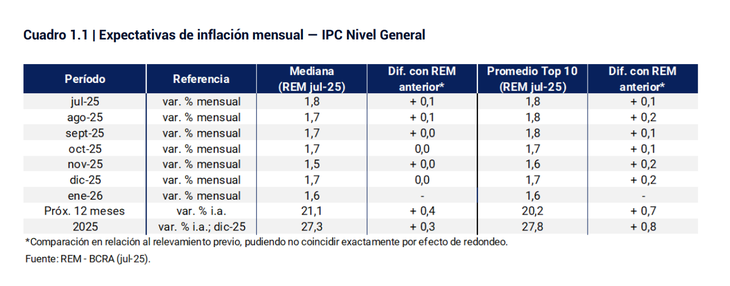

The Julio REM, published by the BCRA, the one that will be released on Thursday, anticipated that the CPI would remain below 2% monthly in the last four months of the year.

The Gurúes de la City They gave their last projections on the official dollar, the inflation and the interest rate and will see the light on Thursday in the survey of market expectations (REM) of July published by the Central Bank (BCRA).

The content you want to access is exclusive to subscribers.

According to the last measurement, which was in July, they foreseen that in August Inflation was going to be positioned in 1.7% (+0.1 pp than previous measurement).

It was also projected that in the remaining of 2025, the average IPC of September, October, November and December are located below the 2% and the variation closes 2025 around the 27.3% interannual, almost some 5 pp more than him 2026 budget project which foresees that the Annual IPC Close with a 22.7%.

Image

Meanwhile, those who participate in the REM foreshadowed a Tamar of private banks for August of 34.85% TNAequivalent to a monthly effective rate of 2.9%. By December 2025, the set of participants of the REM projected a TAMAR of 29.5% annual nominal (TEMS of 2.5%).

Dollar for 2025 (monthly average)

- September: $ 1,340 (+$ 90.90)

- October: $ 1,361 (+$ 89.40)

- November: $ 1,393 (+$ 96.70)

- December: $ 1,405 (+$ 81)

- Next 12 months: $ 1,522 (+$ 102.20)

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.