After the new regulations to arbitrate financial dollars and the officer, the focus of the market is in the accumulation of reserves.

The Bonds in dollars bounce after several falls in line but the ADRs sink up to 6.5%after the recent restriction to the arbitration of the Official and financial dollar while the market continues to maintain attention in the purchase of foreign exchange by Treasureat times where the extraordinary liquidation of agriculture ends due to exemption to retentions.

The content you want to access is exclusive to subscribers.

Thus, the greatest descents in New York are headed by Macro Bank With 6.1%, followed by BBVA with 5.4% together with Supervielle Group (-5.3%). Meanwhile, S&P Merval falls 2.1% to 1,755,987,090 points and among the main casualties are: Northern Gas Transporter (-5,5), Metrogas (-5.5%) and BBVA Bank (-5.4%).

As for fixed income, the bonds bounce both in New York as in the local square after registering several consecutive descents. Thus, the ones that rise most are: Global 2035 (+2.1%), the Global 2046 (+1.9%).

Image

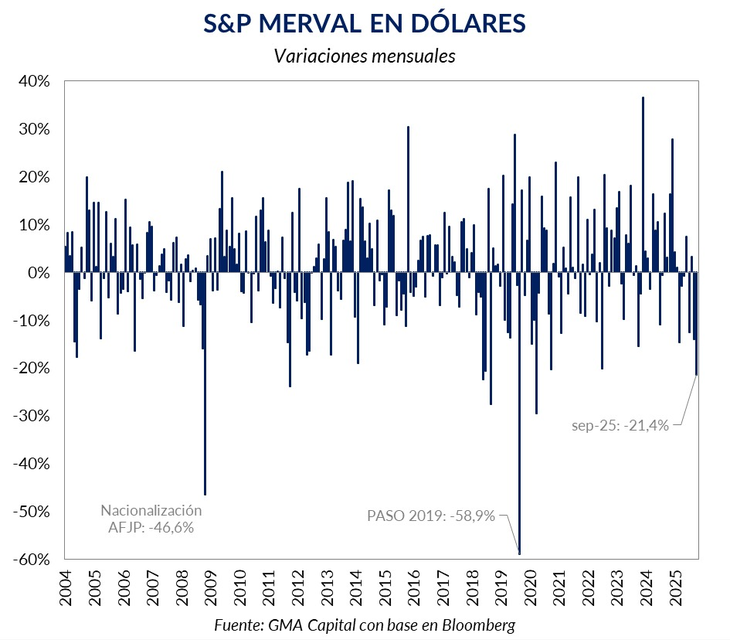

In that framework, The S&P Merval measured in foreign currency heads to register the greatest monthly drop since September 2020according to GMA capital. Now if it is considered within the fixed income to the global weighted by Oustantanding, it is the largest monthly decline for September since 2023.

What looks at the market

From Max Capital They stressed that the BCRA lowered a “rulo” that allowed individuals to arbitrate between both markets buying dollars at the official exchange rate, selling them in financial dollars through a bonus and then using those weights to return to the official market, in a cycle that allowed them to take advantage of the exchange difference and reduce the gap.

In this regard, the director of Investment Profession, Rafael Di Giornohe said to Scope that Volatility persists in the market from the “pre -election mode” already measure that it is known for sure what is the help for the Argentina announced by the American Treasury.

Regarding the restriction to financial dollars, he said that with her, obviously, The government wants to buy cheap dollars at the official exchange rate and “do not want people to get arbitrations”. “In that context, the measure seems logical”the expert slipped in view of the situation and existing restrictions.

This Monday, the Torcuato Di Tella university released an 8.2% collapse in its indicator of confidence in the government with respect to August, which measures the performance of the administration of Javier Milei. Against last year, the setback is 10%.

The last estimate of country risk shows a value of 1,124 basic points (PB). The economist Gustavo Ber He affirmed that the economic indicator is already located at that level “Waiting for possible financial operations that could contribute to clear next maturities and thus reduce country risk to rollover levels”.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.