The greenback has gained around 14% against a basket of currencies in the last year. This rise is “driven by a hawkish Federal Reserve and rising geopolitical tensions,” traders said.

“A stronger greenback puts pressure on the profits of American multinational companies that convert foreign currency into dollarswhich adds to companies’ concerns about accelerating inflation and pushes some to more actively seek ways to hedge their profits.”

Regarding its forecasts, Microsoft, which derives most of its revenue from cloud services, expects revenue for the quarter to be between US$51.94 billion and US$52.74 billionwhich represents a decrease with respect to the previous range of between US$52.4 billion and US$53.2 billion.

The firm cut its earnings forecast to between $2.24 and $2.32 a share, from a previous expectation of between $2.28 and $2.35 a share. “Analysts are forecasting a profit of $2.33 per share on revenue of $52.87 billion,” according to Refinitiv data.

In April, Microsoft had forecast double-digit revenue growth for the next fiscal year, driven by demand for cloud computing services.

Source: Ambito

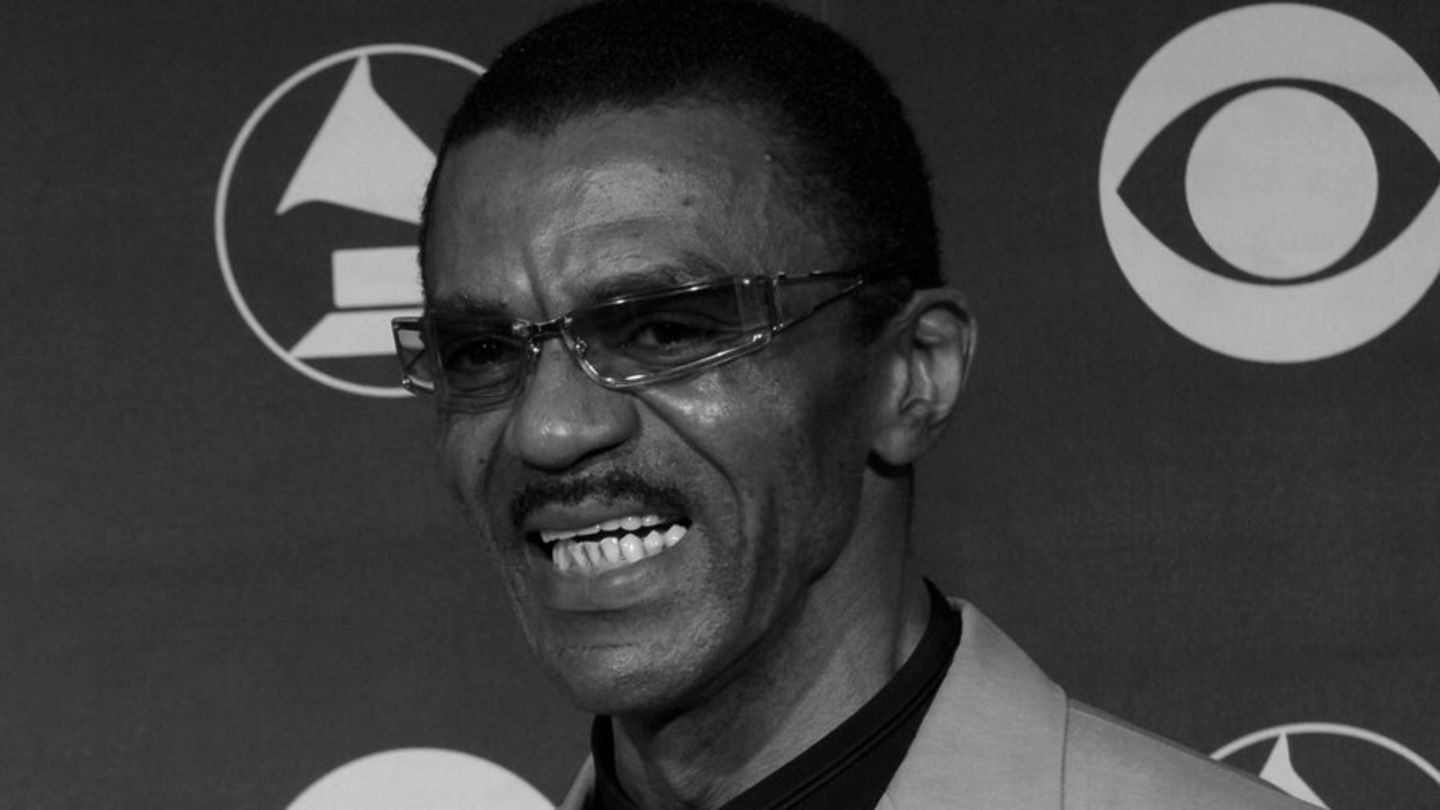

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.