Even bitcoin enthusiasts tend to view the cryptocurrency as a passive asset that investors buy and hold and expect to see an increase in price over a long period. Buffet himself commented that “nobody” is short on bitcoin, they are all long-term holders.

For more sophisticated crypto investors, some coins offer them a way to use their crypto productively, either through loans or as collateral, to create additional portfolio profits. However, they are still young, highly speculative, and have not broken into the mainstream like Bitcoin.

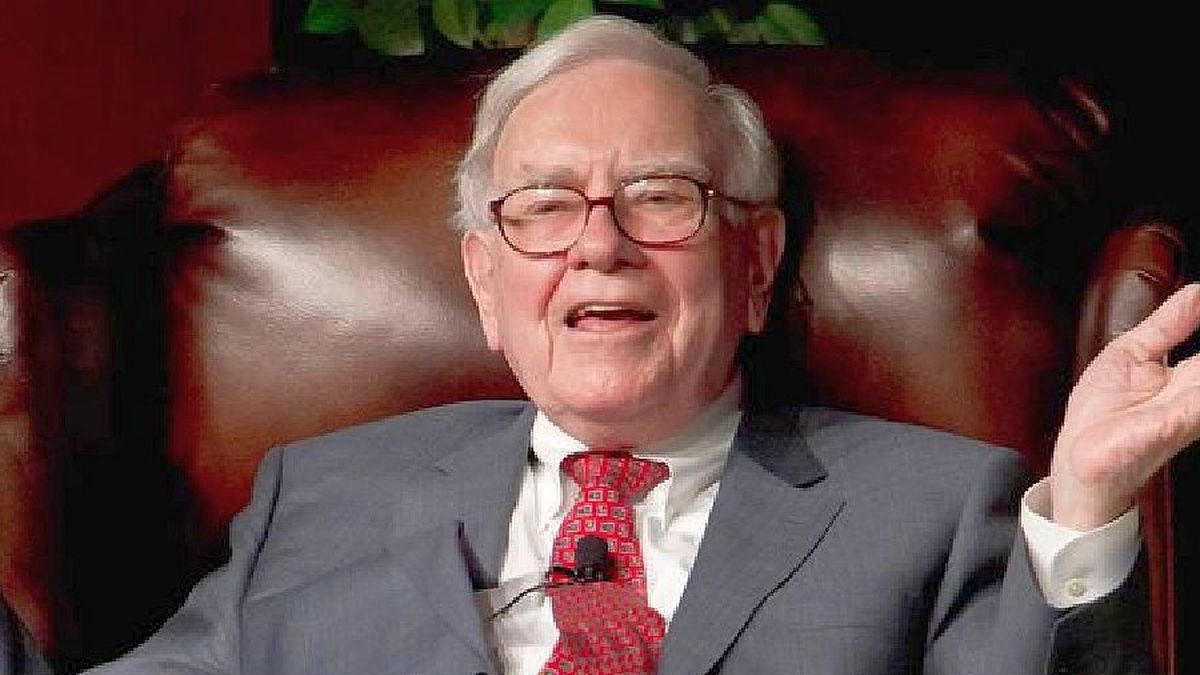

Buffett explained why he sees no value in bitcoin, comparing it to things that generate other types of value. “If he said … for a 1% stake in all farmland in the United States, pay our group $25 billion, I’ll write you a check this afternoon,” Buffett said. “For $25 billion, I now own 1% of the farmland. [Si] You offer me 1% of all the departments in the country and you want another US$25 billion, I’ll write you a check, it’s very simple. However, If you told me you have all the bitcoins in the world and offered them to me for $25, I wouldn’t accept them because what would I do with them? I’d have to sell it to you one way or another. It’s not going to do anything. The departments are going to produce income and the farms are going to produce food”.

Cryptocurrencies have become an investment asset, particularly in the last year as rates and inflation have been on the rise. In other markets, people still see huge potential for use as digital money.

“Assets, to have value, have to deliver something to someone. And only one coin is accepted. You can invent all sorts of things, we can put Berkshire coins in… but in the end, this is money,” she said, holding up a $20 bill. “And there is no reason in the world why the United States government … is going to allow Berkshire money to replace theirs.”

Both Buffett and Charlie Munger have made hostile comments towards bitcoin in the past. Most famously, Buffett said that bitcoin is “probably rat poison squared.” Munger doubled down on that sentiment on Saturday.

“In my life, I try to avoid things that are stupid and evil and make me look bad compared to someone else, and Bitcoin does all three,” Munger said. “First of all, it’s stupid because it’s still likely to hit zero. It’s evil because it undermines the Federal Reserve System… and third, it makes us look like fools compared to the communist leader in China. He was smart enough to ban bitcoin in China.”

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.