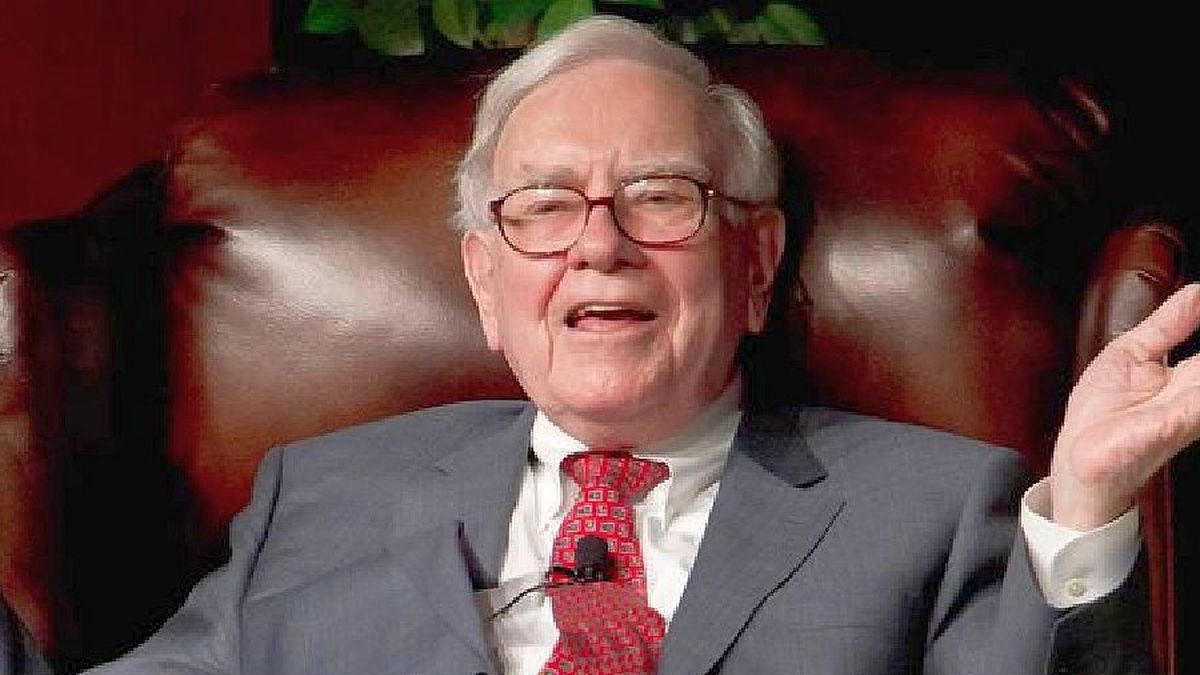

Given this shocking feature, many investors wonder why the legendary investor never did a split to make the shares more accessible to the general public, instead launching the class B shares that cost around $277.

At the 1995 Berkshire Hathaway shareholder meeting, when shares were trading at approximately $25,000, Buffett acknowledged that holding such expensive stocks could be “from uncomfortable to advantageous”but said the barrier to entry was intentional.

“We want to attract shareholders who are as investment-oriented as we can get, with long-term horizons”, he expressed. Later, he clarified that, if the company divided the shares and lowered its price, it would obtain “a shareholder base that would not have the level of sophistication and timing of goals” that he and his partners have.

Today, there are about 615,000 Berkshire Hathaway class A shares outstanding, compared to more than 1.3 billion class B shares. As of March this year, the company’s class A shares reached over $544,000, becoming the most expensive public shares in the world.

In this context, the “Oracle of Omaha” reiterated that did not see any incentive in having a cheaper stock that has more volatility if it does not create a “intrinsic value” for your investors. “There are a lot of people who are attracted to stocks that are going up. It doesn’t appeal to us.”said. “We don’t care if it sells higher, except when the intrinsic value grows”he concluded.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.