China’s industrial production, retail sales and fixed asset investment they fell short of analyst estimates in data released on Monday, as the nascent recovery from the COVID-19 lockdowns faltered. “Concerns about Chinese demand for raw materials … at the margins are probably fueling a risk-on attitude,” said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York.

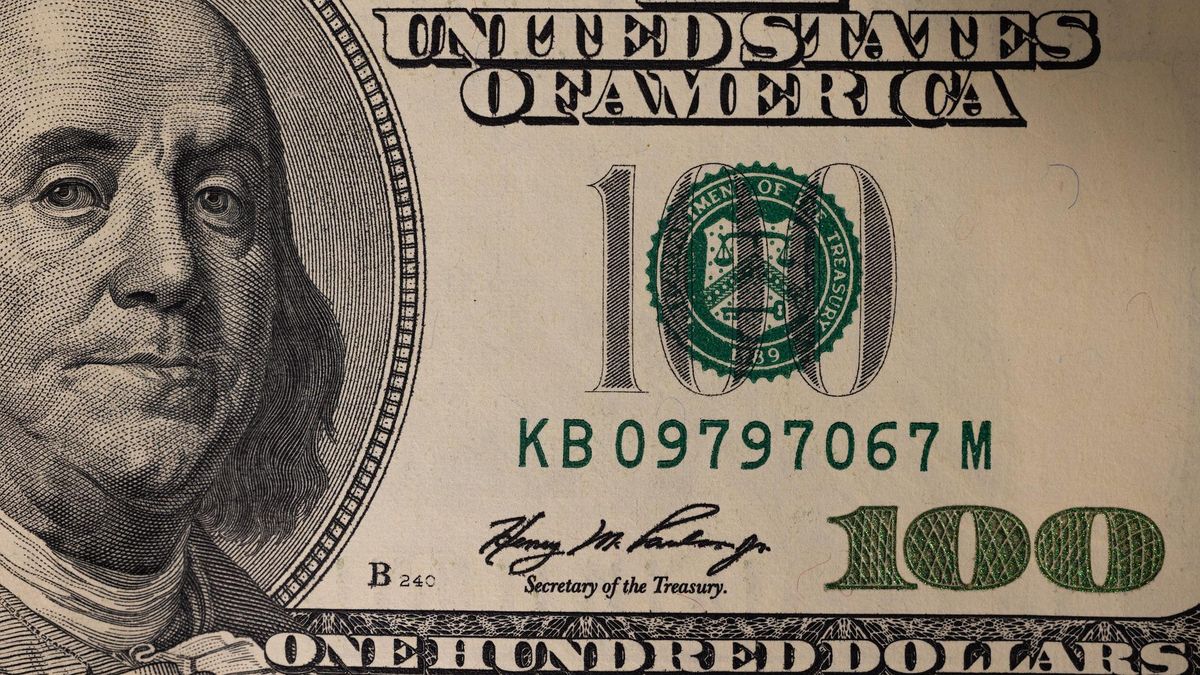

The dollar Index, that measures the performance of the greenback against six pairs, it rose 0.8% to 106.52 units. The euro gave in 1% against the dollar, a $1.0157.

The Australian dollarwhich is sensitive to commodity prices and is considered an indicator of global growth, fell 1.4% to $0.7021. For its part, The New Zealand dollar was down 1.5% at $0.6363.

While, the international yuan reached 6.8197 per dollar, the lowest level since May 16, after the China’s central bank will cut key interest rates in a surprise move to revive demand.

The dollar index has fallen from a 20-year high of 109.29 on July 14 on bets the Federal Reserve will slow its aggressive pace of rate hikes. and that the worst of the acceleration in inflation may be behind us.

Concerns that the Fed’s monetary tightening will push the economy into recession have also helped push US Treasury yields lower. However, Fed policymakers maintained an aggressive tone, emphasizing that it is too early to declare victory over inflation.

This week’s data including industrial production on Tuesday and retail sales on Wednesday could also “help ease fears that the US has contracted again,” which would boost the dollar, Chandler said.

U.S. single-family homebuilder confidence and New York state manufacturing activity fell in August to their lowest levels since nearly the start of the COVID pandemic, according to data released Monday.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.