In the city they believe that the objective is the Global titles and the Bonares that expire in 2029 and 2030. They are the ones that generate the most burden in the coming years.

The debt swap operation announced this Monday by the Secretary of Finance, Pablo Quirno, supported by international organizations with the aim of releasing funds for education could involve a total of US$16.3 billion in bonds. This is indicated by an estimate by the consulting firm 1816 based on calculations of market holdings and their current value.

The content you want to access is exclusive to subscribers.

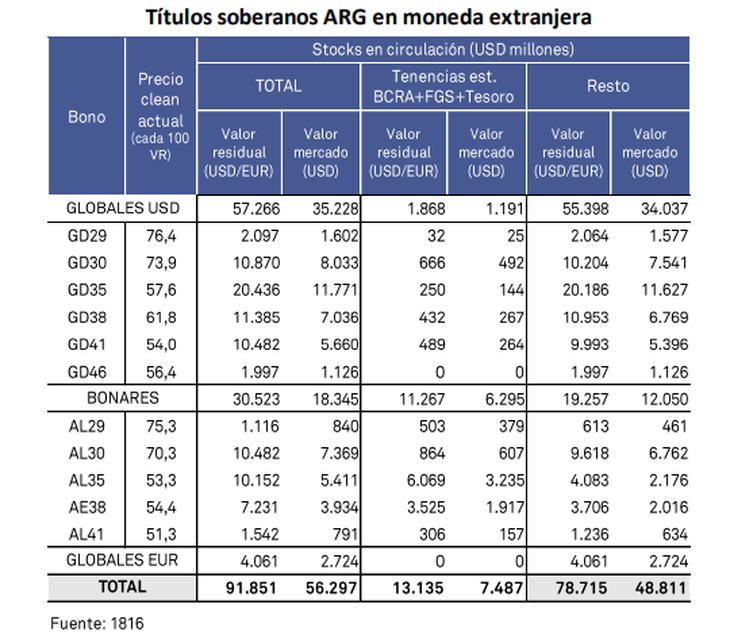

According to 1816, Argentina’s total debt with bondholders reaches US$91,851 million, but your market value is much lower. It is estimated to be US$56,297 million, from which the holdings of the Argentine state itself through the BCRA and ANSES must be subtracted. What remains to be paid is US$48,811 million.

The market assumes that the focus of the operation announced by Quirno It would be in the dollar papers that expire in 2029 and 2030, which are the ones that generate the greatest weight of maturities in the coming months.

bonds-1816

In that case, on the global side, from GD29 US$1,579 million would remain in the market in the hands of private companies, while GD30, another US$7,531 million. Those of legislation national AL29 have another US$461 million ands AL30 US$6,762 million. In total, it would be US$16,341 million.

The value at which the bonds that could be exchanged are currently trading is 76.4% for the GD29 and 73.9% for the GD30, while their similar local legislation is at 75.3% and 70.3% respectively.

It is evident that if the Government wants, in a certain way, “take out” debt from the international capital market and pass it on to international organizations such as the Inter-American Development Bank (IDB) or the World Bank (WB), since the rate is lower. The result must be applied to social investment. In this case, the interest savings would have to be applied to investment in education. One point to keep in mind is that the only expense of this item borne by the Nation are the public universities.

The international experience

According to 1816, in most cases this type of operation is carried out by issuing a new bond guaranteed by organizations, which makes them pay cheaper interest. “Debt at a high rate is exchanged for debt at a low rate thanks to the support of an organization. What does the country commit to? Essentially to invest the resources saved by the operation in the areas agreed upon with the organization,” explains 1816.

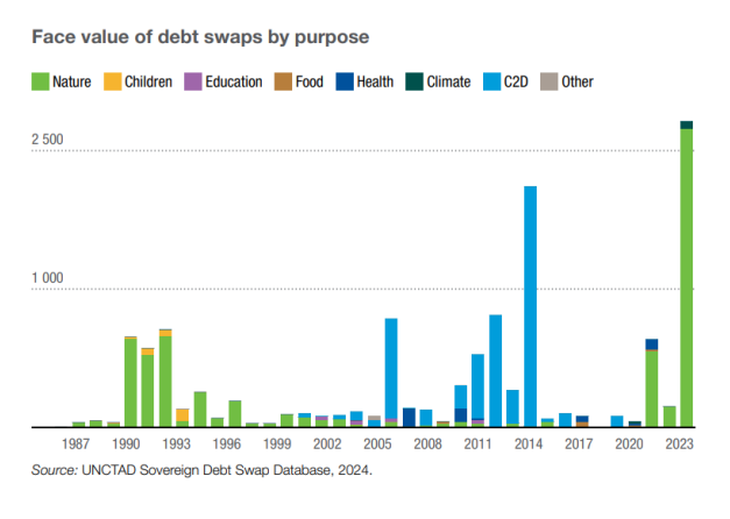

buybacks-1816

According to United Nations statistics, cited by the report, Between 1987 and 2023, 235 “Debt for Development” exchanges have been made in a total of 58 countries.

“These exchanges involved debt for an aggregate total of just over US$11.5 billion, most of which were of the ‘Debt for Nature’ type. One of the most useful operations of this type to think about the case of Argentina is the one Ecuador made in 2023, which at the time was the largest exchange in history (later surpassed by one made by El Salvador last year),” the report says.

Ecuador issued the Galapagos Bond to 2041 for US$656 million and withdrew a nominal debt for US$1.6 billion from the market. The savings go towards the protection of the Galapagos archipelago in the Pacific Ocean.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.