The stock of debt in pesos is very high, since it amounts to the equivalent in dollars of US$43,347 million in debt in pesos at a variable rate, and US$73,231 million in debt in pesos adjusted by CER.

The variable rate at which the State borrows is 65.0% per year, and the market only lends to the month of November 2022. Beyond that date, the State places pesos adjusted for inflation plus an additional rate, with levels outrageous rates.

If we take the variable rate at which the State borrows as of October 2022, it stands at 65.6% per year, and for the same term it borrows at the inflation-adjusted rate plus 3%, this implies that the market discounts a inflation rate of 62.6% for the last 12 months, the annualized May inflation adds up to 60.7% per year, this implies that the market discounts more inflation.

The market does not want to finance the State beyond the month of November, and the rate of 65% per year is the opportunity cost of business in Argentina, for doing nothing the State pays you 65% per year, this implies that we are in trouble capturing new investment.

The chart shows variable rate discount bills called LEDES and inflation-adjusted discount bills called LECER.

1.jpg

The debt in pesos adjusted for inflation is very high, and shows chilling rates of return. For example, a bond like the T2X3 maturing in August 2023 has an annualized yield of inflation plus 11.0% per year. If we estimate that inflation for the next 12 months could be 75% per year, this bond in pesos adjusted for inflation has a potential yield of 86% per year. In the case of a longer bond such as the T2X4 with maturity in July 2024, in 2 years and one month, the yield is inflation plus 16.9%, estimating an annual inflation of 75%, its yield would amount to 91 .9% per year.

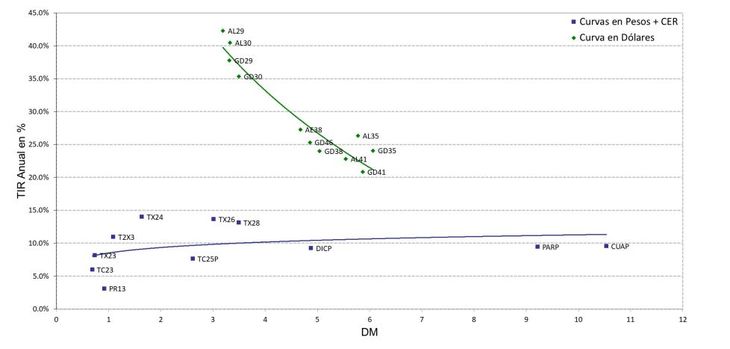

They say that when alms is great even the saint distrusts, the bonds in dollars of Argentine debt show exaggeratedly high yields. The debt in dollars of our country amounts to US$ 253,010 million, the rate of a bond in dollars maturing in the year 2030 amounts to an internal rate of return of 40.5% per year, this places this bond at parity of 23.0%, this implies a default price.

Yield curve of bonds in dollars and pesos, the rates are high that drive out investment.

graph 2.jpg

With the rates that our bonds yield, it is clear that Argentina does not generate confidence in investors. It was useless to restructure the debt in dollars in 2020, and even less the renegotiation of the debt with the IMF. Restructuring debt was only an administrative procedure that the current government could not complete, generating more confidence by accessing international and local financial markets at rates lower than those set by the government of Mauricio Macri.

The real problem in Argentina is the fiscal deficit, to the extent that the government does not give a signal that it will reduce the deficit, the market will continue to ask for a higher interest rate.

When the government does not reduce the deficit, the market begins to withdraw financing, which raises the rate of return on the debt in pesos and in dollars. That money begins to migrate from being placed in state debt to buying alternative dollars.

There are three alternative dollars, the first of which is the stock dollar, which can be bought by anyone who has money in a bank account and wants to buy dollars using a public debt security as a tool. This dollar is already trading at another $230 and could continue to rise while the government exudes distrust.

The second alternative dollar is the cash dollar with liquidation, with pesos placed in a local bank account an Argentine bond is bought and the bond is sold abroad, it is used to withdraw money from the country, its price is located at $ 240.

The alternative third dollar is the one popularly known as Dolar blueis the old black or informal dollar, the one you buy from the little tree on the street or in the financial cave, with cash and without registration in the control agencies, this dollar trades at around $ 225.

With the crisis that the government is experiencing in fiscal matters, the distrust of investors who have stepped aside when it comes to financing the State, the rise in return rates on bonds in pesos and a more inflationary scenario, many savers they began the journey back to quality, seeking to dollarize their portfolios, in a local and international context of high uncertainty.

conclusion

The high volatility in the price of bills and bonds in pesos in the market is exclusively related to the high fiscal deficit shown by the public accounts, and the little confidence that the government generates when seeking funds to finance it.

The dollarization of portfolios has just begun, with which we can see rising prices for alternative dollars, with clear objectives around $240/$250 for a first stage, by the end of the year we will see much higher values.

By the end of the month we will have a large maturity of debt in pesos, we predict that the government will be able to overcome it without problems, but validating higher rates than those obtained a month ago.

The interest rate is the fever, the diagnosis of the disease is a high fiscal deficit, and the consequence of this is the weakness of the economy weighed down by a very high dollar that generates a state of exhaustion in investors.

To solve this problem, it is necessary to have a fiscal surplus, at any rate, in this way the government would look for less money in the market, the interest rate would decrease, the government would not issue pesos, inflation would fall and the price of the dollar would fall. If we do the opposite of what is recommended, prepare to live in an environment of high inflation, devaluation and interest rates higher than the current ones. In this context it will be difficult to grow and generate more employment.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.