A modest uptick in investor appetite for risky assets also weakened safe-haven demand for the currency.

Fed officials signaled on Friday that they likely rates will rise 75 basis points at its meeting on July 26-27, despite the fact that a recent inflation measure could justify higher than expected hikes later in the year.

Traders in the Fed’s short-term fed funds rate futures contracts, which had favored a one percentage point hike, shifted bets firmly in favor of a 0.75 point hike. percentages at the next meeting.

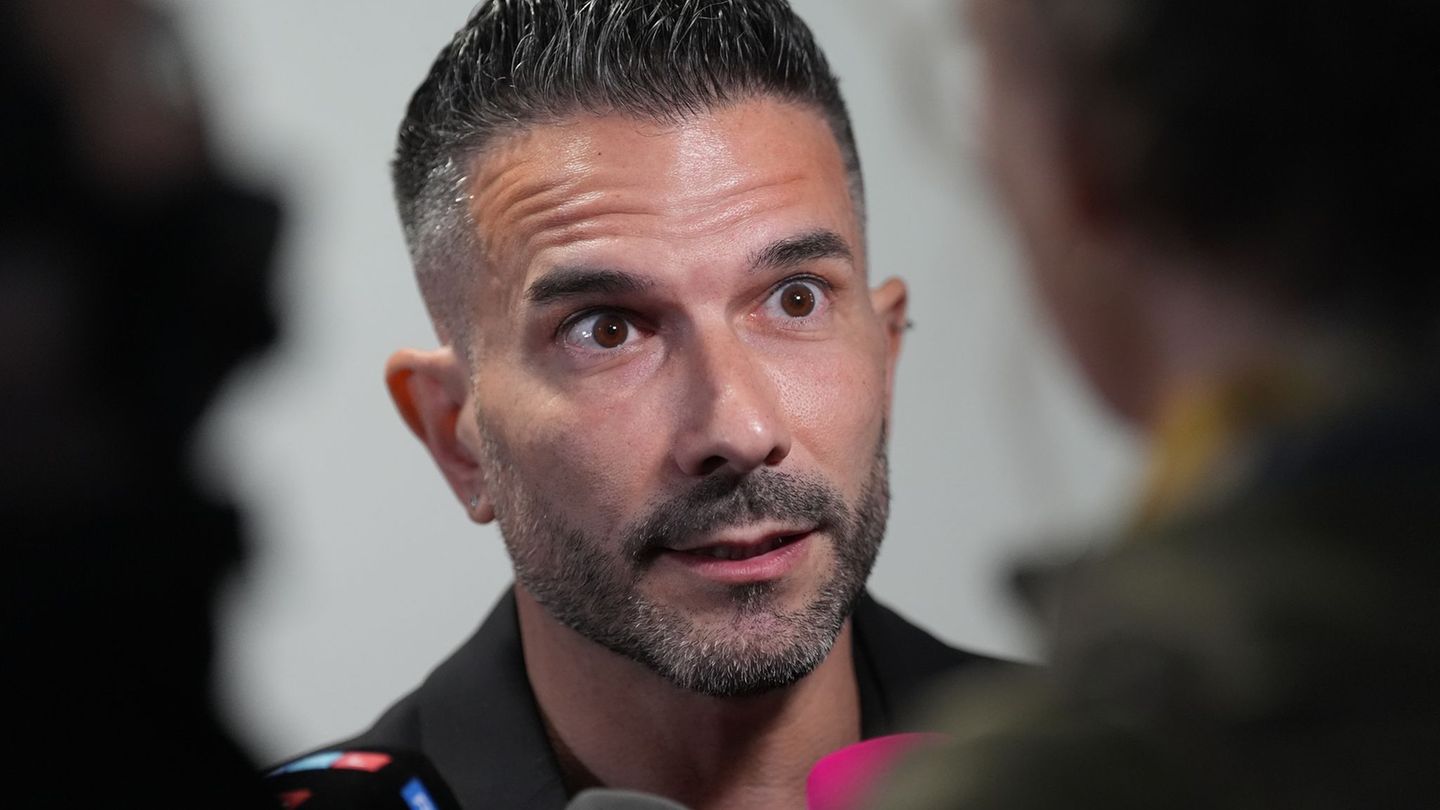

“It’s a clear price reversal from last week, after the UMich 5yr inflation expectations figure and after (Fed Governor Christopher) Waller cast significant doubt on a higher hike.”said Michael Brown, head of market intelligence for Caxton.

The University of Michigan’s preliminary survey of consumers for July showed on Friday that they see inflation at 2.8% over a five-year horizon, the lowest in a year and down from 3.1% in June.

Federal Reserve Governor Waller said he favored a further 75 basis point rate hike this month, lowering bets to a 100 basis point one, which had risen after a report The Labor Department showed on Wednesday that consumer prices rose 9.1% in June.

Against a basket of currencies, the dollar index fell 0.48% to 107.32 units. On Thursday it had closed at a two-decade high of 108.65 units. While, The euro was up 0.68% at $1.0158.

Some of the dollar’s weakness on Monday likely reflected profit-taking after its strong rally, Brown said.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.