The administration of the center-left president Alberto Fernández announced the day before, at the close of the markets, an exceptional aid for the less wealthy society in the face of the inflationary jump and summoned leaders of the economy to advance in the creation of a business tax, which must be dealt with by the National Congress.

This legislature is not controlled by the ruling party.

Economy Minister Martín Guzmán traveled to the United States to participate in the spring plenary session of the International Monetary Fund (IMF), an organization with which the South American country closed a debt renegotiation in March for some 44,000 million dollars.

Argentina extended a concession in the southern sea for 10 years in the hands of the oil companies Total Austral, Wintershall Dea Argentina and Pan American Sur, and approved an investment plan for 700 million dollars, according to a decree published on Tuesday in the official gazette.

On Monday, sovereign bonds denominated in dollars rose up to 2% in the Buenos Aires stock market, with the leadership of Global 2041.

After a negative start, the globals ended with greens. The weighted average price continues the rise of the previous week and is one step away from breaking the ceiling of US$34.

Thus, the weighted average rate stood at 20.1% and the Argentine country risk fell 0.6% to 1,679 units, the lowest level in almost six months.

“We understand that the important price differential between the bond issues under local and international legislation would not be justified, since the eventual fate of both would be even,” VatNet Research pointed out.

Likewise, CER bonds (adjusted for inflation) continued to be in strong demand, posting increases of up to 1.3% (TX23). Thus, in the month they accumulated rises of up to 16.2% (Quasipar), while in the year the advances reached 40.3% (Quasipar).

“There is still a significant amount of pent-up inflation in the system due to widespread currency controls, price controls, export controls and public tariffs significantly below cost,” Goldman Sachs estimated.

He added that “in general, Argentina has yet to develop a strong and credible medium-term fiscal consolidation plan and lacks a coherent conventional monetary strategy/anchor.”

“The rise in the ‘Leliqs’ rate by 250 basis points arranged by the central bank is in the right direction, but it can do little in this context to appease inflation. The new TEA is 58.7%, below 60 % of inflation expected for this year,” said Roberto Geretto of Fundcorp.

Lastly, dollar-linked sovereign bonds were in demand, rising by 0.5% on average, with TV23 standing out (+1%).

Source: Ambito

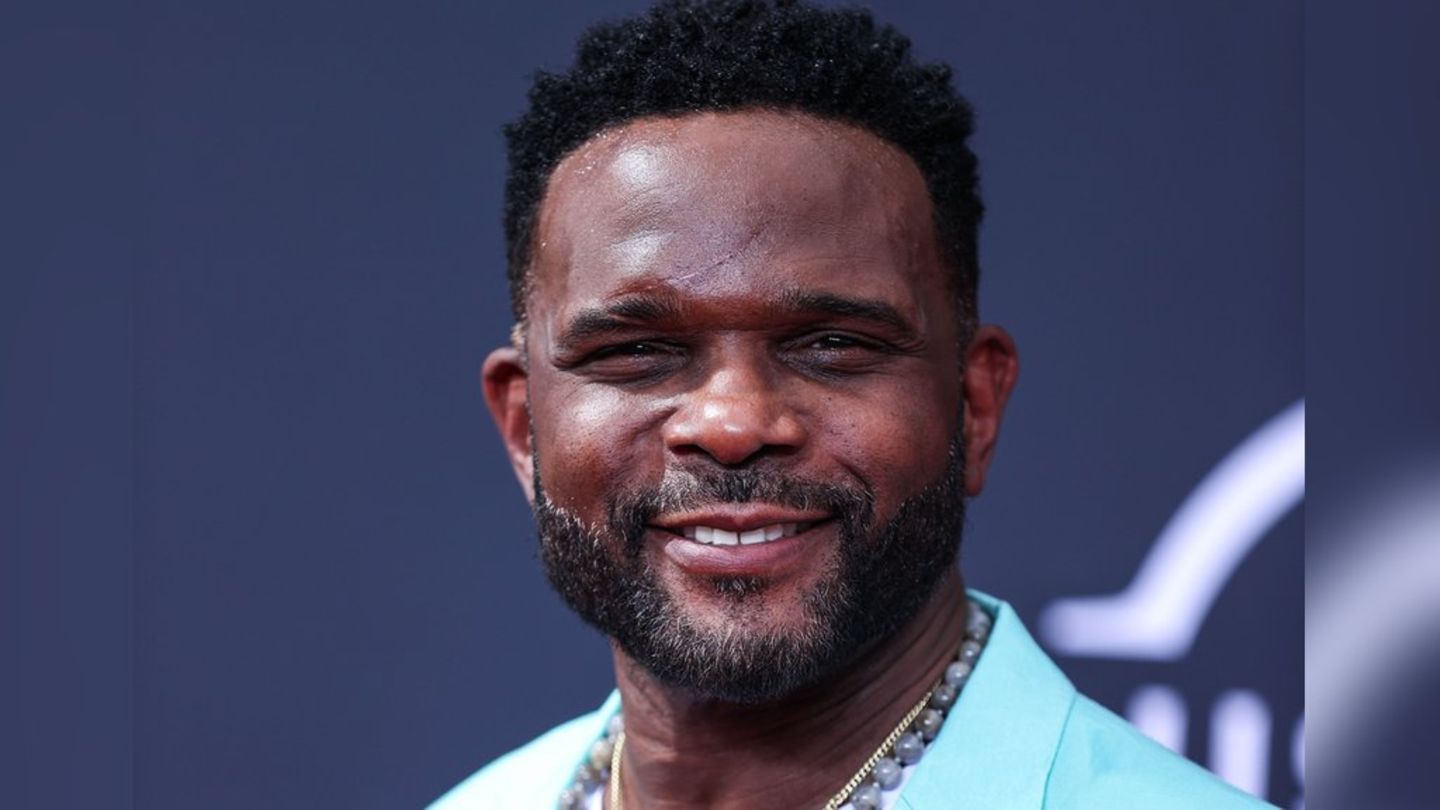

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.