The indebtedness of households with non-financial entities rose to 31% of the wage bill and the default reached 16.5% in August. According to a recent report, credit outside the banking system is growing despite the rise in financing costs and rate volatility.

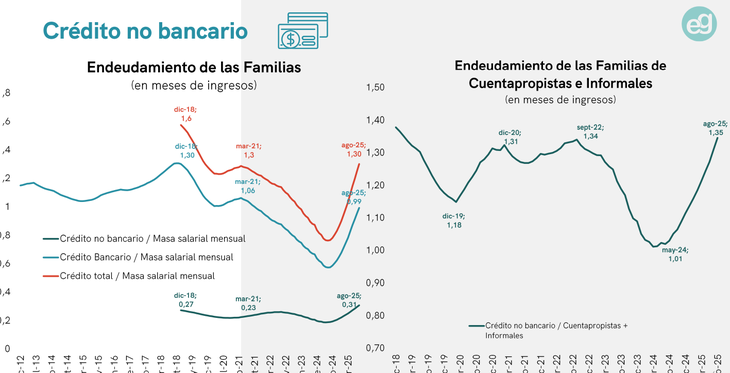

He household debt with non-banking entities continues to rise. At the moment It is equivalent to 31% of the monthly wage bill, that is, 9 percentage points more than last December, reflecting a notable growth in late payments. When including bank credit, the total debt of families represents the equivalent of 1.3 months of average income, while in the case of informal workers, the weight of non-bank credit reaches 1.35 months of the wage bill, even exceeding the peak of September 2022 (1.34 months).

The content you want to access is exclusive to subscribers.

To put it in perspective, non-bank portfolios totaled $11.7 trillion, being 136.8% above the last floor of March 2024 in real terms. Having surpassed the historical maximum of March 2018, current levels are 15.3% above them, in real terms.

The growth of non-bank credit demonstrates the high delinquency levels. In August, last known data, 16.5% of the portfolios were in an irregular situationwhich implies an increase in 1 percentage point compared to the previous month and more than 9 points above the minimum recorded in November (7.4%). The report belongs to the consulting firm EcoGo, based on official data from the Central Bank.

He 70% of the top 100 portfolios of non-financial entities showed an increase in their default cases. The trend is also replicated in the banking system: delinquency of bank portfolios reached the 3.6% in Augustwith an increase of 0.5 points compared to July.

“Far from slowing down the expansion, non-bank credit, which is mostly accessed by families who cannot ask for loans from banks, grew more than in July, even with the high volatility of rates that began with the disarmament of LEFIs and continued with the government’s objective of curbing the dollar. Despite the increase in the cost of funding that was not completely reversed, the dynamics of non-bank credit appears resilient,” expressed from EcoGo.

image

Family debt, according to EcoGo.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.