The American currency retreated in the wholesale segment after sales of the Treasury, through the BCRA, in the Mulc.

The official dollar loosen after the strong rise of the start of the month and fell into the wholesale and retail segments, as the first reaction to the announcement of the Ministry of Economywhich confirmed on Tuesday that the Treasure would begin to intervene (through Central Bank) in it Single and Free Market (Mulc)to contain the exchange pressure prior to the elections in the Province of Buenos Aires.

The content you want to access is exclusive to subscribers.

At the wholesale level, The currency dropped $ 11 (-0.8%) to $ 1,361 after the Secretary of Finance, Pablo Quirnoindicate that from this day the treasure will participate in the Mulc “In order to contribute to its liquidity and normal functioning”. And in fact, this Tuesday, he already debuted with sales for approximately US $ 100 million, According to market sources. The operated volume was US $ 611.3 million.

Also, the Retail dollar backed almost $ 13 a $ 1,378.91 for sale In the average financial entities of the Central Bank (BCRA). In it Nation Bank (BNA), Meanwhile, the green ticket closed with a drop of $ 10 and $ 1,375. Thus, the dollar card or tourist, equivalent to the official retail dollar plus a surcharge of 30% deductible from the income tax, was located in $ 1,787.5.

As for parallels, the MEP dollar 0.8% fell to $ 1,365.62, while the dollar counted with liquidation (CCL) He did 1.4% to $ 1,372. A countermarket, the dollar Blue went up $ 5 to $ 1,360according to a survey of Scope in the City caves.

For their part, future dollar contracts closed mixed. The “Price” market that the wholesale exchange rate at the end of September will be $ 1,406.5 and that in December will reach $ 1,544, which exceeds the band’s roof. In the market, US $ 2,060 million were operated, with renewed BCRA intervention.

As for the news of official sales in the exchange square, the economist Eric Paniagua said to Scope that it was “a very ambiguous ad” that allows to officialize the institutional participation of the government in the Mulc, although without specifying how or when, something that would allow “Decompress devaluation expectations”. “It doesn’t seem a bad play,” he added.

The BCRA operated in the Mulc on account of the treasure and caused falls in the price

Market sources confirmed to Scope that There were BCRA operations in the Mulc to “Account and Order” of the Treasury (which cannot be sold directly in the market). They were recorded sales close to US $ 100 million that caused falls in the price. The price of the wholesale currency had touched maximum $ 1,380 at the start of the wheel.

BC

In turn, they highlighted that then the wholesale dollar operated very stable on the strip of $ 1,360 and with little spred between the purchase price and the sale pricewithout an unusual volume of operations. The average repo ranged by 58%, while the bond rate one day closed by 47%.

In this regard, the economist Gustavo Ber pointed to Scope that The exchange rate can be maintained “relatively stable” in the passing of this pre -election weeksince the economy statement seeks economic agents to delight their dollarization at this stage so that the price does not reach the upper band.

“It would seek to deter, but without having to act with the same decision, the potential sales that would then have on the roof of the band, a strategy that could be just conjunctural to avoid volatility,” he added.

The economist Lorenzo Sigaut Gravina He assured that the ruling is doing “a bit everything that all governments do before the elections, which is keep the dollar controlled so that inflation does not accelerate“, including the sale at subsidized prices of futures, the interest rate rise and, now, the direct sales of the Treasury in the Mulc.

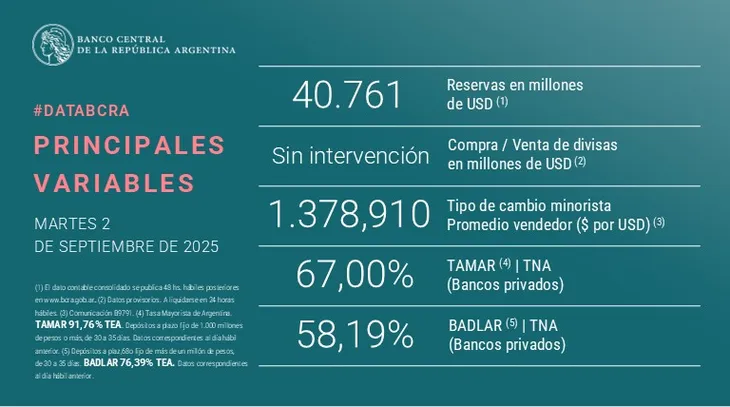

BCRA reserves

Despite treasure sales, International BCRA reserves increased by US $ 731 million and closed at US $40,761 million. Official sources reported that the rise is explained by the reversal of the downward movements of banks last Friday, when US $ 1,533 million fell. But the same sources clarified that the increase was lower than expected since there was a payment of US $ 40 million to the BIRF (International Reconstruction and Development Bank) and al IDB.

So much, there is a rest of U $ S762 million They left the public coffers on Friday and did not enter again this Tuesday after Monday’s holiday on Wall Street.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.