In a recent report entitled “Argentina – Going Binary”Barclays warned that the chances that the country can continue “Muddling Through” – that is, “keep the step” holding the current scheme without great alterations – decreased substantially. The British bank considers that the Current regime is under pressure due to the situation of the reserves and stated that a prompt modification of exchange regime is necessary. Besides, recommended a more expensive dollar that dynamizes economic activity and decomposes to the Central Bank. Is it before the legislative elections?

Tension reservations: Government Achilles heel

One of the central foci of the analysis is The level of international reservationswhich remain at low levels despite the policy of high rates and monetary contraction.

According to Barclays, gross reserves are around US $ 24,000 million, But if the yuan holdings of the BCRA are discounted (equivalent AU $ S13,000 million), the currency liquidity is reduced to $ 27,000 million. If the support of the dollars of the banks (US $ 13,000 million), the effective “mattress” low $ s14,000 million is also considered.

Barclays calculates that, even with the IMF disbursement goals, Liquid reserves would be $ 9,000 million below what is necessary to cover payments up to 2027. If the BCRA buys that sum to close the gap in the market, the net reserves would end the mandate of Javier Milei in negative terrain (US $ 13,000 million), a level similar to that inherited from the government of Alberto Fernández.

BARCLAYS-SIGNAGE-SCALED.JPG

The bank made an extensive report with the reservations.

The report indicates that the exchange rate is practically on the ceiling of the exchange band – In fact, he reached it yesterday and the economic team was forced to intervene- and that “there is a material risk that the BCRA has to sell dollars before the elections to defend it.” This, in the opinion of the entity, It makes it harder to sustain the strategy of enduring unchanged until the October elections.

“This environment changes the incentives in favor of more aggressive policy decisions, in our opinion. With the appeal to continue” enduring “considerably reduced, Milei has more incentives to offer a convincing macroeconomic turn. And, what is important, We believe that this regime would be attainable with contained costs“Barclays analysts said.

For experts, a successful regime that can underpin Milei’s popularity and improve fundamental funds has to offer these three key points: 1) Economic growth. 2) Low inflation (1.5-2% monthly) and a sustainable reserves trajectory). This would bring a “virtuous circle of minors sovereign spats, access to the market and less political uncertainty.”

What level of the dollar the bank suggests

Analysts take time within the report to compare the current real exchange rate. They ensure that it is 30% weaker than in 2010, when the economy grew in a similar way, although with current account deficit of 0.4% of GDP.

The other comparison is from May 2018 to July 2019, when the real exchange rate was 20% weakest than today. “We believe that at those levels, a new roof (de facto or jure) 40% in real terms above the current levels would be credible “, They sentenced in the report to which he accessed Scope.

Would there be transfer at prices if it was devalued? For Barclays, no. The Pass-Through, as July and August demonstrated, would continue content since it would not be motivated by nominal reasons. “In our opinion, this means that a great inflation leap would not be necessary,” they added.

“An overvaluation of the relatively small real exchange rate (20-30%) based on 2% inflation, Combined with a solid fiscal position, it means that the distance between the current regime and a functional regime is not prohibitive, in our opinion, “analysts say, although They anticipate that the roof should be at least 40% above the current value.

In summary, the Barclays suggestion coincides with that of some analysts that ensure that a real exchange rate such as the one that had hinders the possibility of accumulating reserves.

It is worth remembering that historically in the country, a cheap exchange rate encourages the exit of dollars for tourism and strongly encourages import growth, which can bring commercial deficit. In fact, it follows from the 2026 budget that the Government expects a External deficit of goods and services until 2028.

“With a real exchange rate convincingly aligned, we believe that the BCRA could buy about 2.2% of GDP (OU $ S17,000 million) without generating additional impulse to inflation. A pre -established dollar shopping schedule would make the commitment more solid “they projected from Barclays.

A positive fact, according to Barclays

“The fiscal task is made”. Thus, Barclays defined the primary surplus of 1.5% of GDP where it confirms that the pension expense is “controlled” and the service rate “already cover most of the costs.” Greater economic activity – which could occur, if the changes are made – “they would support the fiscal front on the income side.”

Screen capture 2025-09-18 074538

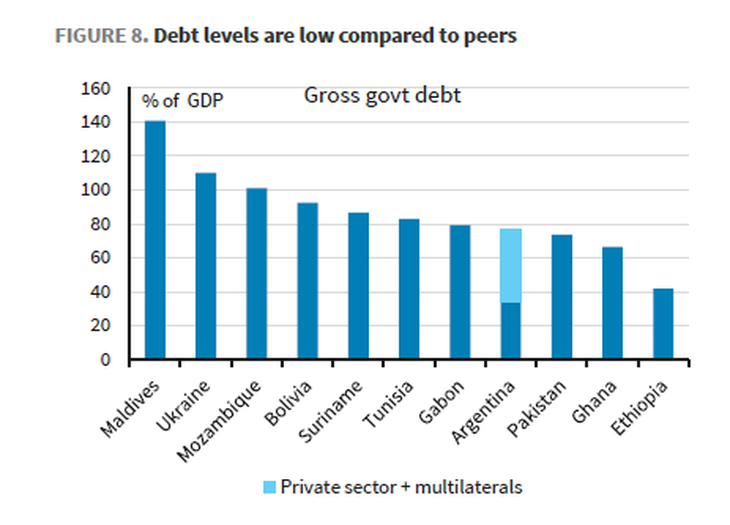

Low levels of Argentine debt vs comparable

And he stated that even if the ruling has a bad result in October, Milei could protect the fiscal surplus with enough deputies willing to keep the veto. Despite the projections and the change suggestion, In the short term they anticipate greater tension in the regime and fall of reserves.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.