In this framework, the consultant compared the situation of the maximum denomination banknotes of our country in relation to the other countries of the region, in the period from November-2017 to July-2022. There he reports that the $1,000 Argentine peso bill in almost 5 years was the currency that devalued the most interannually by -94%, following behind the 100 Brazilian reais with -38%, the 100,000 Colombian pesos with -31%, the 20,000 Chilean pesos at -28%, etc.

Focusmarketmonedas.jpg

“The distrust of our currency is such that Argentines in the North of the country are saving in Bolivian pesos. All decisions in microeconomics are stressful for the business sector, the worker and the household administration. The macro accounts do not close. The micro accounts are the consequences of an economic policy where the monetary and fiscal never had the objective of privileging the value of our currency, give stability and predictability to our lives,” added the economist.

In this way, it took the year-on-year period from July 2021 to July 2022 to see if the same situation is replicated. The $1000 pesos in just 1 year were devalued 39%, followed by the 20,000 Chilean pesos at 16%, the 100,000 Colombian pesos at 6.5%. On the other hand, there were currencies that appreciated in the same period of time, such as the 2,000 Uruguayan pesos by 4.7% and the 200 Peruvian soles by 3.4%.

“This tour of Latin America allows us to visualize that The Argentine peso is gradually losing the functions of money, which are: “store of value” (because in the face of currency devaluation, other means of saving are used), “unit of account” (because in the face of escalating inflation, prices do not follow the peso but rather in stronger currencies such as the dollar or even other currencies of Latin American countries ) and “means of payment” (it is the only function of money that the peso has as a measure of exchange so far)” said the economist.

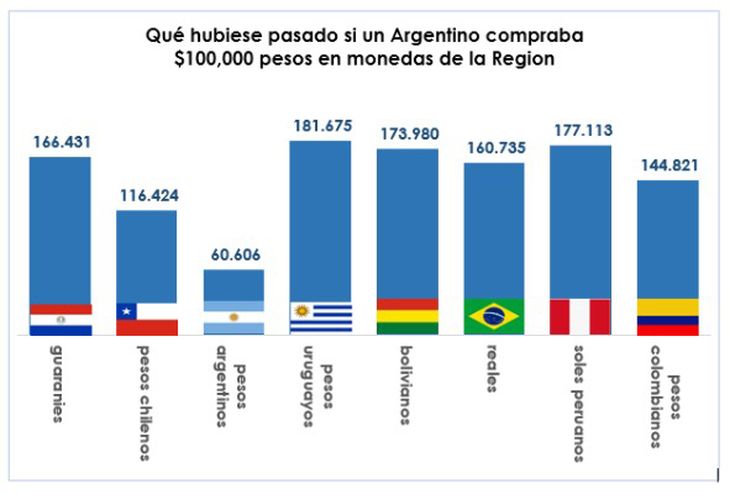

The performance in currencies of the region

What would have happened if we saved the $100,000 in regional currencies? the report wondered. In this way he exemplified: with the pesos in July 2021 when hoarding currencies such as Uruguayan or Bolivian pesos, today the yield of the $100,000 would be 181,675 pesos (when protected in Uruguayan currency), 173,980 pesos (when protected in Bolivian pesos), 177,113 pesos (when be protected in Peruvian soles).

That is to say that at Taking refuge in currencies of the region not only prevented the devaluation of the Argentine peso, but in currencies such as the Uruguayan pesos, the value improved due to the fact that it appreciated in that year-on-year period. Therefore, there is no doubt that saving in currencies from another region is still more profitable than having the Argentine peso, since in real terms those $100,000 Argentine pesos in one year fell in real purchasing power to $66,606.

focusmarketmonedas2.jpg

“The planning and development of the economic activity of a country depends on the accounting unit that allows the value of its currency. When its value begins to fall in the market, it is because the government is unable to administer the regulatory instruments that it has as it is the monetary and fiscal policy in post of the interests of the citizens that it represents but of its own. We can only hope that in this way it is thought that people see their income grow nominally by force of parity, compensatory bonds or social plans but to turn to see it fall in the supermarket on the way back from home at an increasingly faster speed, “he concluded.

Source: Ambito

David William is a talented author who has made a name for himself in the world of writing. He is a professional author who writes on a wide range of topics, from general interest to opinion news. David is currently working as a writer at 24 hours worlds where he brings his unique perspective and in-depth research to his articles, making them both informative and engaging.