After using its deposits to contain the dollar, the treasure remained with just US $ 1,100 million compared to maturities for US $ 8.100 million to January inclusive, and analysts evaluate scenarios ranging from an improbable default to an optimistic return to the market.

After the sale of currencies to control the dollar In the previous legislative elections in Buenos Aires, The Treasury stayed with approximately US $ 1,100 million in the coffers in the Central Bank (BCRA) but the bulky debt maturities until January include AU $ S8.1 billion. This implies that Luis Caputo’s administration at the head of the Economics portfolio has the days counted to get the currency that they lack. Indeed, the City already analyzes which are the possible scenarios, from the most pessimistic, A DEBUDULT OF DEBTsomething unlikely for the moment, as the most optimistic: A country risk reduction -from a good choice in October -that allows access to the international credit market.

The content you want to access is exclusive to subscribers.

As found Scope with Facimexbetween September and January The national administration faces debt maturity in dollars with private and multilateral organizations for US $ 8.1 billion, of which US $ 3,800 million correspond to payments of Global and Bonares In January, U $ 3,100 million to Yu $ 1,200 million multilateral organizations to the Bopreal. But, if one takes into account that the treasure currently has nearby amounts au $ 1,100 million, at least US $ 7,000 million would be missing to face its maturities only in the next four months. It is worth asking, then, what options you have to get fresh funds.

For Martín PoloEconomist and Chief of Strategy at Cohen financial alliesin talk with this medium, he said that “The best scenario is that they get the country risk and go to look for the market”but if they don’t succeed, “The worst scenario is to use alternative sources, such as IMF loans, repo loans or a bridge until July, considering that it is not a very large amount”. Which He does not believe that it happens is another debt restructuring And see how The less likely scenario “a default for so few maturities.”

In fact, as he also told this medium, Leonardo Anzaloneeconomist and director of CEPEC, Today bond prices reflect concern about strong debt maturities. Precisely to illustrate how this distrust is manifested in the market (Bond in dollars, under local legislation), that this Monday lies under US $ 48. This means that for every US $ 100 of nominal value, the market is willing to pay less US $ 48which reflects that the perception of risk increased significantly.

“The best scenario is that the ruling party wins the elections clearly, that goes down the country risk and allows access to external credit to roll the commitments. But the worst scenario, without access to external credit and with a market that does not validate more debt in pesos, is the default“, also coincided with the analysis Leonardo Anzalone. It should be noted that, right now, The country risk shot at a level close to 1,200 basic points, and so that Argentina can return to the international credit market, at reasonable rates, this indicator should lower at least 600 basic points.

“The economic program needs Argentina to recover access to the market to stop paying maturities with reservations. For that, Argentina needs a country risk in 550pbs zone (today is double), something that we expected to happen towards the end of the year and now look further. The dynamic will not be linear and will depend crucially on the October election, which is why the next 6 weeks will be key to the program of the next 2 years, “he told Scope, Tobias Pejkovich Balbianieconomist of Facimex.

The other scenario: Buy currencies at the cost of recalibrating the bands

The economist Amílcar Collantealso in talk with Scope, He said: “With the current level of country risk and the dollars that Treasury has, The government necessarily has to announce a reservation purchase program. This implies recalibrating the scheme of exchange bands since the price is close to the ceiling. I understand that even in a scenario that recovers the centrality and it is doing well in the elections you have to announce as Buy the necessary dollars and so you can lower the uncertainty to the market“

Why does the government need to modify the current scheme to buy reservations? Basically because The current band scheme has a roof and a floor for the exchange rate, which implies that the BCRA can only sell at the upper limit and buy in the lower (below $ 1000). Assuming that the BCRA decides to violate this rule that agreed with the IMF and buys dollars in the market, it would also be injecting pesos, which presses the upward dollar, which is at the limit of the upper band.

Image

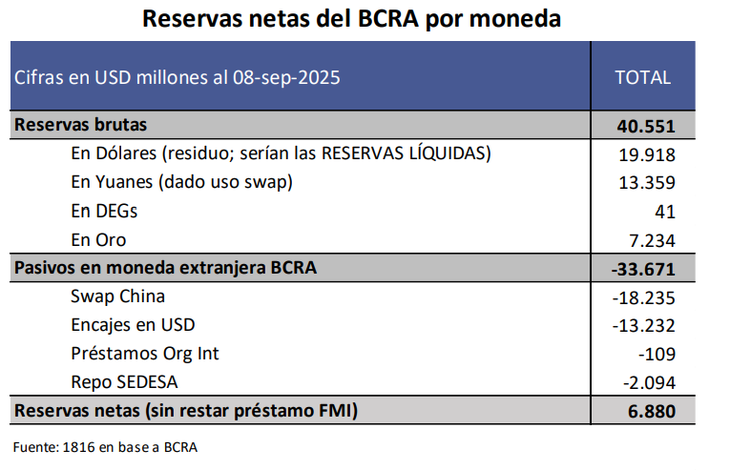

In fact, the Consultant 1816 He did a theoretical exercise: He took all debt maturities for 2027 and assuming that there is no “rollover” analyzed how many currencies the central and treasure should acquire. Both “They have capital maturities and interests for US $ 34.2 billion”they specified and completed: “Today the country has net reservations for U $ S6.9 billionso that even assuming that the net stock of the BCRA can return to very negative levels, the government should buy many dollars in the next 27 months. “

“To reach the end of the mandate with void net reserves, the government would have to buy US $ 27.3 billion in total, about US $ 1 billion a month to December 2027 (The calculation is simply US $ 34,200 – US $ S6.900). Making the same number but to reach the end of the mandate with negative net reserves of US $ 12,000 million (which was at the end of the government of Alberto Fernández), It would be necessary to buy US $ 15.3 billion in total, just over US $ 500 million per month, “they described.

Finally, from this consultant, they asked How pessimistic is this position. “The possibility of renewing the PLACs at 2028 (or issuing others) does not look simple if the market will want to buy papers with expiration in the next mandate. The possibility of requesting a new financing from the IMF or the US Treasury is always available, but it is difficult for us to see a relevant loan if just the political scenario, which begins to have the entire market in mind, is that of non -continuity. The necessary purchasing amount could be a bit with some privatization or with some local issuance in dollars“They closed.

In short, Balbiani closed: “If the government makes a good choice in October, I think Argentina will be able to recover access to the market in 2026. On the other hand, instead, If the country risk does not fall to a level that allows refinancing maturity, a higher real exchange rate will be needed to favor the accumulation of reserves and remain performing. There may also be an intermediate scenario, in which the government pays part of the maturities with reservations and part with bridge loans with international organizations or rest, as happened this year. “

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.