Cryptocurrencies register strong increases this Monday. The market awaits signals from US monetary policy and a possible trade agreement between Washington and Beijing.

He cryptocurrency market operates this Monday with significant gains, prolonging the trend of recent days. Bitcoin (BTC) advanced nearly 1.5% to trade around US$115,000while Ethereum (ETH) scale 2.6% and approached US$4,100.

The content you want to access is exclusive to subscribers.

Among altcoins, tokens like Binance Coin (BNB), Solana (SUN), Dogecoin (DOGE), Tron (TRX) and Cardano (ADA) showed increases of up to 3%. In contrast, XRP gave up around 1%.

According to CoinGlassin the last 24 hours there were liquidations for US$400 million on different platforms: US$340 million corresponded to short positions and close to US$75 million to long positions.

Consolidation after weeks of volatility

The price of Bitcoin is going through a consolidation phase after a 2025 marked by high volatility and sustained institutional interest. After several failed attempts to surpass its all-time high (ATH), the leading cryptocurrency remains in an area that analysts consider crucial.

For the first time since the fall of last October 10, accumulated spot and futures volumes show stabilizationindicating a reduction in aggressive selling pressure.

He Crypto Fear and Greed Index places market sentiment in a neutral zone, although still close to “fear.” According to glassnodehe Cumulative Volume Delta (CVD)which measures buying and selling pressure, flattened in both spot and futures, coinciding with the recovery in the price of Bitcoin.

The Fed and the Trump-Xi summit, in the spotlight

The current uncertainty over BTC is closely linked to the Federal Reserve’s upcoming interest rate decision. Although in recent months the organization adopted a more cautious stance, the indications are that a new adjustment could trigger a renewed flow of capital into digital assets.

Bitcoin has historically reacted strongly to changes in monetary policy, especially when the dollar weakens or liquidity returns to financial markets. A favorable move from the Fed could be the boost needed for Bitcoin finally break your previous ceiling and enter a new bullish phase.

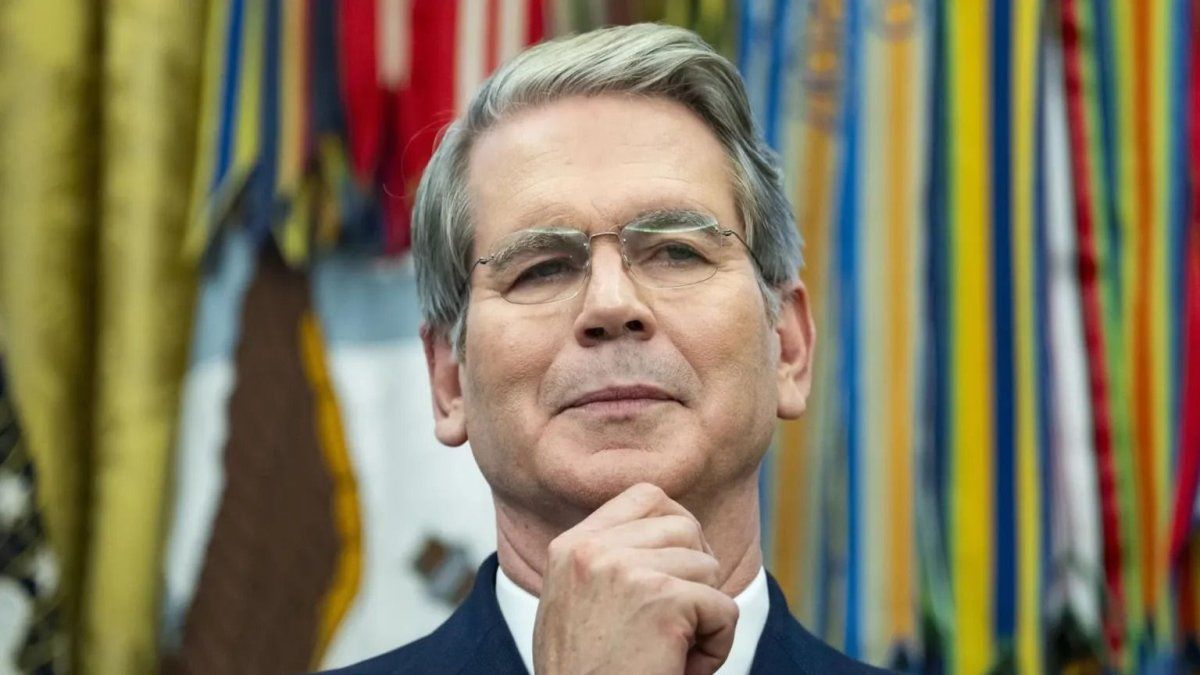

Added to that is the upcoming meeting between Donald Trump and Xi Jinping. Scott Bessent, US Treasury Secretary, noted that Washington and Beijing are close to reaching an agreement to avoid new tariffs. The understanding could be sealed on October 30, when the presidents of both countries meet in South Korea, within the framework of the Asia-Pacific Economic Cooperation Forum (APEC).

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.