We arrived at the general elections after more than two months of strong intensity in the exchange front, marked by a joint intervention between the Central Bank (BCRA), the Argentine Treasury and the US Treasury. Throughout the month, the position of the monetary authority in the futures market remained at high levels, with days of high volume, reflecting official efforts to anchor devaluation expectations in the run-up to the general elections.

In this context, the BCRA exceeded US$7 billion sold in futures, according to preliminary estimates from October, which although it is still far from its ceiling of US$9 billion, there are some caveats that are worth taking into account.

The expiration of the October contract, the shortest on the curve, now concentrates all the attention of investors, that operates below the ceiling of the exchange rate band. On this point, the reading predominates in the City that, if an exchange rate correction occurs, it would not occur this month.

The hypothesis is based on the perception that the Government would not be willing to assume the cost of paying the “difference” for that contractwhich expires next October 31. According to the estimate of Consulting Firm 1816, this contract represents 20% of the Central’s total futures sold position in A3, however it warns that the “The market will be expectant of the operations of the monetary authority during the rollover.”

Uncertainty in the exchange market led the private sector to intensify its search for coverage. Companies and investors resorted to all available alternatives to protect themselves: from the direct purchase of dollars to the use of linked dollar instruments, futures contracts and other conservative options such as bopreales and negotiable obligations. According to the BAVSA estimate, “the Government arrives with 4.76 million open future dollar contracts in the three shortest positions and in the dollar linked segment showing more trading volume than the fixed rate or Boncer segment.”

This scenario reflected a profound dollarization process in the private sector that continued throughout the month, and that, as a positive sign, boosted deposits in foreign currency above US$35 billion. At the same time, the perception persists in the market that, despite Minister Luis Caputo’s efforts to rule out changes in monetary policy, the Government should evaluate two possible post-election paths: adjust the exchange bands by stretching the “ceiling” or move towards a managed floating scheme, with the support of the United States Treasury to guarantee a transition without abrupt shocks. But everything will depend on the results.

This is how the financial advisor, Gastón Lentini, puts it: “It seems to me that if the ruling party gets a thirdthe dollar is going to calm down in the short term. The bands will be maintained the week following the election. But I think that after November, it is a different story, considering that there are many debt maturities in futures or bonds, in October. And if they decide to eliminate the gangs, they will do so in November, precisely because the financial cost is lower. Therefore, with a good result, I think we can have a week of calm, and they can change the exchange rate scheme the following week and then it will continue its course because we do not have dollars either in the BCRA reserves or in the Treasury.”

In addition, Lentini contributed one more element that is worth taking into account: “To consider, at the end of the year, all the dollars deposited from last year’s money laundering will no longer be required to be in Argentina, which means it is a capital that can come out of the “Argentine risk”. If it is not all, it will be a part, and we will not have sellers, at least until the next harvest liquidation arrives.”

Future dollar: what the BCRA did in September

The Central Bank officially announced its position in future dollars as of September 30. There, it reported a monthly increase in the position of US$1,777.58 million. “Throughout the month, the futures market saw a BCRA that was more out of control compared to previous months, an absence that was noted in open interest, which only increased 2% so far in October. This is explained by the greater firepower via dollar linked that the BCRA has, which facilitates intervention (the sale of DLK is more direct than that of futures) and avoids increasing its position by a context in which we are increasingly closer to the limit established by A3 Mercados for the BCRA of US$9,000 million,” said Martín de la Fuente, Research at Adcap Grupo Financiero.

G39elsAXsAAk9Jv

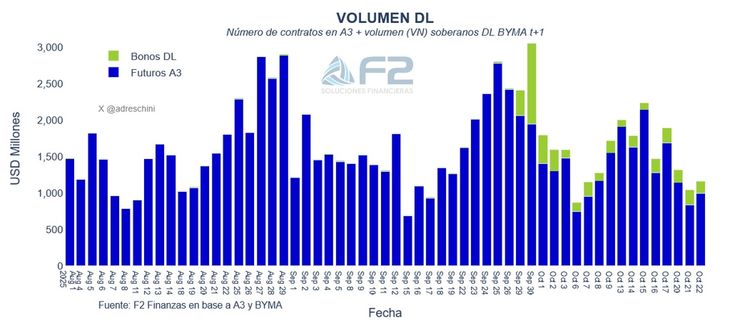

For his part, analyst Andrés Reschini contributed that according to F2 Soluciones estimates, the Central Bank’s sold position to date, It could be around US$7 billion.

At the same time, he recalled that this same month, “the Treasury placed debt tied to the official dollar (hedge) in the last two tenders for approximately US$4.3 billion and that the trading volume of these instruments has increased significantly since the end of September. In addition, At the beginning of October, the BCRA exchanged Lecaps for dollar-linked bonds to the Treasury for almost US$7.3 billion (VN) to increase its firepower when it came to supplying the demand for coverage.“. This is demonstrated in the following graph:

WhatsApp Image 2025-10-23 at 15.10.17

In the run-up to the elections, the Government managed to reach October 26, with the help of the US and, at least in the future, with a controlled margin of maneuver. Going forward, the factors to look at will be linked to debt maturities, how the political panorama turns out in the elections and the possibility of the Central Bank buying reserves again.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.