But let’s see how his stocks are doing today:

image.png

Was the price that it had at its maximum sustainable, taking into account its sales? Of course No. Why? simply because his valuation was totally crazy. A simple metric is to use the ratio Price-to-sales, which is nothing more than comparing how much the action is worth in relation to the company’s sales. Let’s see the evolution of this ratio:

image.png

Mercado Libre was worth 26 times its annual sales, an absurdity. For a few months, the reality is different. It is worth noting that until a few weeks ago, it was worth 4 times its sales, a minimum level for its history, only comparable to the worst moment of the 2008 crisis.

Is it a good idea to buy now? The long-term trend remains bearish, despite the strong rebound we have seen in recent weeks. Although it is much cheaper than a few months ago, there are still not too many certainties in prices.

Can this bounce continue and change the trend? It will depend on the general sentiment of the market. For your reference, MercadoLibre has a correlation of more than 85% with the S&P 500.

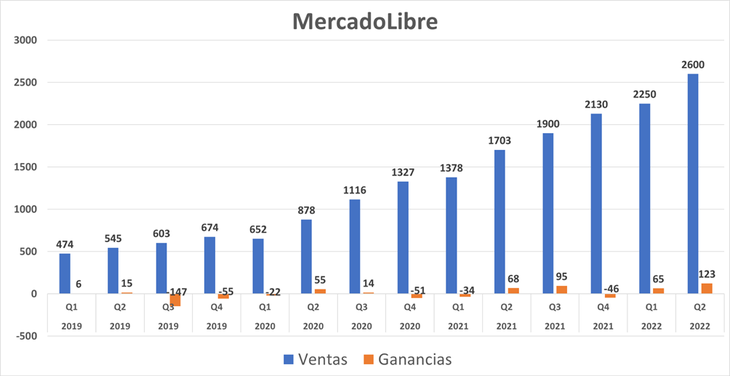

Let’s take a look at their sales and earnings for the past few quarters:

image.png

His Achilles heel was the inability to earn money (orange bars), despite growing sales (blue bars), as seen in the photo. This situation changed: out of the last 5 quarters, in 4 he was able to make a profit.

On its balance sheet, it registered sales of US$2.6 billion, which implies a growth of 57% year-on-year. In addition, it made a record profit of US$123M. One negative aspect is its operating margin (return on sales), which was 9.6%, down from 9.8% in the same quarter of 2021.

E-commerce sales grew by 23%. Although it is worth noting that its great strength came from Mercado Pago, the Fintech sector: they had sales above US$1,000M for the first time, growing above 100% year-on-year.

These results were celebrated by investors, so the stock rose 16% on Thursday. The new story seems to be that the recession will calm inflation, which would allow the Federal Reserve not to be so restrictive. And that benefits stocks, especially tech stocks.

What could overshadow this positive expectation is that inflation does not come down fast, as the market expects. If so, Mercado Libre could be harmed. To follow her closely. Do not forget that its long-term trend, for now, remains bearish.

To finish, I want to invite you to download a report with all the variables you need to know to understand the price of the dollar in Argentina. I really recommend it. You can download it at the following link: Financial Letter – dollar.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.