The bank warns that, beyond support from the United States, the Government will have to recalibrate its exchange rate policy and prioritize the accumulation of reserves.

The investment bank Morgan Stanley warned that Argentine exchange rate policy will face decisive challenges after the mid-term legislative elections, and projected three possible trajectories for the dollar according to the electoral performance of the Government of Javier Milei.

The content you want to access is exclusive to subscribers.

In a report sent to its clients, the Wall Street entity noted that the reconstruction of reserves and the recalibration of the exchange rate scheme will be priorities in the coming months, even despite the recent financial support from the United States.

“The main objective after the elections should be to accumulate foreign currency, beyond Washington’s assistance package,” said the document, referring to the US$20 billion swap agreed with the US Treasury.

The report highlighted that both the monetary policy like the would change They will have to be adjusted after the elections, regardless of the result. “A continuity scenario would facilitate a more orderly transition, while an opposition victory could generate greater volatility and pressure on the exchange rate,” the bank warns.

dollar blue

Dollar: what one of the giants of global finance says about the Argentine scene.

Depositphotos

Three scenarios for the dollar, according to Morgan Stanley

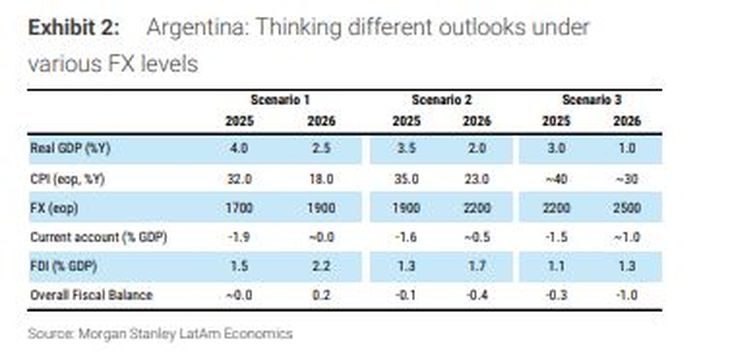

Morgan Stanley simulated three main hypotheses:

-

Scenario 1 – Continuity with expanded majorities (LLA 35%-40%)

If the ruling party achieves a solid result, the Government could move towards a coordinated exchange float with the backing of the United States. In this context, the dollar would stabilize around $1,700 towards Decemberwith inflation in gradual decline and estimated growth of the 2.5% by 2026.

-

Scenario 2 – Adjusted result (LLA 30%-35%)

An even choice against Homeland Force (FP) would imply lower market confidence, a delay in the external correction and a higher exchange rate, among $1,800 and $2,000 at the end of the year. Progress on reforms would be more limited and fiscal adjustment would lose intensity.

-

Scenario 3 – Wide defeat (LLA 25%-30%)

If the ruling party is ten points behind the opposition, exchange rate pressure would skyrocket and the dollar could exceed $2,000in a context of disorderly adjustment, drop in activity and deterioration of investment.

morgan22222222222222

Morgan Stanley’s scenarios, according to the election result

Reservations, reforms and relationship with the United States

The bank warned that, even with Washington’s support, Argentina will need reinforce your reserves through market purchases and positive current account policies. The permanence of the scheme exchange bands It should be accompanied by proportional adjustments and opportunistic foreign exchange accumulation operations.

Regarding a possible dollarizationMorgan Stanley considered it a distant alternative: “Argentina would require between US$21,000 and 86,000 million depending on the conversion rate, compared to net reserves less than US$10 billion”, details the report.

At the political level, the bank highlighted that increase legislative representation of La Libertad Avanza will be crucial to guarantee the governance and approve structural reforms in matters labor, fiscal and pension.

Finally, the report concludes that the US support marks a paradigm shift in the bilateral relationship, but warns that the recovery of bonds and market confidence will depend on two factors: macroeconomic stability and political consensus.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.