These moves, fueled by expectations of faster policy tightening by the Fed and other central banks, have weighed on stocks, pushing the MSCI global stock index down 7% this year, while the US tech benchmark Nasdaq lost more than 11%.

Minutes from the Fed’s March 15-16 meeting revealed concerns about inflation in the economy and suggested that its balance sheet reduction could start next month.

“The question is how far the Fed will be willing to kill growth. My fear is that they are not as sensitive to weak growth as expected,” said Thomas Costerg, senior economist at Pictet Wealth Management.

The ten-year Treasury bond yield fell three basis points to 2.57% from a three-year high hit on Wednesday around 2.66%, while the two-year note fell almost seven basic points, to 2.43%.

The spread between the two-year and 10-year segments was the widest in a week, reversing a recent reversal often seen as a recession signal.

With the Fed leading the tightening push among major central banks, the dollar is trading near two-year highs against a basket of six major currencies.

The euro hovered at a one-month low, pressured by what ING analysts called a “double threat” from the economic impact of mounting sanctions on Russia and uncertainty over the French election.

Source: Ambito

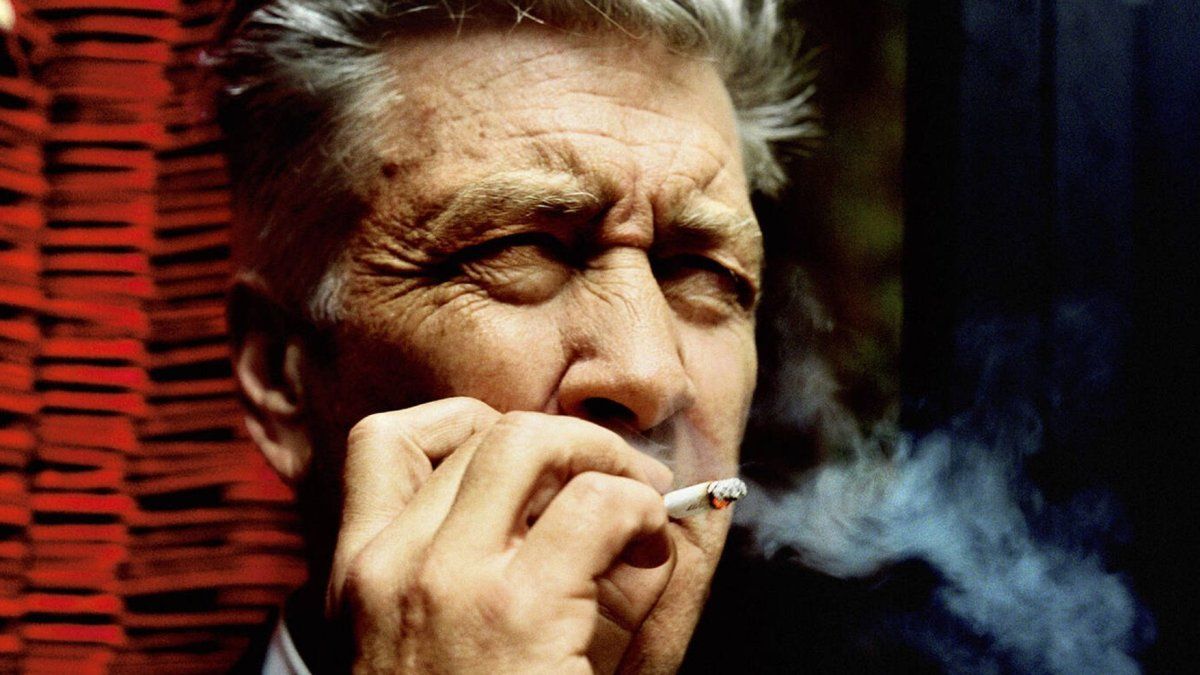

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.