With the treasure deposits in low, the eyes are now placed in the intervention of the central. The market does not believe there is a modification in the bands here to the elections, but the doubts and then grow.

After the electoral setback of the ruling party in the province of Buenos Aires (PBA)the official dollar rose on all rear wheels, to end this Monday just 0.4% below the band’s roof of flotation ($ 1,473.40). With the national elections on the horizon, The Central Bank (BCRA) has a strong fire power to contain the price below that “stop” until October, although the cost forward can be high.

The content you want to access is exclusive to subscribers.

In the last six days, the wholesale exchange rate advanced 8.3% to stand in the $ 1,467 and be shot from the roof set today in $ 1,473. After selling US $ 500 million the week prior to Buenos Aires legislative to stop the climbing of the currency, the treasure now has just over US $ 1 billion in its deposits to continue intervening.

Therefore, The eyes are now put in the actions of the BCRAwhich has the monetary support disbursed by the International Monetary Fund (IMF) following the new agreement signed in April.

The US $ 14,000 million of the IMF reaches until October, but later?

“According to our estimates, the Central Bank would have almost U $25,000 million of liquid reserves, of those who I could use at least US $ 14,000 millionthat is, the disbursements of the IMF of April and July, to intervene in the market, “said the Economic Studies Management of the Province Bank in a report. To spend those US $ 14,000 million here until October 26, the monetary authority should sell US $ 500 million per daya figure only seen in a couple of weeks throughout the last two decades.

Indeed, from the province they reflected that, From 2003 to date, “Only in the third week of April 2018 and in the third week of October 2019: when the first run of the Cambiemos management began and on the wheels prior to the presidential election of 2019, the BCRA lost more than US $ 450 million a day. Therefore, we should cross six weeks like those to “burn” all those resources.

BPA 2

Source: Economic Studies Management of the Province Bank.

This makes the market believe that there will not be a modification in the exchange scheme here to the elections. “I do not seem advisable to put changes before the elections. That they fulfill at least for a while the scheme they agreed with the IMF and that they communicated,” he said in dialogue with Scope the director of the Outlier consultant, Gabriel Caamaño.

“The US $ 14,000 million are a lot. After the elections, with the result already put and that uncertainty already resolved, it can be a more conducive moment for changes“The specialist added. In the meantime, he suggested to the economic team that” he commits to the scheme and does not do strange things. “

Dollar in debate: the market does not believe in the exchange scheme after elections

Even so, the economist thinks that the government It will be increasingly difficult to sustain this exchange rate regime, since “The market has already concluded that the bands after the elections fly, because they were very short“.” If we had accumulated reservations before, it could have been reached differently when sending another sign. These expensive dead times are recurring in our economy, “he deepened.

And after October, market credibility in the exchange scheme is already much weaker. The foundations have their root in the large number of debt obligations That the country has to face in the next 12 months, for which the level of the exchange rate looks insufficient.

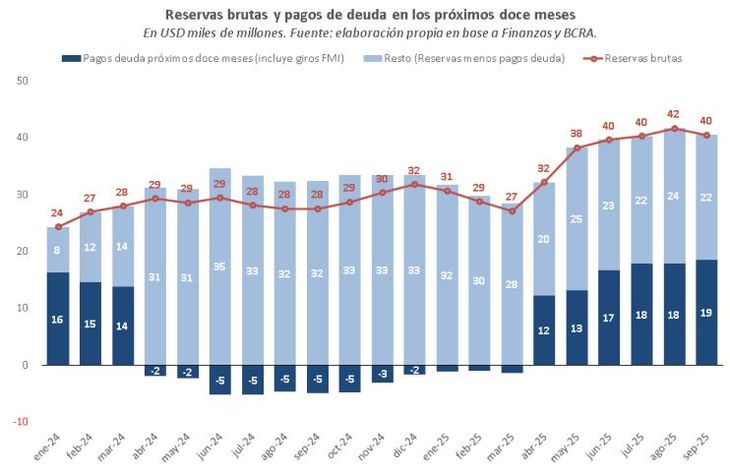

BPA 1

Source: Economic Studies Management of the Province Bank.

According to the province, the maturities for said period represent some U $ S19,000 million. 47% correspond to debt with private bonds, 38% to debt with international organizations, and the rest to obligations with Bopreal holders.

Even assuming that the BCRA does not play an important portion of the dollars that the IMF provided, the stock of reservations is scarce to face those payments. That is why the vast majority of economists have been highlighting a while ago about The importance of accumulating currencies.

Although with the last jump the official exchange rate already corrected 60% of the delay that had accumulated between January 2024 and January 2025, in historical terms the “green ticket” is still 17% below the average post convertibility average and is not located at a level associated with other moments of the past with current account surplus.

The importance of swelling reserves is not only relevant to encourage a greater balance of that account, but also to generate better conditions for the return to international credit markets, which could contribute dollars on the financial account side.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.