Corporate financing was contracted in August and presented the cost of the monetary squeeze made by the BCRA. One of the most used lines collapsed more than 10% in real terms.

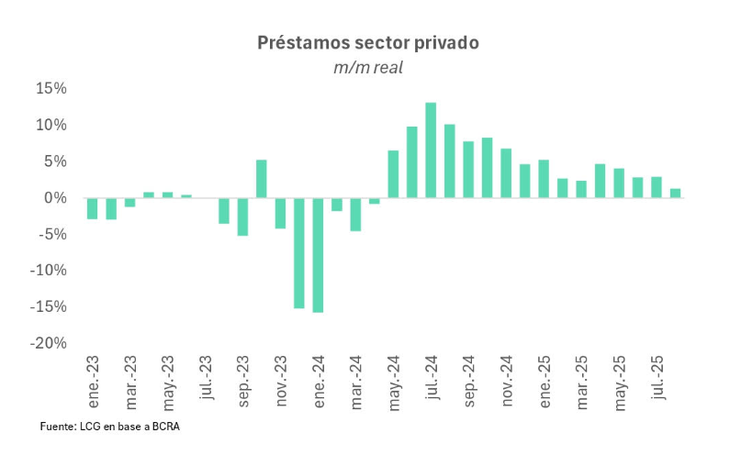

He Financing in pesos to the private sector in August showed a clear sign of deterioration: the Credit to companies fell 2.3% real monthly, the first decline after 15 months consecutive growth, and reflects the impact of Strong increase in interest rates. These are private estimates based on the data published by the BCRA, which reflects the impact of the changes on the monetary policy that the government carried out to try to contain the dollar.

The content you want to access is exclusive to subscribers.

The setback is explained, above all, by the marked contraction in the Advances in current accountwho collapsed 10.3% real monthly.

According to the LCG consultant, in addition to the rates, it also influenced – although to a lesser extent – the disposition of liquidity after the payment of bonuses in the previous months.

Emmanuel Álvarez Agis consultant, PXQ, He stressed along the same lines, that this high level of rates product of the lefis output affected the real economy. The rate of advances to companies jumped from 36% annual nominal to 85%which resulted in a “monetary squeeze” that explains the fall in corporate credit. In this sense, PxQ calculated that, Since mid -July 2025, loans to companies “accumulate a 6.6% contraction in real terms.”

Guillermo Barbero, partner of First Capital Grouphe also talked about the fall in credits in pesos after the rise of rates: “In relation to commercial loans, a monthly drop was reflected in nominal terms of 1.3%. The balance reached $ 26.4 billion, presenting an interannual growth of 69.9% against the $ 15.6 billion a year ago. In real terms, the monthly decline was 3.2% and the annual increase of 26.8%”.

Barbero remarked that “More than a year ago, a nominal balances fall in any loan line was not observed.” And he added: “While, when inflation down and stabilize the portfolios, it is logical that positive and negative variations appear, the truth is that companies opted for Cancel the financing before the high cost of the same. This phenomenon can be sustained for a few monthsbut, to grow in production or sales, it will be essential to access funds of the financial system in more compatible conditions with the price market. It should be noted that it is the type of financing that has grown less in real terms in the last 12 months. ”

Screen capture 2025-09-04 081042

Loans to the private sector as a whole, went up but for a rise in loan card financing

Did the high rates come to stay?

On the other hand, LCG said that this level of rates could last longer. “The high interest rates, the result of the economic policy implemented by the Government They continue to slow down the loans in pesos and increasing delinquency levels. We hope that this high rates environment is maintained after the elections, until the macro configuration is revealed. In this context, the slowdown of the credit will have an effect on the diminished economic activity which would increase the probability of a recession “said the consultant.

While the BCRA justified the output of the Lefis scheme ensuring that interest rates at levels above inflation would be a “transitory” phenomenon, the truth is that The real impact on the economy will only begin to measure in the coming months. Even when the rates manage to stabilize, the government will face a complex scenario for October: a activity coolingelderly MORRAGE OF FAMILIES and companies that, given the high cost of financing, prefer not to make credit. This implies, in practice, resign growth.

In this context, companies and banks concentrate their efforts on administering short -term liquidity, waiting for a greater clarity in the financial and macroeconomic front, Where the Electoral results will play a more than decisive role.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.