What were the three stocks you added to your portfolio that allowed you to earn high returns:

Activision Blizzard (ATVI)

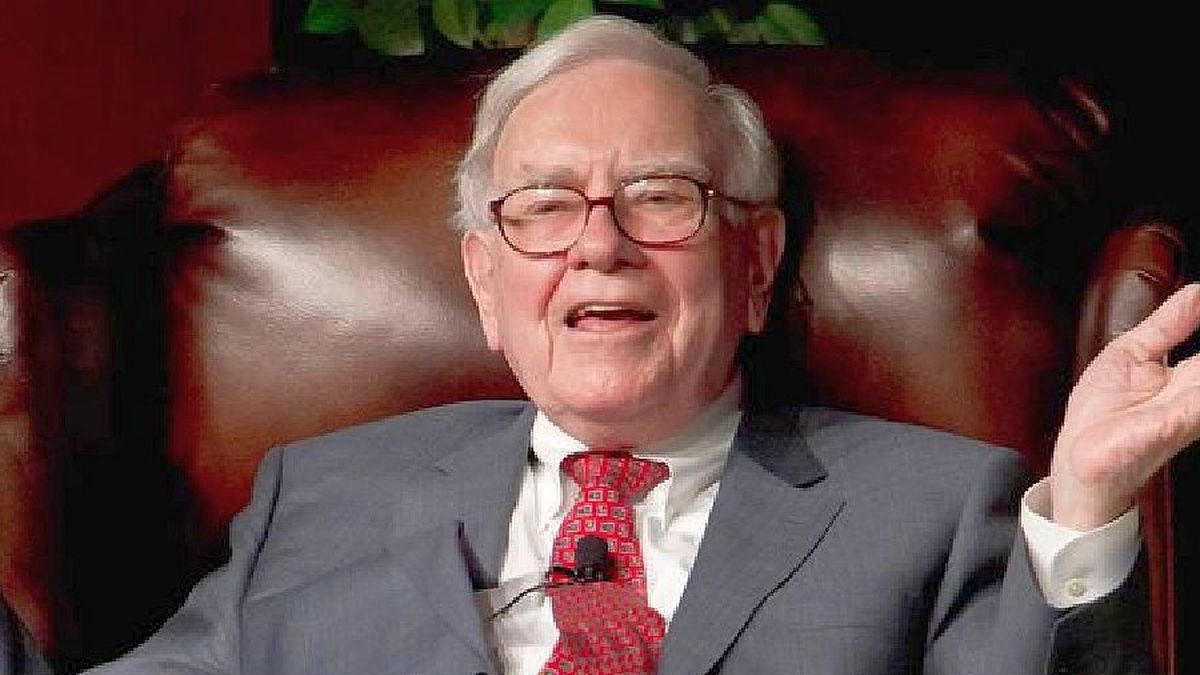

Buffett made a small bet on game developer Activision Blizzard earlier this year. However, when it was announced that the company was to be acquired by Microsoft, he quadrupled his stake. He now owns 9.5% of the game maker’s outstanding shares.

In a meeting with Berkshire Hathaway shareholders, Buffett claimed that this was now part of a merger arbitrage strategy.

Microsoft has offered to pay $95 a share for the company. However, Activision shares are trading for more than $78 on the Nasdaq stock exchange. If the Microsoft deal goes through as planned, Buffett stands to pocket $17 a share in low-risk gains.

chevron

Especially noteworthy is Buffett’s commitment to energy. The price of oil and gas has skyrocketed over the last year. He is buoyed by a combination of recovering demand and limited supply. The supply shortage is further exacerbated by sanctions on Russia, a key oil-producing nation, due to the country’s invasion of Ukraine.

This is a tailwind for companies like Chevron. The company produces 2% of the world’s oil each year and also plays a key role in other parts of the energy supply chain.

Buffett first took a position in the company in 2020. However, he deployed much more capital in the first quarter of this year, making Chevron his fourth largest position.

Western Petroleum

Occidental Petroleum benefits from the same tailwinds as Chevron. The energy crisis has increased this value by 128% so far this year. Despite that increase, it is still trading at just 10.7 times earnings. Buffett purchased 136 million shares of OXY in the first quarter of the year. It is now the eighth largest holding in Berkshire Hathaway’s portfolio.

Apple (APL)

Berkshire’s portfolio is still dominated by one name: Apple Inc. At the beginning of the year, the company owned about 887 million shares of the iPhone maker. In this quarter, Buffett added almost 4 million more, bringing the aggregate value of this bet to $155.5 billion. That is almost 43% of the entire portfolio.

hp

The Oracle of Omaha seems to have overcome its reluctance to bet on technology companies. In addition to Apple and Activision, Buffett also added a position in device maker HP Inc. The overlooked consumer tech giant could be attractive because of its consistent profitability. Over the past five years, the company has consistently generated $4 billion in annual free cash flow. Some experts expect this to rise modestly to $4.5bn. That implies a free cash flow return of 12%. An ideal addition to Buffett’s portfolio.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.