He strong advance of La Libertad Avanza (LLA) in the legislative elections has transformed the Argentine political landscape into a immediate catalyst for markets. With more than 40% of the votes nationally, the party of Javier Milei not only reversed the previous defeat, but also consolidated a relative majority in Congress, reaching 93 seats in the Deputies and 20 in the Senate.

This unexpected support allayed fears of fragmentation and ignited a surge of optimism in the financial market, where sovereign assets lead the rise. The initial reaction was a collapse of the country risk what would happen 1,081 points basics last friday to the area of 650 basis points, according to JP Morgan estimates.

The American investment bank, in a post-election report, anticipates a contraction of more than 440 basis points in the sovereign spreadequating it to levels from January 2025, when it stood at 627 points. “This result radically changes market expectations,” say the entity’s analysts, who see in the official consolidation a “virtuous cycle” anchored in fiscal discipline.

This country risk fall It would not be a mere technical adjustment: The US bank maintains that the issuance of sovereign debt could fall under more favorable conditions. In fact, the report recommends an “overweight” position in Argentine bonds, and recommends titles such as Global 2038 and 2041, since, he maintains, they could recover up to US$9 per unit in pricesaligning with performances of peers such as Ecuador. “Argentina could become the best sovereign credit until the end of the year,” they claim.

But there is a detail: the entity ties that course to the possibility of dollar bond buybacks and a more flexible exchange rate frameworkboth architects to sustain the rise.

The signature Barclays It also expressed itself positive regarding what is to come, but made said evolution subject to the modification of the exchange rate scheme. “We believe that a new exchange rate regime is still necessary, even after these results,” the entity’s report said.

RBC BlueBay Global Asset Management At this time, he also recommended Argentine debt, with a “positive vision on sovereign debt, with a longer horizon for foreign investments in financial and real assets, thanks to the reduction of electoral risk and greater impetus for reforms.” In this sense, They considered “strengthening the exchange rate” as “feasible” and that “the BCRA should take advantage of the strength of the peso to accumulate reserves.”

Ninety One (emerging fixed income portfolio manager), projected an improvement in prices “highlighting the moderate and cooperative tone of Milei’s victory speech, which facilitates alliances for reforms.”

The plan to buy back debt in the secondary market

In this context, the Government accelerated announcements that reinforce the fiscal consolidation agenda. Days before the elections, the former Secretary of Finance, Pablo Quirno, confirmed progress in a plan repurchase of sovereign debt for up to US$16,000 millionfocused on short-term bonds.

The initiative, named “Debt for Education”, seeks to buy back securities in the secondary market at depressed prices and replace them with financing at lower rates. “This not only alleviates the financial burden, but transforms debt into human capital”Quirno declared in his X account, highlighting the support of multilateral organizations such as the IDB and the World Bank.

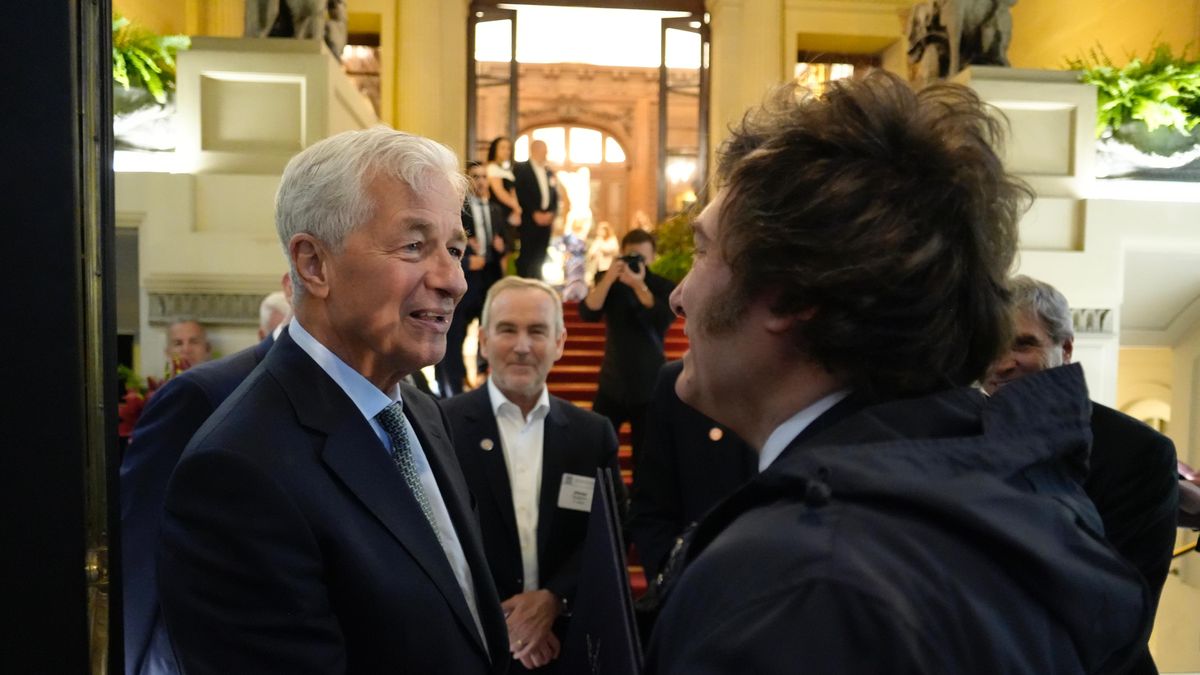

The fact is that the axis of the operation falls on JP Morgan, which will assume the role of main advisor and potential financier. The New York bank, which already participated in the 2020 restructuring, would grant funds for the repurchase at market values - up to 40% below the nominal value – at an interest rate estimated at 5-6% annually, compared to a much higher rate for the chosen bonds. Sources close to the Ministry of Economy reveal that the meeting between Milei and the CEO of JP Morgan, Jamie Dimon, the previous week sealed the commitment, with projections of an initial saving of US$800 million in coupon payments by 2026. For some analysts, this maneuver raises the credit rating and repositions Argentina as a debt issuer.

Source: Ambito

I am a 24-year-old writer and journalist who has been working in the news industry for the past two years. I write primarily about market news, so if you’re looking for insights into what’s going on in the stock market or economic indicators, you’ve come to the right place. I also dabble in writing articles on lifestyle trends and pop culture news.