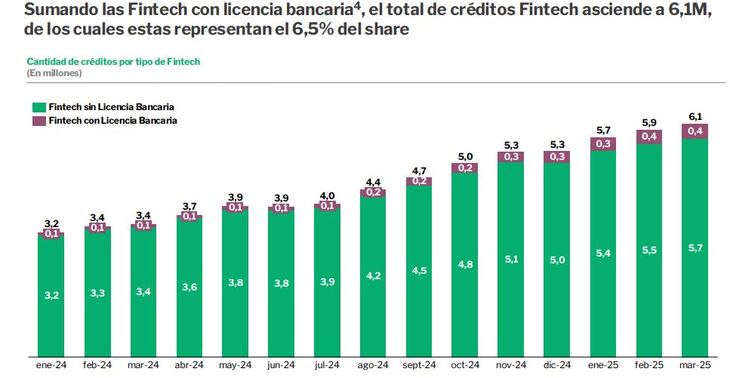

The digital loan industry is booming in Argentina: in the first quarter of 2025, the loans granted already reach more than 5.7 million operations. While a positive trend follows, the amounts are still low.

The Argentine Fintech ecosystem continues to show a strong dynamism in the credit sector. According to him Fintech Q1 2025 credit reportprepared by the ITBA and the Fintech Chamber, the loans granted by these platforms reached the 5.7 million in the first quarterwhich represents a year -on -year growth of 68%

The content you want to access is exclusive to subscribers.

At the moment, 27% of people with credit in the financial system have at least one Fintech loanwhich marks an advance in terms of penetration. The number of users grew a 65% year -on -yearadding more than five million people. However, the percentage of those who are financed exclusively with these platforms dropped four percentage points in one year, located around 29% of the total.

credit

Smaller credits, but with impact

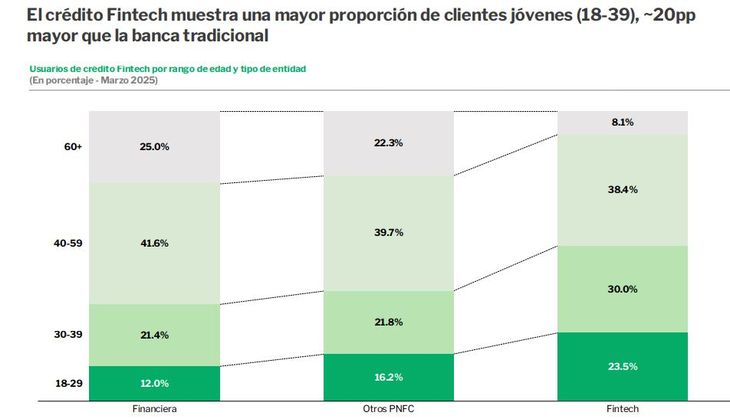

While the Average amount of Fintech credits ascends to $424,000the sector still represents the 2% of the total credit volume of the financial system. The differential is in the profile of customers: younger, with more restricted access to traditional banking, and in many cases with first credit experiences thanks to these tools.

The report emphasizes that Women lead demandrepresenting the 53% of userswhile by age the segments of 18 to 39 yearswith a twenty points higher than that of conventional banking

Growing interest of companies

The legal persons segment also shows strong growth. The number of companies that use Fintech credit increased a 36% year -on -yearreaching some 5,000 companieswith an average amount of Ars 44 million by credit.

Portfolio and delinquency quality

In the matter of risks, the portfolio quality It remains stable, with a Average improvement of two percentage points in the uncollectibles compared to 2024. However, the report warns that young customers have greater irregularity than older ones. In contrast, companies show a stronger performance, with 6.9 percentage points less delinquency than natural persons.

Creditofintech

Fintech credit expansion occurs in a context of greater financial digitalization. This dynamism confirms the role of Fintech as key actors in financial inclusion, although the macro remains decisive for growth.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.