Thus, the wholesaler advanced $ 2 to $ 1,469 And it was 0.3% ($ 4.90) of the band of the band, which today was located in the $ 1,473.90. The volume operated in the segment counted was US $ 351,000 million, a “discreet” negotiated value.

In that line, Gustavo Quintana He stressed that “the evolution of the wholesale dollar remains bullish and reaches new historical maximums every day”, although the rise of the first two days of the week was $ 16, quite below the climb of $ 61.50 seen in the same period last week. “After a beginning with price drops, today’s wheel showed a very active demand but in an environment of lower activity level that prices approach to the upper limit of the fluctuation band fixed in a timely manner, generating expectation of the official response when reaches that level“The specialist said.

City operators reported that during this wheel There was an important presence of the monetary authority in the future dollar contracts, which recorded generalized casualties, with greater emphasis on May 2026.

Future prices fell into all their deadlines. In this way, the September He stayed under the roof of the band, around the $ 1,467.50. So much, the “price” market that in October exceed that key threshold ($ 1,494.55 where the band’s roof would be located if it is not modified) and reach the $ 1,524.50.

Along these lines, an extension of the limits and conditions for the monetary authority to operate in the dollar futures contracts were known on Tuesday. An initial limit of 6 million contracts was set, expandable to 12 million if the margins scheme allows.

Parallel dollars

While the Financial dollars cut initial falls: he MEP or “dollar bag” falls $ 13.99 (-0.9%) a $ 1,474.07 while the Counted with liquidation (CCL) yields $ 17.18 (-1.1%) to $ 1,483.35, its greatest fall in two weeks.

In economic terms, The economic foundations were not altered, but trust was diluted after the government stumbled upon making decisions that compromise the payment of bonds in dollars. That is, plain and plain, for the power of the central bank to control the exchange rate for more than a month of the legislative election.

Dollar Blue Vivo Investments Markets Bonds

The Government presented the 2026 budget: what is expected for the market day on Tuesday.

Depositphotos

Local vendors argue that, if the Central Bank intervenes in the exchange market using IMF dollars To contain the price in the upper strip, it will end up weakening its ability to pay future debt, since the reserves will continue to fall. In fact, yesterday they were reduced in U $ 461 million And they remained in U $ 39,048 million, product of payments to bilateral organisms. Tomorrow and Thursday the treasure must face new external commitments.

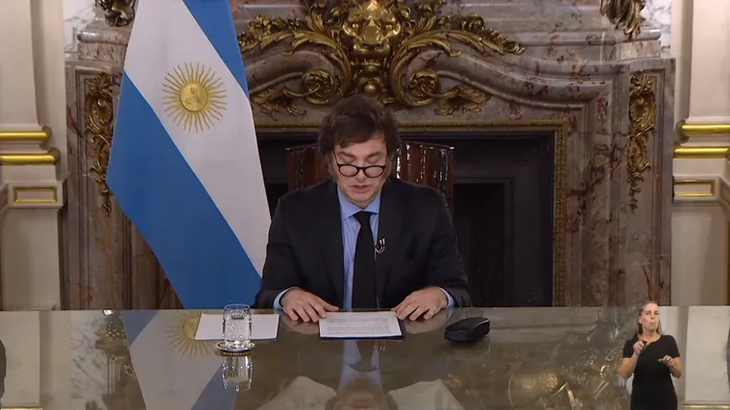

“With a remarkably more moderate tone, with a message mainly directed to the potential voters, Milei announced the sending of a new budget to the congress that contemplate Optimistic, in line with the assumptions raised in other key instances. Federico Filippiniof ADCAP Financiero Grupo.

chain

Javier Milei read the speech that was recorded during the afternoon

Dollar price today, Tuesday, September 16

He Card or tourist dollarequivalent to the official retail dollar plus a surcharge of 30% deductible from the income tax, it was positioned in $ 1.924.

Crypto dollar price today, Tuesday, September 16

The crypto dollar or dollar Bitcoin quote a $ 1,480.07according to Bitso.

Bitcoin value today, Tuesday, September 16

He Bitcointhe most popular cryptocurrency on the market, operates in the US $ 115,312, according to Binance.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.