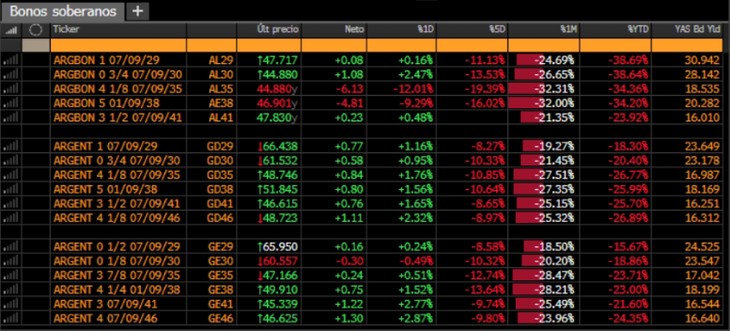

The sovereign debt in dollars already “price” scenarios of the most negative. It is that the market saw with a bad signal that the Central Bank begins to sell currencies on the ceiling of the band would change.

The Swing bonds in dollars They had a day for oblivion on Thursday: they sank up to 13.4% and the country risk exceeded 1,400 basic points. On this day try a slight rebound. Is that BCRA intervention With the sale of reservations he alerts investors in fear of future debt maturities. Thus, the country risk shot over 1,400 basic points, played a maximum of one year, and already accumulated a jump of more than 60% since the hard defeat of freedom advances in the Buenos Aires elections.

The content you want to access is exclusive to subscribers.

After the closure of the markets, The Minister of Economy, Luis Caputo, tried to send a signal to the markets through his participation in Carajothere although he assured that the government will remain firm the exchange strategy agreed with the International Monetary Fund (IMF) and ratified that the Central Bank will intervene in the market to the limit of the established band also He said they will comply with the debt commitments of January, although he did not confirm where the money will come from.

Image

For, Rafael Di Giornodirector of Investment Professionthe market enters these junctures in “Panic Selling” (panic sales) and said that the political leg also makes a dent in the price. For him, although it was discounted that the Lower House will reject the vetoes of university financing and pediatric emergencythe number of votes against the government were greater than expected. In addition, “the news was given that the BCRA began selling on the roof of the band and the market and ‘Pricea’ other scenarios.”

News in development.-

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.