series of key data on the state of the US economy that met from this Tuesday, with The publication of the PMI manufacturers of S&P Global and ISM. They gave 53 and 48.7 points, respectively. In both cases, below what analysts.

Anyway, the main course will be the August Employment Report that will be published on Friday. The previous report not only realized a slowdown in the generation of employment in the US during that month, but also corrected the data of previous months, which forced the Fed to shuffle a rate cut in September.

Therefore, two weeks after the Fed Committee meets to decide whether or not the current interest rate will maintain, the employment report next Friday It will be one of the two most important data that the agency will have available to make that decision. The other will be the August IPC, which will be known on Thursday, September 11.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.