The seeking refuge in the dollar and the consequent fall in demand for pesos —a cyclical behavior in the Argentine economy that usually intensifies in pre-electoral periods— has deepened since mid-April, after the elimination of the stocks for natural persons. This measure coincided with the launch of the new agreement with the IMF and the establishment of exchange band schemewhich opened a period of greater monetary volatility.

Since then, they explain in the city, a “coin competition” began that is reflected in the recomposition of savings and investment portfolios.

Rising dollar and changing expectations

According to the report of the Quantum consultingthe process is intensified at the beginning of Augustwhen political and financial factors were added. “Since then, variables such as a new reading of the medium-term exchange rate, the perception of greater risks regarding the electoral calendar and certain changes in monetary policy have influenced,” says Quantum’s weekly report.

Between April and August 2025, the sector “Formation of Net External Assets” —which measures the dollarization of savings by residents— recorded net purchases of bills and coins for US$3.6 billion monthly.

unnamed (4)

The increase in dollar deposits, after laundering

What do Argentines do with those dollars?

The Quantum report specifies that a good part of these funds were turned to deposits in local banksupon payment of expenses abroad and to hoarding. The financial system’s dollar deposits increased US$3.4 billion between April and August, and another US$2 billion were added between September and October 8.

“With these increases, the total dollar deposits of the private sector reached US$34.4 billioncompared to the u$s18.5 billion registered before the laundering of September 2024”, details Quantum.

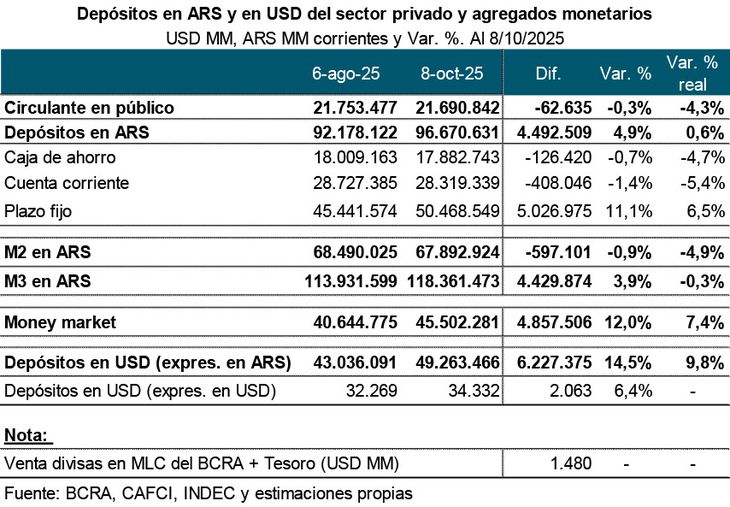

He dollar boom had its other side: the weakening demand for pesos. The report highlights that the monetary aggregate M2 —which includes cash and deposits— fell 4.9% in real terms between August 6 and October 8.

In that same period, the circulating in the power of the public stepped back 4.3% realwhile the total deposits in pesos it barely grew 0.6% real. Within this last group, the transactional deposits (checking accounts and savings accounts) decreased 5% realbut the fixed deadlines increased 6.5% realdriven by a positive real interest rate close to 2% monthlywhich accumulated 4.2% in two monthsand for the persistence of exchange restrictions for companies.

In other words, the only demand for pesos that resists is the one offered returns above inflation. This phenomenon, however, makes credit more expensivelimits the financing of consumption and slows down economic activity.

unnamed (5)

The fall in demand for pesos according to Quantum Finance

Quantum adds that part of the growth in fixed terms is explained by the role of money market fundswhich work like paid demand accounts and that they invest part of their assets in term deposits. “These funds increased 7.4% actual in the period analyzed,” says the consultant.

Still, the trend is clear: Argentines take refuge in the dollaralthough with one key difference from other episodes. “Unlike previous crises, the public you are not withdrawing your funds from the financial system. The banking sector and the capital market are playing a role of value preservation channel. Many of the pesos converted into dollars remain deposited in local banks or are channeled to negotiable obligations in foreign currency issued by Argentine companies,” indicates the report.

The pressure on the exchange rate

The growing demand for foreign exchange—now partially fueled by US Treasury dollar saleswhich seeks to provide liquidity to the Argentine market—translated into greater pressure on the exchange rate and in one loss of demand for local currency.

Quantum warns that difficulties in containing exchange tensions are evident both in the net foreign exchange sales by the Central Bank as one’s own Treasureand in the help received from Washington.

The report concludes that, for reduce precautionary dollarization and improve weight position, it will be necessary restore political and economic confidence. “Containing the demand for coverage and strengthening the peso will require clearing up doubts about the governancethe continuity and sustainability of the current exchange and monetary schemeand advance in structural reforms that provide predictability,” says the consultant.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.