For his part, Gustavo Ber said: “After the marked weakness that has been accumulating, wall street unsuccessfully threatens to insert a breather within a path still characterized by caution and volatility, while follows the debate among investors about the possibilities – and implications – of a possible stagflation scenario, which could further accentuate risk aversion“.

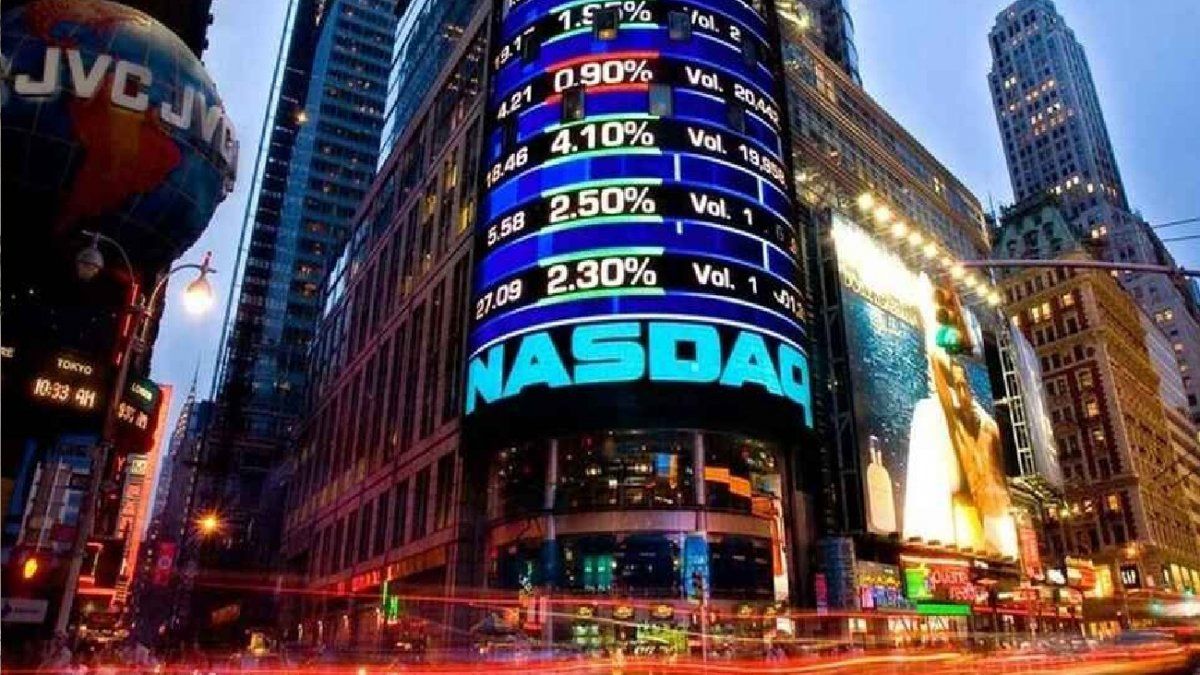

Over the course of 2022, the Nasdaq index sank 29%, the S&P 500 20%, and the Dow Jones Industrials 15%.

In her analysis for Rava, Gissela Avenia, said: “Another stock market week has ended that does not let up and persists with widespread declines. As expected, the investing public remains uneasy in the face of so much uncertainty. Probably, the tightening of the Federal Reserve’s monetary policy to control inflation continues to be a material fact that harms Wall Street, since it could turn into a recessionary scenario.”

Much of the recent decline in investor confidence is due to “lackluster retail earnings, prompting fears that consumer-driven recession loomingin addition to inflation and supply chain challenges that have weighed on sentiment for weeks,” traders said.

For his part, executive Stephen Roach affirmed that the rise in interest rates that the Federal Reserve must adopt will generate a recession and considered that inflation is not a transitory phenomenon. The Yale economist disagrees with the argument that inflation will peak and recede, as he believes it will remain above 5% for the rest of the year.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.