Major indices, however, bounced off session lows as investors looked for signs that inflation had peaked. against a backdrop of a broad pullback in commodity prices, with benchmarks for Brent and WTI crude now trading below $100 a barrel.

Consumer prices in the United States accelerated in June as gasoline and food costs remained high, the data showed, resulting in the largest annual rise in inflation in 40 1/2 years and cementing the case for the Federal Reserve to raise interest rates.

“When you look at the data, a lot of it is energy prices. So if you go back, inflation was starting to slow in other areas, which is what the Fed wants to see.” said Dennis Dick, owner trader of Bright Trading LLC in Las Vegas. “I think (markets) are saying that this June data was the peak of inflation and it’s only going to get better from here.”

Rising prices globally have pushed central banks to raise borrowing costs this year, raising concerns that a reversal of decades-old easy-money policies could lead to a sharp economic downturn.

Fed policy rate futures traders quickly priced in a more than 50% chance of a 100 basis point hike at the next meeting, according to CME Group’s Fedwatch tool, up from a 7.6% chance the day before. Expectations for a 75 basis point rate hike were lowered to 46.5%.

Twitter jumped 8.6% after Hindenburg Research said it had taken a long position on the social media company.

europe bags

Recession fears have already stumbled across European stocks, but the CPI figure was still higher than most economists had dared to forecast.

The euro only briefly brushed parity with the dollar, but that was enough. The German DAX and the French CAC40 almost they doubled their losses morning, to 1.5% Y 1.4%, respectively. The London FTSE did not stay very far, since another 4% rise in the price of gas joined the pressures.

“The CPI of 9.1% is the highest figure in the last 40 years; the only good news is that core inflation is slightly lower“, “And the parity of the euro (…) well, European economic prospects continue to worsenespecially if Russian gas doesn’t start coming back,” Close Brothers Asset Management chief investment officer Robert Alster said.

Concerns that rising interest rates in the United States will cripple the global economy have been felt around the world. The copperwhich is in step with global growth, touched a minimum of 20 months Y has plummeted 30% since April.

In this context, the gains that can be received from fixed income at a global level increase. The 10-year US Treasury bond yields -the reference of the costs of loans worldwide- rose again above 3%, from 2.97%while also digesting the latest cut in US growth forecasts from the International Monetary Fund.

Meanwhile, heGerman public debt raises its 10-year yields rose to 1.15%after two days of sharp declines, while the yield on Italian 10-year debt rose to 3.27%.

Automobiles, construction and raw materials were the biggest European sectoral losers, with a decrease of 23% Y 1.8%, respectively. “With equity valuations already reflecting a 20% earnings compression in Europe, we think there will be a additional 20% drop from here if there is no gas supply,” Gheedia said.

Asia

Regarding the Asian stock market, the MSCI index Asia-Pacific stocks outside of Japan gained 0.5%surpassing two consecutive days of losses and having fallen to its lowest level in two years the previous day. Japan’s Nikkei rose 0.5%after losing nearly 2% the day before.

dollar in the world

the dollar indexwhich measures the performance of the greenback against six other currencies, it stood firm at just over 108. The eurowhich is down more than 11% since January, last traded at $1.0022, having dipped as low as $0.9998 shortly after the data. Although traders point to some support in the market, Entities such as JPMorgan have warned that it could fall to $0.90 if Russia severely restricts gas supplies in the region.

Petroleum

As for commodities, crude Brent fell 3.2% and fell back below the u$s100 the barrel, the copper lost 1.5% on the London Metal Exchange (LME) to u$s7,242 the ton, after touching the US$7,202.50.

cryptocurrencies

In the cryptoactive market, the Bitcoin rose more than 2% and it looked like he was going to break a three-day losing streak, though u$s19,772 continued to trade below the key psychological mark of $20,000.

Source: Ambito

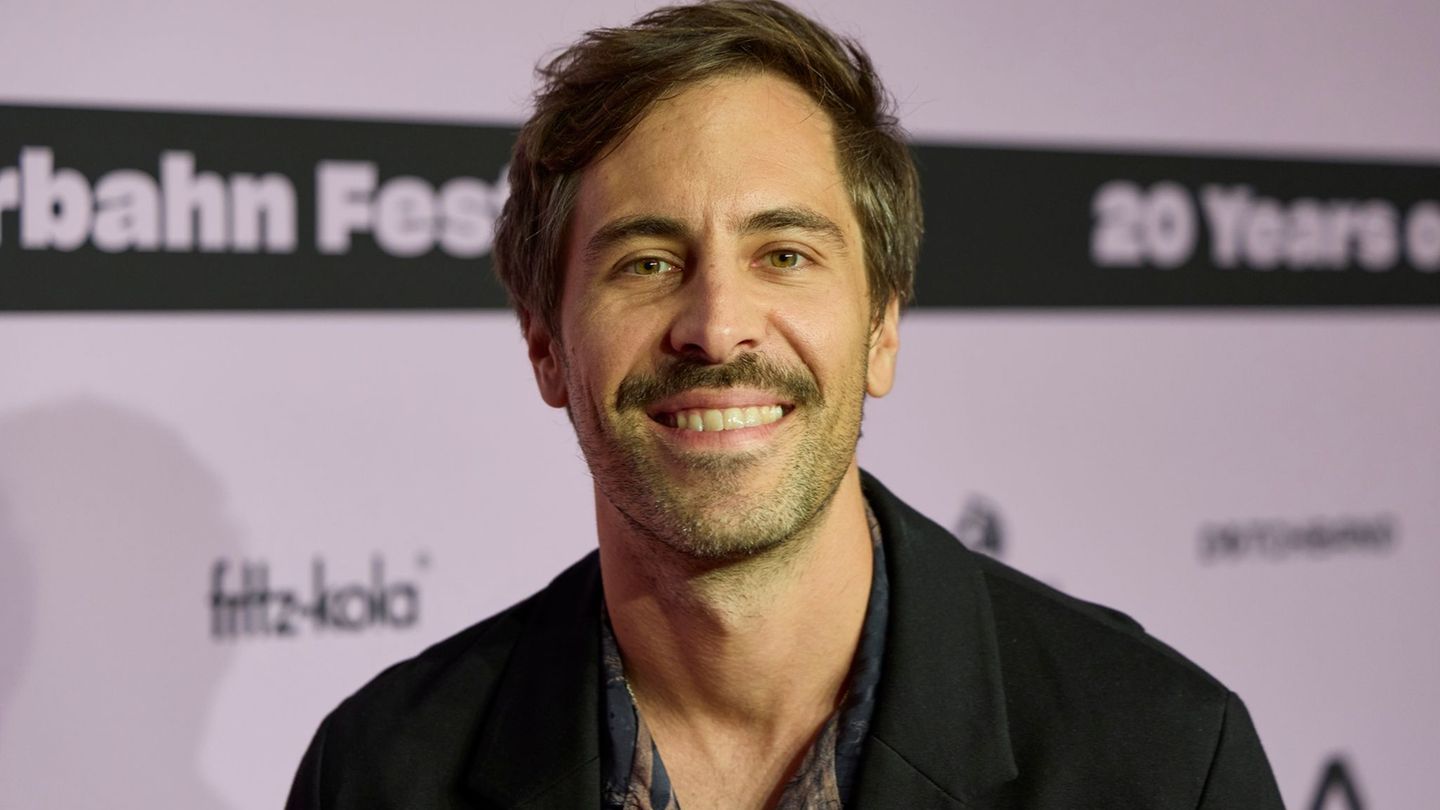

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.