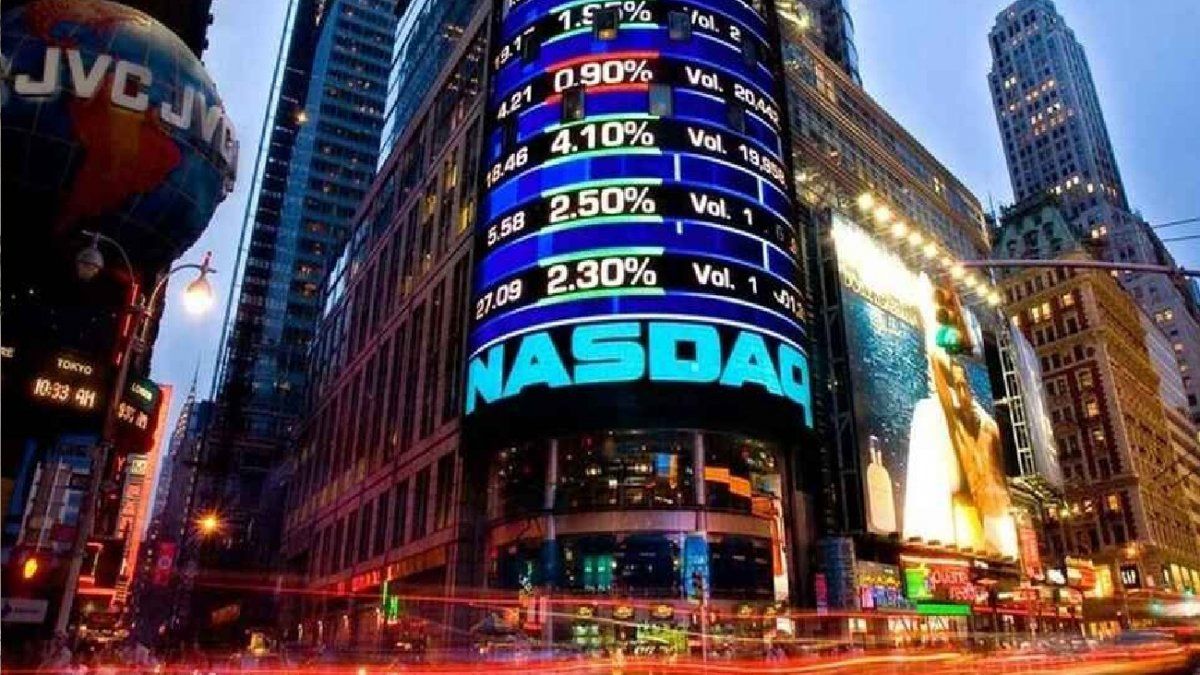

On Wall Street, the Dow Jones Industrial Average fell 2.73% while the Nasdaq, of technology stocks, plummeted 3.53%. The S&P 500, considered the most representative of the market, lost 2.91%.

Technology and growth companies, whose valuations are more dependent on future cash flows, led the declines. Microsoft and Apple were among the biggest decliners for the S&P 500 and the Nasdaq.

After the report on inflation, Benchmark 10-year US Treasury yields hit 3.152%, the highest since May 9.

“What this probably does is change the calculation of what the fed could do in September versus what it could do next week,” said Art Hogan of National Securities, New York, adding: “By this I mean next week most likely a rate hike of 50 basis points“.

The Fed’s monetary policy meeting will be held on June 14-15. “Investors fear that a tight labor market, coupled with persistently high inflation, will force the US central bank to accelerate the pace of withdrawal of its pandemic support policy,” the traders said.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.