The investment bank gave a new estimate on a central index for the Government’s economic program. Argentine bonds could regain ground with political support and backing from the United States.

JP Morgan projected a significant drop in Argentine country risk and a quick bond recovery sovereigns after the electoral victory of La Libertad Avanza (LLA), which consolidated the political support for the ruling party. The bank anticipated a reduction of more than 440 basis pointswhich would take the sovereign spread to levels close to 650 pointsin front of the 1,081 registered the Friday before the elections.

The content you want to access is exclusive to subscribers.

The US bank maintained that the “positive surprise of the electoral result and the consolidation of the ruling coalition “They radically changed market expectations.”. According to their report, “Argentina’s EMBIGD performance could decline 440 basis points to reach 10.2% minimum reached on January 9, 2025”, still being “170 and 206 basis points above Egypt and Pakistan, respectively”.

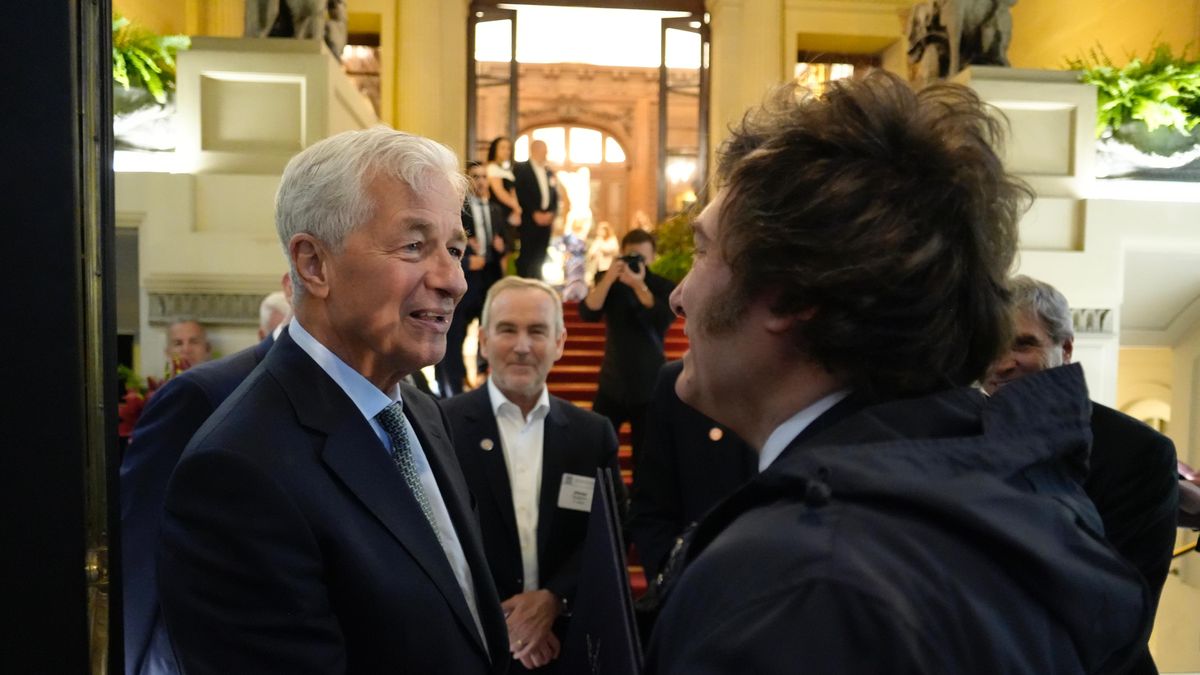

javier milei jp morgan

The bank estimates that the country risk could fall more than 440 basis points in the coming months.

JP Morgan compared the current situation with the country risk average in January, when it was at 627 points basics, and highlighted that even “a recovery to match the performance of the 11.4% of Ecuador 2035 bonds “It would translate into a price increase of US$9 for Argentine 2035 bonds.”

Political and US support

The report emphasized that local political support and the support of the United States “configure a favorable scenario for the price recomposition in sovereign assets.” “US support should boost the recovery,” the document noted, adding that North American support could include “additional concrete measures to boost demand for dollar bonds, including potential buybacks.”

The entity also stated that the electoral result marked “a change in the narrative”with the possibility of returning “to a virtuous policy cycle anchored in fiscal discipline and now likely reinforced by efforts to increase international reserves.”

Milei trump (1)

Support from the United States would be key to boosting demand for bonds and stabilizing the exchange rate.

Outlook for bonds, debt and a new economic cycle

JP Morgan recommended maintaining an overweight position (overweight) in Argentine sovereign securities, considering that the country could become “in the best sovereign credit from now until the end of the year.” The firm expects that longer-term bonds, such as Global 2038 and 2041, “will now show a dynamic of strong recovery.”

Furthermore, the bank estimated that “local rates could quickly approach levels seen during the period more stable after the elimination of capital controls, when the Lecaps They performed around 30%; This contrasts with the closing on Friday 45-50%”.

For JP Morgan, “the main focus will now shift to exchange rate framework The document warned that “recent weeks have exposed the vulnerabilities of the banding system, which lacks flexibility in the face of shocksso “some exchange rate adjustment could be necessary to restore the accumulation of reserves.

Finally, the entity projected that “after months of stagnation, economic activity is ready to reboundwhile inflation is projected to follow a downward trajectory“With the electoral result defined, JP Morgan considered that the markets could resume “a narrative of a virtuous policy cycle anchored in fiscal discipline and reinforced by efforts to increase international reserves.”

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.