What happened since Guzmán’s departure to date?

The day that Martín Guzmán resigned versus last Friday shows us very important differences.

1.png

very big differences

Since Martín Guzmán left, reserves have fallen by US$4,000 million and monetary liabilities have grown by $500,000 million. The equilibrium dollar went from $249 to $289, this implies that on Friday the MEP dollar, which closed at $276.60, has a bid price, it is still not a bargain like when it was at $200.

How to do to return to the stage of July 1?

It is necessary to obtain a loan for US$ 4,000 million, they say that it would be processed, it would be a true miracle if it is achieved. If that happens, the equilibrium dollar would fall to the area of $249.

Could monetary liabilities go down?

Difficult, we do not believe that they can reduce liabilities by $500,000 million, unless the Central Bank divests itself of the bonds it bought to support its price, the market buys them and the money that the Central Bank receives is sterilized.

Everything is possible

But it has its consequences. The least painful thing would be to obtain an external loan for US$5,000 million, present a zero-based budget and get the market to demand the bonds in pesos.

What were the first steps of the new minister?

Although not yet assumed, the steps were 3, namely:

In the Treasury tender on Wednesday, 90-day bills were placed at a rate of 70% per year, on Friday those bills yielded 85.22% per year.

On Thursday, the Central Bank of the Argentine Republic raised rates, the 30-day fixed-term rate stands at 61% per year.

On Friday, the dollar futures market showed a new yield curve. At 90 days, the implicit rate of the future dollar stands at 122.7% per year.

What are you watching?

We are seeing a very attractive rate on Treasury bills, in this way there is an incentive to place 90-day bills and not 30-day fixed-term. The Central Bank discourages placement in banks and encourages placement in Treasury bills. The small big problem is that the market does not believe him.

What happens with the bills in pesos that are adjusted by CER?

An 80-day bill that is adjusted by CER is paying a negative rate of 14.5% per year, this implies that the market is expecting an inflation equal to the yield of a variable-rate bond plus the negative rate of the bond that is adjusted by inflation, the market assumes that future inflation would be around 100% per year.

Is that why the future dollar discounts a rate higher than 100%?

Right, the futures market tells you that we are going to accelerate the rate of devaluation, trying to copy the rate of inflation. That devaluation rate would increase monthly, copying the inflation levels of our economy, trying not to lose competitiveness.

How do we get back what we lost?

That does not seem to be in the new score that Sergio Massa will play from now on.

How is the painting?

As follows, they are all 90-day returns:

1.png

Shall we go to the steaks?

how not

August devaluation?

We define the market logic, the Central Bank never loses in the futures market. Due to how it was positioned last Friday, the rate of devaluation of the peso would not be higher than 8%. We believe it would be between 7% and 8%.

Will we continue with exchange delay?

Correct, the monthly information from the foreign exchange market tells us that, in the last 12 months, taken as of June 30, the outflow of dollars was US$ 3,601 million.

Some interesting facts?

How not:

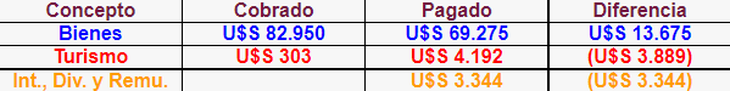

1.png

In order to better illustrate, the balance of goods is what is received and paid for exports and imports, the balance is very positive because there are advances from exporters, however, it was not enough to show a positive general number, since the deficit in dollars is US$3,601 million.

The tourism balance deficit is very high, since it exceeds what we pay in terms of interest, dividends and remuneration abroad. Clearly there is a foreign exchange delay and the tourism deficit is going to spiral as we approach the Qatar 2022 World Cup. For the bad-minded, there should be no restrictions on foreign travel, we must have a high exchange rate that encourages exports and domestic tourism, discourage imports and tourism abroad. The one who earned the money honestly can travel wherever he wants, but it will be expensive.

