The founder of the world’s largest coverage fund referred to gold as a “key refuge” in the volatility of bonds and actions.

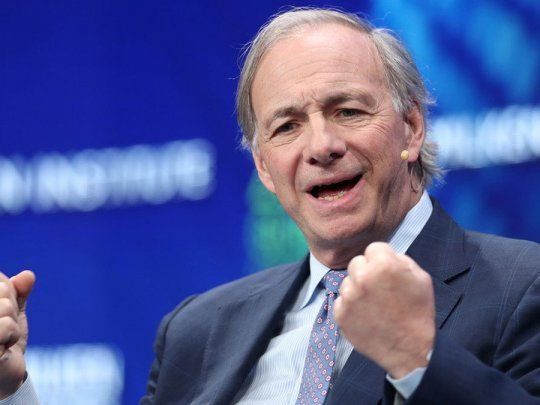

He Famous investor Ray Daliofounder of Bridgewater Associates and former executive director of the world’s largest coverage fund, turned on the debate about the risks facing the global financial system and mentioned the gold as Value refuge.

The content you want to access is exclusive to subscribers.

Investor Ray Dalio trusts gold

In a panel made within the framework of the launch of the ABU Dhabi Finance Week, the billionaire investor warned that the growing indebtedness of the US and geopolitical tensions create an unhealthy scenario for markets.

Dalio compared the situation with an obstructed circulatory system: “As the country allocates more resources to the payment of its debt, other essential expenses are reduced.” “A doctor would say that this is the prelude to a heart attack,” he illustrated. Given that panorama, investors recommended Between 10% and 15% of their portfolios in goldan asset that, as he recalled, historically behaves well in times of crisis and maintains low correlation with other markets.

The price of gold is located around U $ 3,678 per ounceafter registering a slight daily rise. The strength of the metal reflects in part the search for refuge against the volatility and expectations of an imminent cut of fees by the Federal Reserve (Fed), after more moderate inflation data.

Ray-Dalio.jpg

Dalio insisted that investors must rethink “who is really their money” when building more resilient wallets in the face of a world “overloaded debt.”

Global risks

On the other hand, on the same table, Bill WintersExecutive Director of Standard Chartered, agreed that financial conditions are also complex in Europe.

Although he argued that stock assessments are not as extreme as in the US, he warned that countries like the United Kingdom and France face equally severe restrictions.

Meanwhile, shares markets continue at maximum: The S&P 500 and the Nasdaq accumulate increases of more than 11% and 13% so far from 2025driven by the expectation of a monetary relaxation cycle. In Europe, the Paneuropeo index gains more than 8% in the year, although caution persists on the sustainability of these increases.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.