Fed Chairman Jerome Powell said a half-point interest rate hike will be “on the table” when the central bank meets on May 3-4.in what is expected to be a series of hikes in the cost of credit this year.

With inflation roughly tripling the Fed’s 2% target, “it’s appropriate to move a little faster”Powell added in a discussion of the global economy at International Monetary Fund meetings.

“The market is discounting at least 50 basis points in May and June”said George Catrambone, chief operating officer of DWS Group, adding: “Powell and many others at the Fed said they want to get control as quickly as possible, and that is telling the market that they are going to act aggressively.”

Earlier Thursday, San Francisco Fed President Mary Daly said she supports raising the target for overnight borrowing costs to 2.5% by the end of this year, but whether or how much will need to be increased. more will depend on what happens with inflation and labor markets.

The comments from Fed officials capped the initial gains that markets took from encouraging quarterly balance sheets. All three major indices opened higher, buoyed by strong results from heavyweight Tesla and airline operators.

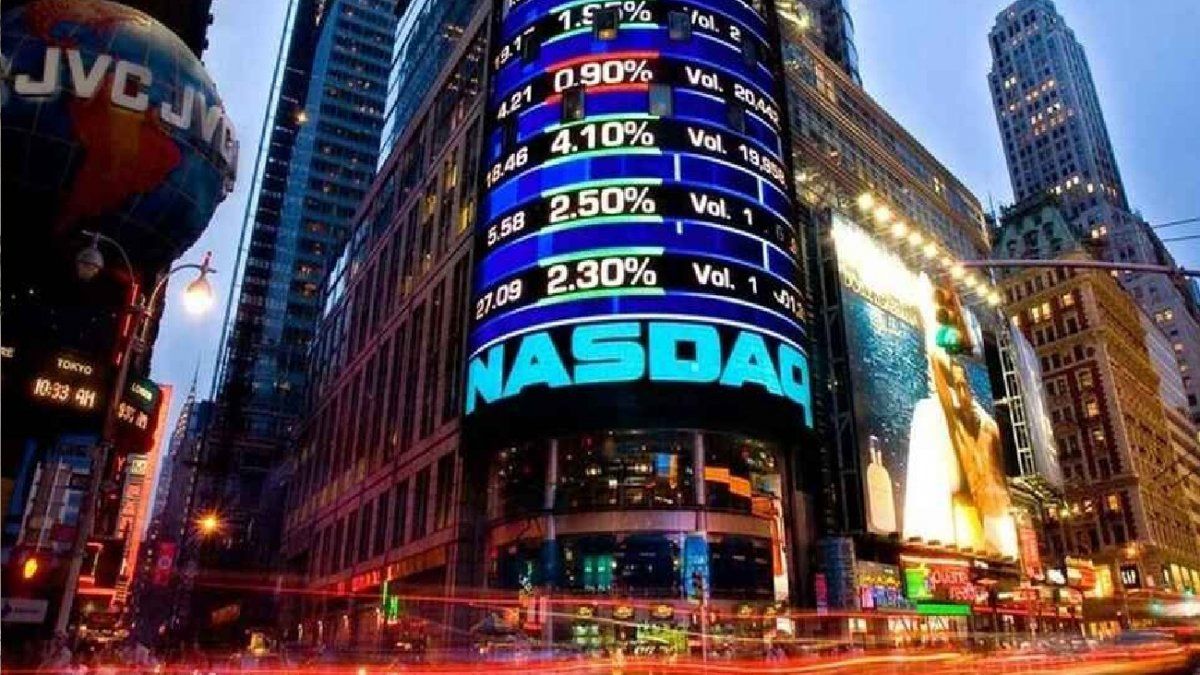

Nevertheless, gains eroded during the morning session and the S&P 500 and Nasdaq had already reversed course by the time Powell spoke.

High-growth stocks, including Meta Platforms Inc, Alphabet Inc and Amazon.com Inc, closed lower as investors worried about how the higher rate environment would affect their future growth potential.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.