In terms of foreign direct investment in the last year, only US$687 million entered. In payments of loans abroad, US$5,422 million went. At any moment we will have more deficit of tourism than payment of loans abroad. This shows us that the exchange rate is very low.

Are these numbers very bad?

Argentina is a dormitory country, we live here, but we do not invest and if we have to spend the summer we do it outside. There are no incentives to invest in the country and the exchange rate is so backward that there are clear incentives to import and travel.

Conclusions

We believe that Sergio Massa, to be successful in his management, would have to focus on three aspects:

- Strengthen reserves and have a competitive exchange rate, with a wholesale dollar that is as close as possible to the balance dollar between monetary liabilities and reserves.

- Have a zero-based budget, in order to eradicate the primary fiscal deficit. The financial fiscal deficit should be brought to zero over time.

- The Central Bank of the Argentine Republic should commit itself not to issue more pesos without backing.

If the announcements do not take these aspects into account, we believe that we will have big problems ahead. Alternative dollar volatility will not stop, there will be no powerful export sell-off, and imports will remain high.

Greater confidence is needed for investments to arrive, if that does not happen, achieving a zero deficit and not issuing will be complex, therefore, volatility between alternative dollars, high inflation and interest rates at higher levels will continue.

Field

How do you see the prices?

The price of soybeans at US$363.50 official for May 2023 is a very good price, it is above the average of 50 wheels and the maximum was US$395 official in April. It seems to me that it is a price to go making coverage. For the 2023 campaign there are very few soybean hedges, barely one million tons sold.

How do you see the price today?

Very low, soybeans are worth US$390 official, in pesos you have $51,178, if you buy MEP dollars with that product, you have US$185. For us, a good selling price is that in dollars MEP leaves us a price above U$S 220 per ton.

They have a transverse vision

Correct, we look at the price in the official dollar, in pesos and in the MEP dollar, it seems to me that the most important thing is the price of soybeans in alternative dollars, as is the case of the MEP.

Is soybean profitable at future prices?

These soybean prices leave us zero returns, but at future prices in May 2023 something would have to be closed, since it is likely that by that date we will have to live with another price of the wholesale exchange rate, and perhaps in that scenario we will be profitable It is a bet on the future.

How are corn prices?

Future corn prices are very low, as of April 2023 it is at US$212.40 official, the maximum prices we saw were US$253.50 official. If we measure the price to April 2023 and charge the costs, we will have that the corn in the Excel is at a loss. We should wait to sell future corn, these prices are very low.

In the short term?

The price of corn is a gift for those who buy, and a dollar in head for those who sell. The price of corn available is at US$227 official and in pesos $29,788, if we measure this price in MEP dollars it is US$107.7, it is still low, but those who bought a week ago at US$ 88 MEP a ton are already making money.

Recommendation?

I would not sell corn at these prices, if I am on the side of the rancher or dairy farmer I would try to buy as much as possible.

How do you see the wheat?

In our last tour we can see that there is little wheat planted, and the drought is damaging the crops. I don’t think we will reach the projected 17.7 million tons of wheat.

conclusion

- The country man if he does not need it, he will not sell soybeans, wheat and corn, since the prices are not good, and in Argentina the costs are very high.

- The weather is not good, therefore, there is an expectation that the first-class corn will be less than a year ago, whoever saves corn will have his reward. The same will happen with wheat.

- There are sold 20.9 million tons of soybeans, 33.2 million tons of corn and 21 million tons of wheat. If the government does not have dollars, it is because it does not know how to manage.

- The soybean dollar would not encourage higher sales. To carry out this operation, the producer must open a special account in the bank, and from there he will be able to obtain 30% of the proceeds from the sale in dollar savings and the remaining 70% he can take home or place in a deposit at the view that is updated to the evolution of the official dollar.

General conclusion

Sergio Massa’s future is in his own hands. The market bought the ticket for Guzmán and Batakis. Politics is a crusher of finance ministers. If fresh dollars don’t come in and you’re not working on a zero-based budget, last Friday’s MEP dollar prices are a giveaway.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.