I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.

Menu

Prior to tender, BCRA accelerates low rates and already pierce 40%: how can they impact dollar and activity?

Categories

Most Read

Wall Street shows caution in the premarket awaiting developments in the negotiations between the US and China

October 21, 2025

No Comments

The official dollar is close to $1,500 and tension grows in the markets days before the elections

October 21, 2025

No Comments

Fury over ETF funds: they reached a record of US$18.81 trillion in September

October 21, 2025

No Comments

Euro today and Euro blue today: how much they operate at this Tuesday, October 21

October 21, 2025

No Comments

Blue dollar today: how much it operates at this Tuesday, October 21

October 21, 2025

No Comments

Latest Posts

Debt exchange for education: an alternative for Argentina?

October 21, 2025

No Comments

The Argentine macroeconomy always suffers in the run-up to elections. Far from being an anomaly, it is something predictable. In this context, the government of

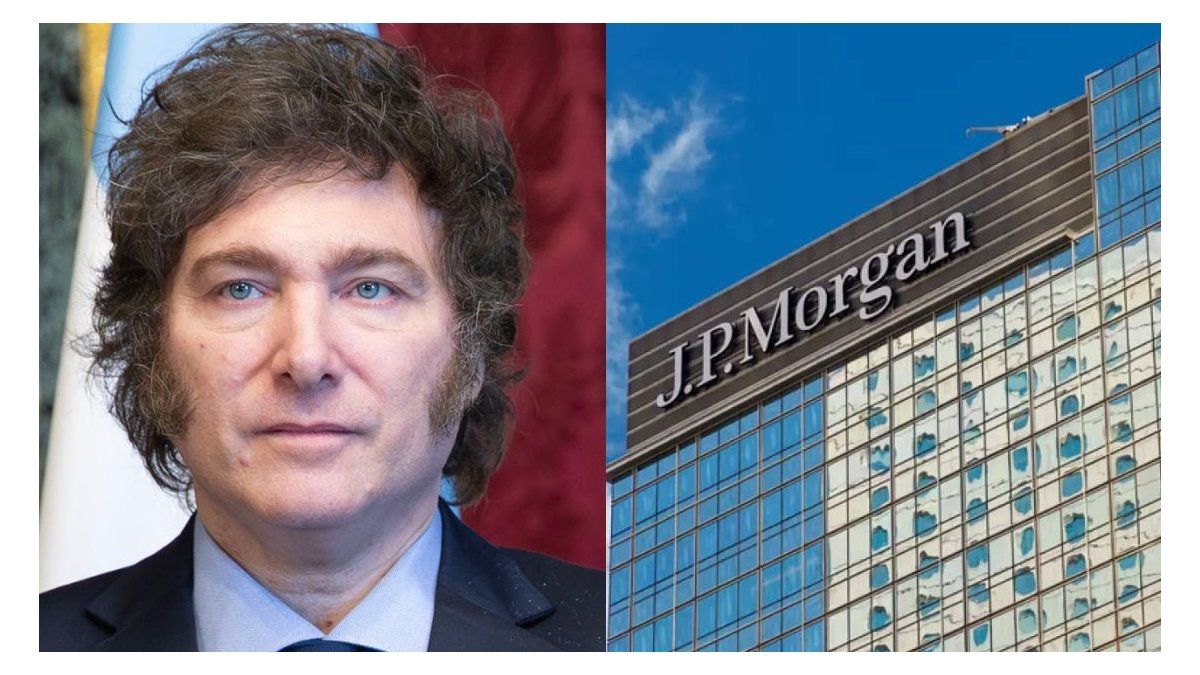

Javier Milei and JP Morgan launch a Brady Plan with multilateral funds

October 21, 2025

No Comments

Quietly, the Government took a step towards financial stabilization this Monday by formally announcing the appointment of JP Morgan Chase as structuring bank of a

the discovery that could change the economy

October 21, 2025

No Comments

October 21, 2025 – 10:42 Finnish scientists discovered trees that accumulate gold in their leaves thanks to soil bacteria. freepik Nature revealed a secret hidden

24 Hours Worlds is a comprehensive source of instant world current affairs, offering up-to-the-minute coverage of breaking news and events from around the globe. With a team of experienced journalists and experts on hand 24/7.